Strengths

- The best performing precious metal for the week was palladium, up 10.31% as demand in China appears to be picking up with the reopening of its automobile sector. GCM Mining released second quarter production results that beat quarterly production estimates, reporting 53,198 ounces of gold produced compared to consensus of 50,600 ounces. Full-year production may meet company guidance of 210,000-225,000 ounces of gold.

- Newcrest Mining reported its June quarter production of 637,000 ounces, better than consensus of 594,000 ounces. The stronger production performance was driven by improved throughput and grades at both Cadia and Lihir.

- Marathon Gold provided an update on the completion of several important stakeholder agreements and permitting milestones concerning the development of the Valentine Gold Project in central Newfoundland. These updates include 1) the completion and signing of a benefits agreement between Marathon and the province of Newfoundland and Labrador, 2) the completion and signing of an outfitter environmental effects monitoring plan between Marathon and the Newfoundland and Labrador Outfitters Association, 3) receipt of the project’s surface lease, and 4) the completion and acceptance of a provincial environmental preview report for the project’s powerline, and its release from provincial environmental assessment.

Weaknesses

- The worst performing precious metal for the week was silver, down 0.53% with a relatively flat trading range. RBC expects a negative reaction from Wesdome shares following second quarter production results, which came in at 26% consensus due to operational issues that appear one-time in nature. At Eagle River, output was impacted by issues with a new hoist rope and leach tank resulting in unscheduled downtime, which has now been resolved. In addition, at Kiena, the ongoing ramp-up was impacted by supply chain delays related to key electrical components.

- Superior Gold Inc. shares fell on Tuesday morning after the company said rainfall and increased cases of Covid-19 in Western Australia dampened second-quarter gold production. The precious metals miner said gold output in the period fell 21% from the prior-year period to 15,196 troy ounces, as it faced unusually high rainfall in May and more cases of Covid following the removal of pandemic measures in April.

- Anglo American Platinum reported second quarter 2022 production, which at the asset level was a miss versus consensus: 923,000 ounces of platinum in concentrate was 4% below consensus and 618,000 ounces palladium was 8% below consensus. More impactful, 935,000 ounces refined platinum output was 14% below consensus and 603,000 ounces refined palladium was 19% below consensus.

Opportunities

- Stifel visited Moneta's Tower Gold project just east of Timmins, ON. Stifel was impressed by the consistency of mineralization over the 4km of trend at the Golden Highway portion with an understanding of multiple areas for the resource to continue to grow at depth and in continued step out. With increased focus on modeling at Garrison, the group also sees excellent potential for additional underground resources at the 903 deposit and in the sediments at depth and along trend at Garrcon.

- According to RBC, valuations for junior miners have approached lows not seen since 2015 when gold was $500 per ounce lower at $1,200 per ounce and copper was $1.00 per pound lower at $2.25 per pound, with valuations down 35% year-to-date (to $29 per ounce in the golds and down 27% to $0.04 per pound in the base metals). This comes on the back of declining commodity prices and rising cost concerns around project study updates, which have crushed the sector.

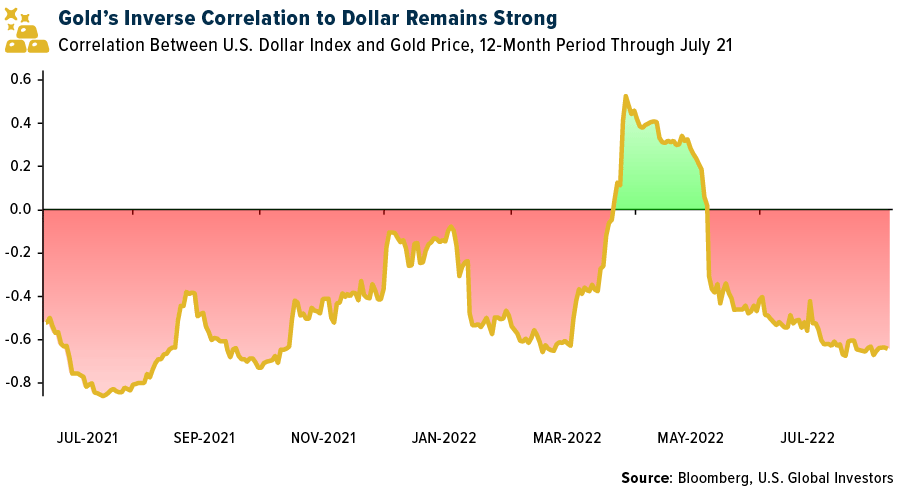

- Retail traders are flocking to the momentum in the U.S. dollar. Shawn Cruz, director of product strategy at TD Ameritrade noticed retail clients are “hyper focused” on the strength of the dollar. Bullish bets on the dollar have garnered a cult-like following among retail traders online. Perhaps it’s the correction in Bitcoin that has traders seeking new returns now that interest rates are no longer zero. That could mean the dollar could get pushed to unreasonable levels but likewise who is the next logical buyer when retail is at the helm? Economic weakness could trigger a switch to gold.

Threats

- Gold is heading into the second half of 2022 under increasing pressure, reports Bloomberg, with the dollar more than ever the dominant driver. One gauge of the greenback hit an all-time high on July 14, the article explains, and bullion priced in dollars fell to its weakest intraday level in more than 15 months on Thursday (with the inverse correlation between the two assets around the strongest level since September). Head of real asset strategy at Wells Fargo, John LaForge, says that while real rates can be a strong driver of gold at times, that’s not the case now.

- UBS calculates that Barrick's second quarter earnings per share (EPS) will likely come in below Street estimates, based on details released in the preliminary production report. Second quarter gold sales volumes of 1.04 thousand ounces were slightly below consensus of 1.07 thousand ounces on implied cash costs of $857 per ounce versus consensus of $791 per ounce. The group’s preliminary calculations imply second quarter EPS of $0.22 per share versus the Street's $0.28 per share.

- According to UBS, pressure has built into the June quarter for Australian gold miners with up to 30% quarter-over-quarter improvements required to get to the low end of guidance. Risks have increased through the year as their Perth trip highlighted: tight labor markets, supply chains and inflation rates up 10-15% and the lifting of Covid-19 border controls in March only exacerbating problems, not improving them.