Strengths

- The best performing precious metal for the week was palladium, up 6.3%, as hedge funds aggressively close short positions. According to Scotia, SilverCrest Metals reported fourth-quarter earnings per share (EPS) of $0.25, significantly ahead of the consensus of $0.13, based on pre-reported silver and gold sales of 1.27 million ounces and 16.1 thousand ounces, respectively.

- Calibre Mining announced an updated reserve and resource estimate for its operations in Nicaragua and Nevada. Nicaraguan reserves increased year-over-year in contained ounces, marking the fourth consecutive year the company has achieved this since acquiring the assets from B2Gold in 2019.

- Ramelius Resources has outlined a 10-year plan for its more valuable Mount Magnet site (90% operating net asset value). Extensions have increased their life-of-mine production to 1.7 million ounces from 1.2 million ounces, which is offset by growth capital expenditures rising by 230 million Australian dollars.

Weaknesses

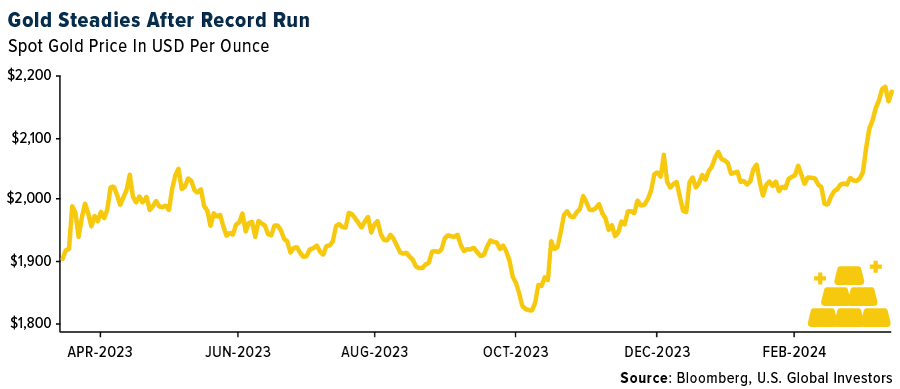

- The worst performing precious metal for the past week was gold, down slightly by 1.1%, as recent U.S. inflation data reduced expectations for future interest rate cuts. Goldman Sachs reported that Gold Road Resources announced substantial rainfall has resulted in the closure of roads that provide access to Gruyere and the suspension of mining operations over a portion of this period, with the likely resumption of open pit access expected next week.

- According to Bloomberg, Gabriel Resources, a Canadian developer aiming to build one of Europe's largest gold and silver mines, has lost a $4.4 billion damages claim against Romania for halting the project more than a decade ago due to environmental concerns.

- Bloomberg also reported that holdings in gold-backed ETFs have continued to decline. The flow of investment, and therefore metal, in and out of funds tracked by Bloomberg had a 0.5 correlation with monthly price changes in the five years leading up to late 2022. Then, the relationship suddenly broke, with ETF investors beginning to sell, even as central bank purchases drove up the price.

Opportunities

- According to BMO, there are currently more sellers than buyers of assets. In addition to the usual supply of junior miners hoping to be acquired, there are also many cash-flowing mines or permitted projects available for sale or partnership.

- Bloomberg reported that the board of Gold Fields approved a $195 million renewable energy project at the St. Ives mine in Western Australia. The project, the largest in the Gold Fields portfolio to date, will supply 73% of the mine's electricity requirements. Construction will start in May and is expected to be operational by the end of 2025.

- Morgan Stanley notes that net non-commercial positioning for gold had fallen in the first few weeks of the year to the lowest since mid-October, as long positions were reduced. However, this trend has sharply reversed with gold’s recent rally, driven by a jump in long positions, while short positions have remained largely unchanged.

Threats

- BMO highlights that, assuming current spot commodity prices, there is potential for Sibanye Stillwater’s leverage ratio (net debt/adjusted EBITDA) to increase to 2.4x, which is just below the debt covenant requirement of 2.5x.

- In congressional testimony last week, Chair Jerome Powell emphasized that the central bank needs "just a bit more evidence" that inflation is headed toward its 2% target before lowering borrowing costs. A hotter-than-expected inflation reading, as happened last month, would be a setback for further gains in precious metals, which do not offer a yield and benefit from a lower-rate environment, according to Bloomberg.

- Bloomberg reported that the ever-higher prices reached by gold are turning Dubai’s traditional bazaar into more of a window-shopping experience, with purchases plummeting at the Gold Souk, according to salespeople at numerous shops.