Gold SWOT: The U.S. government is starting to show bipartisan support for mine development.

Strengths

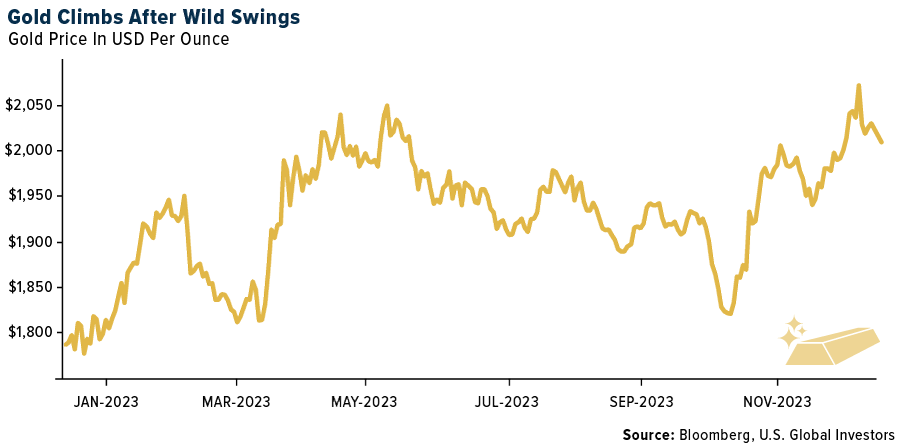

- The best performing precious metal for the week was platinum, but still down 1.48%. Gold shot past a previous all-time high on Monday as it was turbocharged from the prior Friday when comments by Federal Reserve Chair Jerome Powell that monetary policy is “well into restrictive territory,” spurring a plunge in the dollar and Treasury yields as the day started. Gold’s surge on Monday completely evaporated before the markets opened in the U.S., finishing the day nearly $50 lower. On a positive note, China added more gold to its reserves in November, their 13th consecutive monthly purchase.

- Lundin Gold provided an updated three-year outlook with 2024 production guidance of 450,000 – 500,000 ounces versus the consensus of 483,000 ounces, 2025 guidance of 475,000 – 525,000 ounces versus the 501,000-ounce consensus. Cash costs and all-in sustaining costs (AISC) for 2024 increased by 4% - 5% relative to previous guidance but are expected to decline by 4% - 5% by 2026.

- According to Morgan Stanley, polished diamond prices are stabilizing after a long decline. Polished prices for 0.3-3.0 carat stone sizes modestly increased by 1%-2% month-over-month in November after declining significantly during the year due to weak demand, lack of supply discipline and competition from the lab-grown market. However, a sustained price recovery will require a pick-up in underlying demand during the holiday season. Early indicators are suggesting that sales during the holiday season have been sound so far, but they seek clarity on whether natural stones lost further market share.

Weaknesses

- The worst performing precious metal for the week was silver, down 9.83%. Surging gold prices are prompting some Indians to exchange gold jewelry for new pieces as demand rises during the wedding season in the biggest consumer of the precious metal after China. More Indians are looking to reuse their gold, and the higher prices mean imports will remain pressured in the coming months, said Surendra Mehta, national secretary at the India Bullion and Jewelers Association. Consumers have been buying to meet wedding-related needs, but are otherwise largely staying away from the market, he said.

- According to BMO, Tharisa’s 2023 trading statement for the financial year has indicated headline earnings per share (EPS) of $0.275-$0.285, which is lower than the estimate of $0.41. Year-on-year, headline earnings have fallen between 31%-33%, primarily due to the lower platinum group metals (PGM) basket prices, which have declined 26% (from $2,564/ounce to $1,893/ounce).

- Norilsk Nickel, the world’s largest palladium producer, said: “Historically record high net short positions coupled with metal destocking by automotive companies and fabricators (which, in their view, is coming to end) have been pressuring palladium price since the end of 2022, which, along with supply chain disruption led to a 15% YoY secondary (i.e., recycling) production fall in 2023. Moreover, given current precious metals prices major PGM projects in South Africa and North America are expected to incur financial losses next year (and some already became loss-making at current prices) if they opt to sustain current production levels.” As such, there is "significant risk from the primary supply of South Africa and North America amid potential cost optimization at low margin projects."

Opportunities

- According to Morgan Stanley, the government is starting to show bipartisan support for U.S. mine development, which could help to kick-start a domestic mining boom. The Inflation Reduction Act (IRA) has two key tax credits for companies producing critical minerals. The first is a 10% production tax credit (IRA Section 45X) applicable to manufacturing costs and has no sunset provisions associated with it. The second is a 30% investment tax credit (IRA Section 48C) that applies to the capex associated with manufacturing and processing.

- Spot gold is poised to test new heights, driven by expectations of an approaching Fed pivot and favorable year-end seasonal prices. Asset diversification during economic uncertainty, coupled with high inflation and interest rates, helped the precious metal maintain its haven status this year, further supported by geopolitical tensions in the Middle East.

- For many investors, gold is looking hot right now. The precious metal just touched an intraday record of $2,135.39 an ounce thanks in part to its haven status: The more volatile the world gets the better gold tends to do. Bullion has rallied almost 16% since early October, a surge that was initially sparked at the start of the Israel-Hamas conflict but has since been driven by bets on the Fed will shift to monetary loosening early next year.

Threats

- According to BMO, new information suggests that the Cobre Panama mine closure (a major mine in silver production) could be longer than they had previously anticipated. Last week, the government also issued a directive to close the mine for an unknown period and the Supreme Court decision included a decision to withdraw the Cobre Panama mining concessions. These new decisions suggest that the closure could be prolonged beyond their previous estimate. They now assume the mine is closed to the end of Q3 of 2024.

- Mining executives in Peru are imploring authorities to crack down on escalating violence by informal miners, which cost the lives of nine staff members of a large, legal gold mine this weekend. “Formal mining is under attack,” Angela Grossheim, the head of industry group SNMPE and a former minister, told reporters Tuesday. “Illegal mining today is the country’s main illicit activity, even bigger than drug trafficking.”

- Bitcoin surged above $40,000 this past Mondy when gold sold off and is now closer to $44,000 as we close out the week. Speculators love the seven-day nonstop trading of Bitcoin and its volatility. Peter Schiff, renowned economist, and a cryptocurrency critic noted on X, the social media platform formerly known as Twitter, that gold’s surge to a new all-time high is far more noteworthy than Bitcoin trading above $40,000. As reported on Bloomberg, Schiff noted gold has now entered uncharted territory while Bitcoin would need to rally over 60% to reach a new high in contrast to gold, which has completely broken out.