Strengths

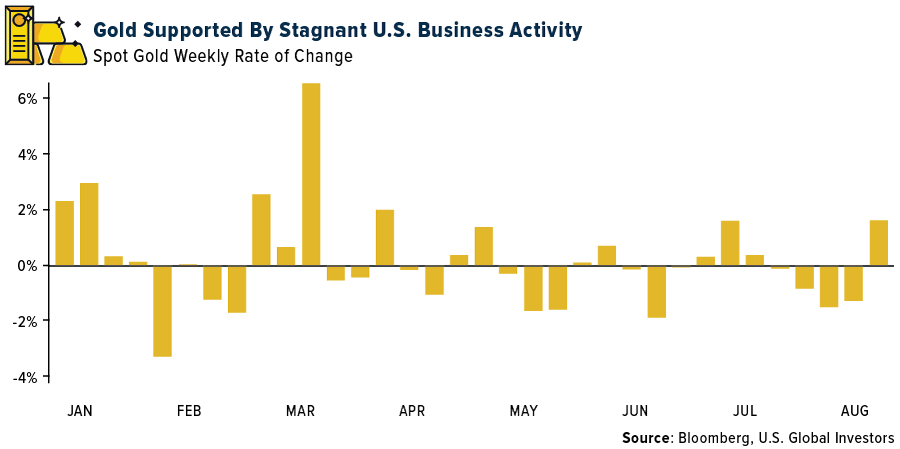

- The best performing precious metal for last week was silver, up 6.79%, up more than three times the change in gold’s price. Gold rose for the first four days of the past week, extending a climb from a five-month low, as the dollar weakened on new economic data. Traders trimmed gains on Friday as the Federal Reserve’s monetary policy is leaning towards one more rate hike in September.

- Dundee Precious Metals announced it has entered into an investment protection agreement (IPA) with the Government of Ecuador for the Loma Larga project. The IPA grants Dundee tax stability and certain tax incentives, as well as legal protections including stability of the regulatory framework and resolution of disputes through international arbitration. Key incentives and protections for DPM under the IPA include a 5% discount on the income tax rate, fixed at 20%; tax stability on VAT and exemption on import duties for key machinery, among others. DPM also intends to meet certain additional milestones for Loma Larga, including resolution of the constitutional court case and receipt of the environmental license, prior to committing significant capital to the project.

- Resolute Mining’s headline EBITDA (earnings before interest, taxes, depreciation and amortization) of $101 million handily beat consensus of $86 million. Headline net profit after tax (NPAT) of $87 million also beat consensus of $20 million, driven by $38 million in non-cash adjustments (inventories, unrealized treasury), lower depreciation and amortization (D&A) and an income tax benefit.

Weaknesses

- The worst performing precious metal for the week was palladium, down 2.42% on no specific news. In Zambia, mining company tax plunged 64% to 3.44 billion kwacha in the first half, while mineral royalty tax collected is down 40% year-on-year to 3.74 billion kwacha, Zambia Revenue Authority Commissioner General Dingani Banda says in Lusaka, the capital.

- Some of Mali's top gold producers said a new law to allow the military-led government to increase its ownership of mines should not apply to existing operations, but analysts said it was likely to deter future investment. Mali's Parliament would allow the state and local investors to take stakes as high as 35% in mining projects compared with 20% now. It will become effective once signed by President Assimi Goita, although it is unclear when that will be. "We are optimistic that, as in the past, we will find a mutually acceptable way to keep gold shining for Mali," a spokesperson told Reuters, saying Barrick has had "constructive relationship with successive governments."

- The prospects for jewelry in China, the main pillar of demand, look rockier. As the economy has slowed, households have conserved cash. That’s shown up in disappointing retail sales and a lapse into deflation that could worsen demand for costlier items if consumers expect prices to keep falling. Bloomberg Economics reckons the chances of deflation persisting into the first quarter of 2024 are about 35%.

Opportunities

- The near-term macro environment for gold is not that positive with U.S. real yields surging and the greenback on the rise, but bulls may be biding their time. The precious metal will likely be much stronger in about 12 months from now, according to the latest MLIV Pulse survey. The median of estimates from the 602 respondents was $2,021 an ounce, while the average was $2,074, shows the survey conducted last week. Not far below its record high of $2,075 set in 2020.

- According to Scotia, the streamers have outperformed the operators both year-to-date and shorter term, given the margin compression. With some signs of relief in inflationary pressures on operating costs, investors should start to consider rotating from the higher valued streamers (that are insulated from inflationary pressures in costs due to the nature of their business) into the lower valued operators. This is because: (1) companies have started to see easing of inflationary pressures in various input costs, which should be fully reflected in their costs once the higher cost inventories are drawn down; and (2) companies are expecting higher volumes in the second half of this year, which should also help with the costs. All of this should lead to margin expansion and help support higher valuations.

- According to Scotia, OceanaGold (OGC) is developing a pathway to achieving mining rates of at least 2 million tons per year from the underground, up from 1.6 million tons. Continuous improvement efforts include debottlenecking the mine, improving material movement, higher operational standards, visible leadership and greater crew engagement. They believe the 2023 drill program has the potential to both convert a significant amount of existing resources to reserves and expand the current resource by 50%.

Threats

- Bank of America is looking at estimate sensitivity to lower gold prices among their precious metal coverage. Based on net asset value (NAV), Kinross Gold, IAMGOLD and Eldorado Gold stand out as having particularly material downside relative to peers. Likewise, should gold go up, they have leverage there too.

- Global ETF gold holdings have declined 4.1% to 89.9 million ounces. With bond yields, which are typically negatively correlated to the gold prices expected to be pressured higher, and the Word Gold Council (WGC) calling for weaker than normal seasonal demand from India and China, ETF selling and lower gold prices may continue near-term.

- According to Morgan Stanley, as a non-yielding asset, gold must compete for a place in portfolios – less of an issue when bond yields are low, but more challenging as yields rise. With central banks raising interest rates (except for China), it makes sense that gold ETF holdings are now the lowest since early 2020 and net long positioning is the lowest since March, with significant new shorts added.