Strengths

- The best performing precious metal for the week was palladium, up 2.68%, perhaps on speculation of mine production falling with the recent spate of layoffs. According to Scotia, Alamos Gold reported its 2023 year-end Reserve and Resource update, which included a 2% increase in reserves compared with year-end 2022 after depletion. Alamos indicated slightly higher grades for 2023 reserves (+1% overall) compared with 2022 due to higher-grade additions at Island Gold and Puerto del Aire (PDA), and growth at Lynn Lake.

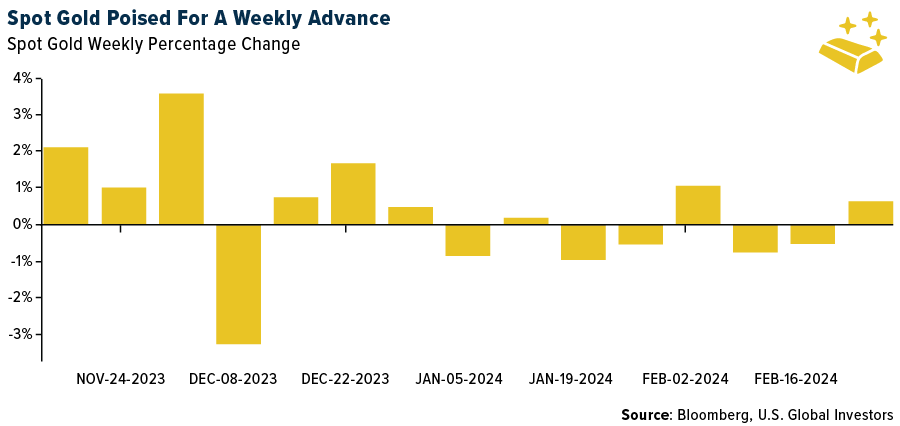

- According to Bloomberg, gold is trading at perhaps the largest premium to modelled values on record. Rather than suggesting that a sharp decline is in store for the metal, it is perhaps worth considering whether the demand function has changed, with regime change affecting the data. They favor a simple regression-based gold valuation model, with the Bloomberg Dollar Index, U.S. 10-year real rates and ETF bullion holdings as the independent variables. It has remarkable success in forecasting the price direction -- yet now, based on data since 2007, it shows gold is more than $400/oz too expensive. And what is more, it has been at a premium consistently since the end of 2022. The lift in central bank buying is likely one driver that has changed the market dynamics.

- Gold shipments from Europe’s key refining hub soared to 207 tons in January from 107.9 tons in December as sales to China and Hong Kong increased, according to data on the website of the Swiss Federal Customs Administration. Shipments to India rose 73% to 14 tons, and sales to China more than doubled to 77.8 tons.

Weaknesses

- The worst-performing precious metal for the week was silver, down 2.18%. After a strong showing in the prior week, the metal fell in price for the first four days of the week, only to get a bounce on Friday with the strongest move of gold. According to JP Morgan, since a local peak in April 2022, total gold ETF holdings have decreased by around 24 million ounces, a 22% drop. Moreover, in COMEX futures, money managers are currently only 34,000 contracts net long, less than 15% of the peak net length in 2019 and 2020

- According to Scotia, SSR Mining has reported that the Turkish Ministry of Environment, Urbanization and Climate Change has cancelled the Çöpler mine’s environmental permits because of leach pad material sliding towards the nearby Sabırlı creek, one of two non-permanent creeks in the area that drain into the Euphrates River. All operations at the site remain suspended as search and rescue efforts continue for the 9 missing employees. Separately, SSR reported that eight Çöpler mine employees have been detained as part of an investigation by local authorities.

- Burkina Faso’s junta has suspended export permits for gold and other minerals from small-scale and semi- mechanized miners after a drop in output in recent years. The suspension follows a need to clean up the sector and to better organize the “marketing of gold and precious minerals,” Energy and Mining Minister Yacouba Zabre Gouba said in a statement on Wednesday.

Opportunities

- According to JP Morgan, gold has remained more resilient than expected over the recent Federal Reserve repricing, prompting them to mark their 1H24 forecasts modestly higher. They maintain their bullish forecast with an upside target of $2,300/oz as the onset of a Fed cutting cycle is expected to open asymmetric upside convexity in gold prices as U.S. real yields fall over 2024 and 2025.

- Newmont, the world’s top gold producer, will seek to sell six mines and two projects in a set of divestitures aimed at generating $2 billion in cash. The Denver-based company said Thursday it intends to divest three Canadian gold mines — Éléonore, Musselwhite and Porcupine — along with Cripple Creek & Victor in the U.S., Akyem in Ghana, and Australia’s Telfer mine. It also plans to sell two “non- core” projects, Havieron in Australia, and Coffee Gold in Canada.

- RBC expects a relatively neutral reaction from shares of Dundee Precious Metals following the announced superior bid received by Osino Resources, which comes two months after DPM’s original acquisition offer. The new all-cash bid of C$368M via a foreign-based mining company represents a 32% premium to DPM’s original offer and DPM has provided notice that it will not be exercising its right to match during the five-day match period.

Threats

- Anglo Platinum looks to lay off staff at its operations. Meanwhile, the market for platinum-group metals also remains under pressure (these are predominantly used in cars with a combustion engine), with Anglo Platinum noting that the company "responded rapidly throughout 2023 to reposition the business to address both the global and local challenges that currently face the PGM industry. However, that the extensive range of actions we have already taken do not go far enough.”

- SSR Mining rescue efforts to reach to nine workers trapped under the soil have been stopped in a gold mine incident in eastern Turkey on concerns of a new landslides, state-run Anadolu Agency reported, citing Interior Minister Ali Yerlikaya.

- For 2024, Wheaton Precious Metals is guiding to production volumes of 550,000-620,000 gold equivalent ounces (GEOs). At constant metal prices, the range implies production volumes that will be -6 to +6% versus 2023 production volumes. (Consensus is 720,000 ounces). They are citing the suspension of operations at Minto and the temporary halting of production at Aljustrel as a driver, as well as lower production from Salobo.