Strengths

- The best performing precious metal for the week was palladium, up 3.72%. Gold is set for its biggest monthly gain since November on uncertainty in the banking sector as investors sought safety in other assets. Everything is playing in gold’s favor: A banking crisis, falling rates, high inflation, pressure on the dollar, hot Asian demand and technical momentum as it flirts with breaching the $2,000 an ounce level for the first time in over a year.

- Northern Star looks ready for bond investors after securing a BBB rating from Fitch and Baa3 from Moody’s for its unsecured notes. The miner wants to raise the debt from investment-grade U.S. dollar bond markets. The plan for the notes to be guaranteed by Northern Star subsidiaries that held at least 85% of the company’s EBITDA and total assets.

- Bloomberg reports the Brazilian government will require electronic invoices for gold trading starting July 3, in what observers say is a long-awaited step to curtail illegal transaction from small-scale unregulated mining operations that typically use mercury to extract the gold from the ore and then burn off the mercury over an open fire, leaving the gold behind.

- The worst performing precious metal for the week was gold, down 0.70%. Gold prices in India, the second largest consumer, are up 15% from the prior year and that has led to a pullback in demand going into next month which is a key demand period. The cash market for gold is currently trading at a discount.

- Galiano Gold reported Q4/22 financial results with adjusted earnings per share (EPS) of -$0.03 (versus the consensus estimate of $0.01) on a lower realized gold price and higher finance costs from production of 34,100 ounces gold with an all-in sustaining cost (AISC) of $1,191 an ounce.

- Overall, inflation pressures were significantly underestimated in 2022 with only 30% of producers achieving original guidance and average AISC coming in +$100 an ounce higher than expectations. For 2023, companies have rebased costs higher, outlining an additional +3% increase in guided costs versus 2022.

Opportunities

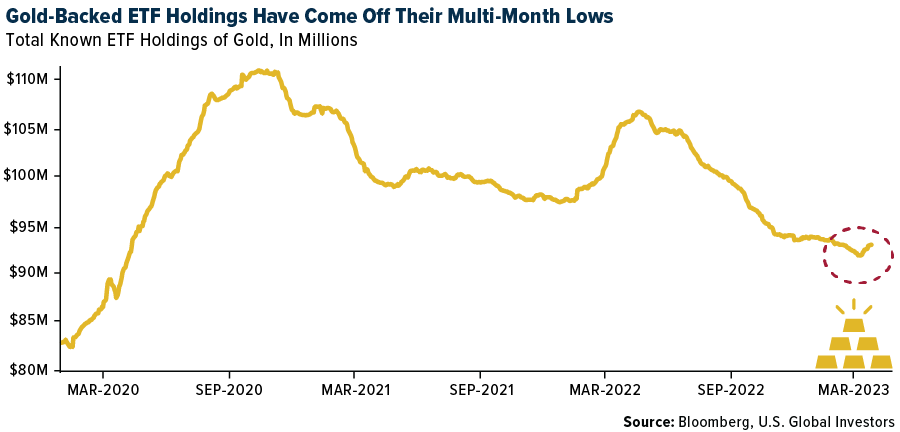

- With investors shifting to accumulate gold over the past two weeks as evidenced by net inflows into physical gold ETFs, the chief economist and global strategist at Euro Pacific Capital believes investors may be running out of time to purchase gold below $2,000 per ounce. Banking stress, a weaker dollar, and falling bond yields are driving investors to follow the lead of many central banks around the world that bought record amounts of gold.

- Gold is near its highest price in nearly a year, with the copper/gold ratio declining by 4% year-to-date. Historically, this ratio has exhibited a close correlation with the cyclical/defensive ratio; however, the latter is +12% YTD. Gold equities should continue to benefit at this point in the cycle.

- Barrick Gold and the Papua New Guinea government and partners have agreed to resume operations at the Porgera gold mine at the earliest opportunity according to Bloomberg. Upon operational restart, the plant and operations have been on care and maintenance since 2020, the mine is expected to ramp up to around 700,000 ounces per year. This should be a positive as it brings a second operating gold mine to the Papua New Guinea outside of the presently established operations of K92 Mining. Barrick has the confidence to return to this jurisdiction.

Threats

- Analysts are taking down their platinum group metals (PGM) basket price forecasts by 20% on average between 2023-2030 to reflect a faster-than-expected decline in ICE vehicle sales through 2030 and a growing perpetual palladium/rhodium surplus that emerges by 2025. Recalling ICE vehicles are one of the primary demand drivers for platinum/palladium/rhodium (given use in ICE vehicle catalytic converters), and growing penetration of EV’s poses a strong demand-side threat to PGMs.

- Only 33% of operations were able to execute on mine site cost guidance in 2022 with average miss of $50 per ounce gold. Company-wide, producers saw average AISC of +$100/oz above original guidance, with only 30% of producers able to achieve guidance, representing a record low versus the prior five-year average of 75%.

- CoinDesk data shows that the top cryptocurrency by market value rose almost 72% to $28,500 this year, its best quarterly gain in two years. The cryptocurrency's market value is $542 billion after the rally. After falling 76% since November 2021, some experts predicted Bitcoin could fall to $12,000 this quarter three months ago. The rebound has put Bitcoin ahead of Ether, the second-largest cryptocurrency by market value, which is on track for a 50% quarterly gain. Gold has uneventfully only gained 8% this year, reflecting it hasn’t seen a major jump in price due to current stress, but people are noticing.