Strengths

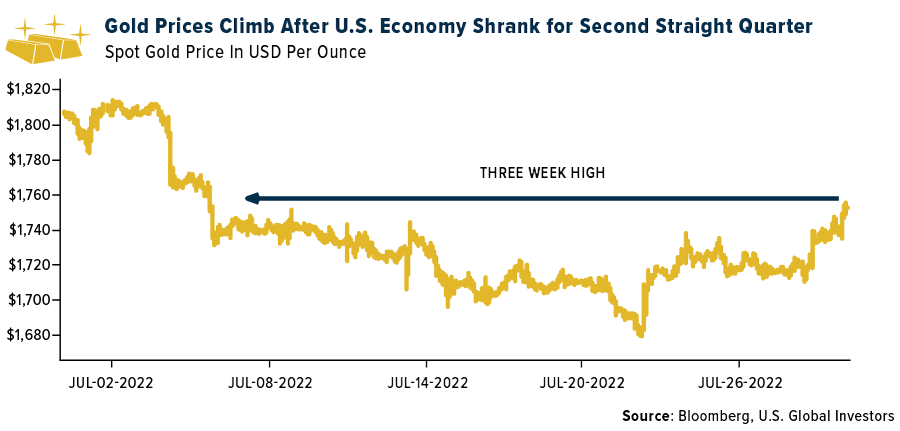

- The best performing precious metal for the week was silver, up 8.88%, likely on short covering around the Federal Reserve hiking the borrowing cost. Gold climbed this week after the U.S. economy shrank for a second consecutive quarter, reports Bloomberg, pushing the dollar and Treasury yields lower. Bullion rallied as much as 1.2% to reach a three-week high after GDP fell 0.9%.

- According to the World Gold Council’s second quarter Gold Demand Trends report, continued growth in the second quarter lifted first-half mine production 3% to 1,764 tonnes – making it a record first half for the group’s data series. Mine production benefited from an absence of COVID-related lockdowns, the report explains, and was also boosted by continued recovery in China following safety stoppages in 2021.

- Agnico Eagle Mines reported strong financial and operating results for the second quarter of 2022 on Thursday. Highlights included record gold production along with strong earnings and cash flow generation. Payable gold production in the quarter was 858,170 ounces at production costs per ounce of $766, total cash costs per ounce of $726, and all-in sustaining costs per ounce of $1,026. Expected payable gold production in 2022 remains unchanged at between 3.2 and 3.4 million ounces.

Weaknesses

- The worst performing precious metal for the week was spot gold, but still up 1.98%. Shares of Newmont tumbled on Monday after the gold miner’s second-quarter earnings fell short of estimates, reports Barron’s. For Newmont, adjusted earnings per share of 46 cents came in below consensus of 65 cents. The miss was largely due to higher cost of sales, exploration, and G&A expenses. Management notes that earnings were negatively impacted by higher labor, materials and consumables costs of $80 million, higher fuel and energy costs of $50 million, and the $70 million expense recognized in the second quarter related to the Peñasquito profit-sharing agreement announced in early July.

- Over the broad market selloff over the last few months, gold has managed to outperform nearly all other asset classes (except for the U.S. dollar) as a store of value. However, gold miner equities (as measured by the GDX ETF) have underperformed the underlying commodity by 25%. While a portion of this is due to some margin compression from input cost inflation, the group has also underperformed the S&P 500 by 22% (where almost all companies in this broad market index have also seen margin pressure from inflation).

- SolGold is in discussions with major shareholders on possible financing options for its Cascabel Project in Ecuador. Initial capital costs of $2.7 billion to build a large copper mine presents a challenge and local communities near the proposed mining projects are gaining political support in some government agencies.

Opportunities

- It is estimated that quant-oriented commodity trading advisors unwound nearly $100 billion of bearish stock-bond bets recently, helping the world’s biggest markets to recover from their worst half in history, according to Bloomberg. Nomura Holdings and JPMorgan noted that commodity trading advisors have offloaded big, short positions that were oriented around soaring inflation. The recent Federal Reserve commentary implies that they could perhaps reduce their pace of rate hikes due to recession risk. Nevertheless, the junior gold stocks have had a strong bid since the start off the month, with the GDXJ ETF up 5.06% while the GDX ETF is still off 4.05%.

- GCM Mining Corp. agreed to buy all of the outstanding Aris Gold shares it doesn’t own to form a new company named Aris Gold Corporation. All outstanding Aris Gold shares not held by GCM will be exchanged at a ratio of 0.5 of a common share of GCM for each common share of Aris Gold. GCM and Aris Gold shareholders are expected to own, on a diluted in-the-money basis, approximately 74% and 26% of the combined group, respectively.

- The India International Bullion Exchange has just launched, giving qualified jewelers the ability to directly import bullion. Current rules that require a bank-approved agency to act as an intermediary would be eliminated. India is the second biggest importer of gold. It is expected the new rules will be more transparent which allows for better pricing for the consumer.

Threats

- According to RBC, the relationship between gold and the U.S. dollar is inversely correlated but has drifted a little in terms of correlation strength over time, with current recent dollar strength driving material weakness in gold but periods in the past (2013-2019) where they were less correlated. One would likely need to see double-confirmation of peaking real interest rates and peaking/reversal in U.S. dollar strength for gold to start working to the upside.

- The greenback now stands at an all time high, according to some measures noted Bloomberg. Since mid-2021, the dollar has appreciated by 15% against a basket of currencies. Vishnu Varathan, head of economics and strategy at Mizuho Bank Ltd. in Singapore said, “There is no Kryptonite to blow up the dollar’s strength immediately, with the Eurozone hampered by the war in Ukraine and China’s growth uncertain.” With about 40% of global trade priced in dollars, consumers around the world are feeling the pain of a rising dollar. In the 1980s when the Fed last fought inflation, dollar strength eventually led to the Plaza Accord, an agreement that international policy makers cut to artificially rein in the dollar as they realized the possibility that further gains would convulse the global financial system and trigger all sorts of other pain.

- Despite bullish signals on Chinese demand, UBS expects the palladium price to slide through 2022. The bank cut its year-end price target by $200 to $1,700 an ounce on the prospect of a recession in the European Union and rate hikes by the Federal Reserve. “Robust imports are likely one reason why palladium has held up so well compared to other precious metals in recent weeks,” UBS wrote in a note. “Industrial demand will suffer from slower economic growth in Europe and in view of aggressive monetary policy tightening in the U.S.”