Strengths

- The best performing precious metal for the week was silver, up 4.11%. Deal flow for the royalty sector remains strong, with increased complexity in deal investment structures, partly due to intense competition between royalty companies for quality assets, and $1.2 billion of transactions announced since June 2022. Year-to-date, $2.9 billion has been deployed (one of the highest years on record), driven by sector consolidation. The current deal pipeline remains focused on precious metals streams and development projects.

- RBC expects a positive reaction from Artemis shares following the finalization of the mill contract with Sedgman for C$318 million. The final cost is in line with the initial budgeted amount of C$312 million announced in May, and together with the power line contract (C$80 million) represents fixed contracts covering 55-60% of the Phase 1 capital spending estimate for Blackwater.

- Analysts expect a positive reaction from Equinox shares following the announced resumption of operations at Los Filos on September 10. The restart of operations represents a relatively short two-day blockade at the mine and allows for previously revised guidance (155-170,000 ounces) to remain achievable for 2022. Overall, the resumption of operations is positive given the short turnaround time.

Weaknesses

- The worst performing precious metal for the week was HRC steel, down 3.55%. Amplats announced a revision of its 2022 refined production guidance to 3.7-3.9 million ounces (down 8-11% versus the previous range of 4.0-4.4 million ounces). The group cites quality assurance processes after detecting the delivery of sub-standard materials for the Polokwane smelter rebuild, with a new consignment of materials to be delivered by the end of October.

- Harmony Gold’s all-in sustaining costs (AISC) have grown at a 15% rate in rand terms over the past three financial years, despite acquiring lower cost assets such as Mponeng and the closure of higher-cost assets such as Unisel. As a result, Harmony has been unable to expand margins over the period, despite the average rand gold price increasing 55% over the period.

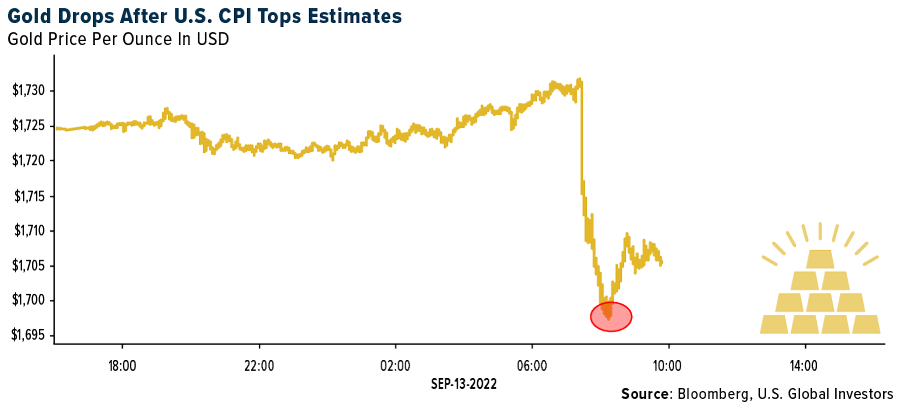

- Gold fell the most in a month this week after U.S. inflation data came in hotter than expected, reports Bloomberg, maintaining pressure on the Federal Reserve to keep aggressively raising rates. The consumer price index (CPI) rose 0.1% in August from the month prior, surprising the market after the median economist forecast pointed to a small decline, the article continues.

Opportunities

- Central bank demand remained robust in July. Global gold reserves increased by 37 tons (net), below June’s 64 tons increase. Added to the 270 of net purchases over the first half of the year, this pushes year-to-date central bank demand toward the 300-ton mark.

- UBS upgraded Newmont Corporation to “buy” as the group’s estimates now reflect 20% upside to the shares on top of a 5.4% dividend yield. Even with costs/ounce forecasts 5% above the high end of long-term guidance, UBS expects the company can continue to pay an annual dividend of $2.20 per share within its commitment to return 40-60% of excess free cash flow. Following recent management conversations, they are confident the dividend is based on a multi-year framework with visibility to falling capex in 2025.

- According to RBC, prior to Centerra Gold’s successful close of the Kumtor transaction, the group believes investors had become frustrated with other operational problems, most notably the suspension of gold production at Oksut. RBC thinks the change at the CEO level (following the retirement of the previous COO in May 2022) should be taken positively by the market, with an opportunity for a change in direction and clarification of strategy.

Threats

- Equinox management maintains its $1.225 billion capital budget at this time, with 55% of total cost contracted (25% on a fixed cost basis). Sixty-eight percent of the overall contingency has been consumed. It is possible that the entire contingency will be consumed and that the project will come in above budget.

- Silver has continued to struggle, underperforming gold year-to-date with the silver/gold ratio creeping higher toward 100:1. The market continues to focus on the U.S. Federal Reserve and other central banks for near-term price direction, and expects volatility to prevail until there is more certainty on inflation, real rates, and recession risks.

- Calibre Mining has reported an equipment failure at its Libertad Mill (Nicaragua) which is expected to have a temporary impact on the company’s ability to pour gold (expected decrease of 15,000 ounces gold sold in the third quarter). However, currently, Calibre does not anticipate changing fiscal year 2022 guidance (220-235,000 ounces gold).