- The best performing precious metal for the week was palladium, up 6.67%, as platinum group metals bounced back strongly this week from the double-digit losses experienced last week. Gold continued to stabilize after comments from Fed Chairman Jerome Powell indicated that inflation should move back to the 2% target once supply imbalances are resolved. Toward the end of the week, gold edged lower as economic data indicated a recovery is underway.

- Silvercorp Metals reported assays from its 2021 exploration program at the LME mine at its Ying Mining District. The average of 60 infill and step out holes drilled on known veins averaged 448 grams per ton silver. This is higher than the current measure and indicated (M&I) grade of 301 grams per ton silver.

- Montage Gold Corp last night provided an update on developments at its Kon Gold Project, with a positive takeaway in our view of the rapid pace of development that the company continues to have. With seven drill rigs turning, this program is now 95% complete with a total of 49,694m drilled to date since commencement of the program in January 2021.

Weaknesses

- The worst performing precious metal for the week was gold, but still up 0.98%. Hochschild Mining reported that a bus operated by one of its contractors to transport employees between the Pallancata operation and the city of Arequipa in southern Peru was involved in a traffic accident resulting in 27 fatalities and 13 injuries. A total of 50 miners were in the bus when it flipped.

- Equinox Gold Corp. said Tuesday that a mine in the Mexican state of Guerrero has been blockaded by a group of unionized employees and members of the Xochipala community. The Canada-based mining company said it has suspended operations at its Los Filos mine, and said that it is working to find a long-term solution with the union and community members who are demanding higher payments than were contractually agreed upon.

- Kinross Gold provided an update on the Tasiast fire that occurred on June 15. The company has resumed mining activities (including stripping to access higher grade ore), while milling operations remain suspended. Kinross is building higher grade stockpiles for when the mill restarts – possibly by year-end. Preliminary estimates indicate a restart of the SAG mill by year-end at a cost of up to $50 million. Production estimates were reduced by 13% for 2021.

Opportunities

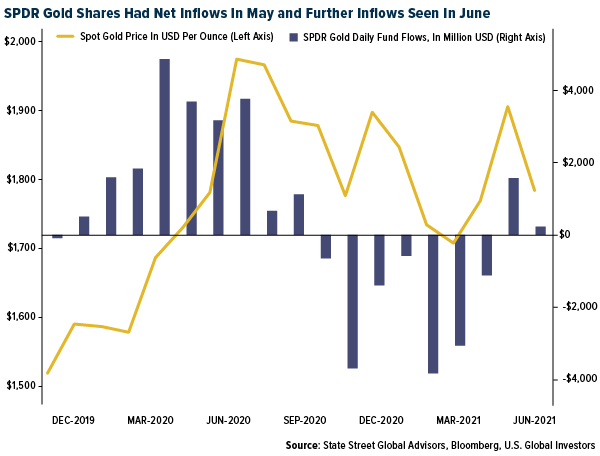

- Gold purchases by central banks and ETFs is continuing. Poland’s gold holdings increased 1% in May, to $7.4MM ounces. The May purchase was the first major purchase by the central bank since 2019. Thailand has boosted its gold reserves 60% in recent months. ETFs added 283,000 ounces of gold last week, which was the biggest increase since March 19. Gold has had seven straight weeks of inflows. Net inflows have been $390 million in the first three weeks of June.

- De Grey Mining released its maiden resource statement for its gold discovery at Hemi, declaring 6.8 million ounces at a finding cost of just A$8.50 per ounce, well below industry averages. This brings the gold inventory up to 9.0 million ounces for De Grey’s Mallina Gold Prospect. De Grey’s gold discovery is in the Pilbara region, not known for gold discoveries, but more the home to the iron ore mining districts. This still provides a costs advantage to De Grey as there is well developed infrastructure support in the region, which could lower capital costs.

- Indonesia, home to one of the world’s largest gold mines, plans to set up a bullion bank to spur trading of the precious metal domestically. The plan is to start this bank in 2024. Indonesia currently exports much of its gold to countries such as Singapore and Australia.

Threats

- Morgan Stanley forecasts that scaled back bond buying and higher interest rates are likely to be a drag on gold. Susan Bates, commodity strategist, wrote that higher inflation is likely to be transitory. Jewelry markets are expected to recover but total sales will likely end 2021 12% lower than the pre-pandemic year of 2019. Morgan Stanley left intact its $1,680 price target. A counter factor outside the Morgan Stanley report that investors will be watching for, that would overpower the transitory inflation argument, would be rising wages for labor.

- Bolivian lawmakers are debating a bill that would require all gold produced in the country to be offered to the central bank as the nation builds its reserves and cracks down on the illegal bullion trade. Local producers would need certification to sell abroad and would first be required to offer their gold to the central bank at international prices in return for tax breaks.

- According to RBC, new projects have faced upward pressure on capital costs due to ongoing cost inflation including steel (up 50% or more year-to-date) and labor. Since 2019, RBC estimates that project capital intensity has increased by 25%, with average cost to build a 100,000 ounce per year operation of $205 million. Operating costs are also under pressure. Diesel is one of the largest components of input costs, with higher prices to date (up 25%) placing upward pressure on operating costs. RBC estimates a $90 per ounce cost impact for open pits versus $28 per ounce for underground mines.