Strengths

- The best performing precious metal for the week was platinum, but still down 2.30 percent as hedge funds boosted their net long positions. Although a rocky week for gold, it rose as much as 2.6 percent on Thursday after the U.S. dollar weakened as stimulus negotiation stalled. Ray Dalio’s Bridgewater Associates invested more than $400 million in gold in the second quarter, according to a regulatory filing. The firm piled into the iShares Gold Trust and the SPDR Gold Trust – two of the largest gold-backed ETFs.

- Barrick Gold boosted its quarterly cash dividend by 14 percent to 8 cents per share. The company said in its second quarter earnings statement that “the dividend increase is sustainable and reflects the ongoing robust performance of our operations.” In afterhours trading on Friday, Barrick Gold was up 5 percent as Warren Buffett’s Berkshire Hathaway disclosed in a 13F filing that it had accumulated 20.9 million shares in the recent quarter. Newcrest Mining reported a 34 percent rise in full-year profit. CEO Sandeep Biswas said the miner is well-placed to consider further acquisitions due to its strong balance sheet and rising gold prices.

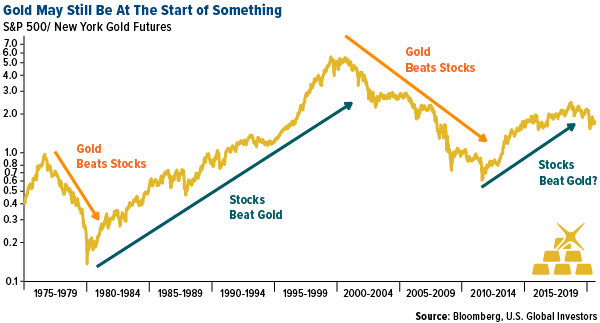

- The S&P 500-to-New York Gold Futures ratio could be telling us something about where gold is headed. As you can see in the chart below, there have been several multi-year cycles where gold and stocks trade leadership positions. The ratio is now falling after rising from 2010 to 2019, leaving the door open for a possible big gold run where it beats stocks.

Weaknesses

- The worst performing precious metal for the week was silver, down 6.55 percent as investors redeemed money from silver bullion ETFs for the past five days. Gold bullion had its first weekly loss since June. Gold fell more than $100 on Tuesday and dove below $1,900 an ounce briefly on Wednesday. Bullion took a sharp downward turn after a sudden rise in U.S. bond yields. Gold dropped as much as 5.7 percent on Tuesday – it’s biggest one-day loss in seven years.

- Investors trimmed gold positions after gold soared above $2,000 an ounce. The SPDR Gold Shares ETF saw $382 million in outflows last Friday as investors weighed a mixed economic outlook.

- Goldman Sachs closed its long silver trade after a 50 percent monthly surge. Analysts said in a note that “with gold currently still below $2,000 an ounce, the increase in silver was much faster than we anticipated, and we think that the near-term risk return trade-off for silver has diminished.” Bloomberg notes that the bank is still bullish on precious metals in the medium term.

Opportunities

- Lu Jun, founder of private fund firm Shanghai Congrong Investment Management, whose macro fund has beaten 96 percent of its peers this year, said he is avoiding aggressive equity bets and will focus on gold-related assets. In a Bloomberg interview, Lu said there is still huge upside potential for gold prices and they “might hit $5,000 per ounce on a five-year horizon.” Due to rapid money printing, Lu is bullish on gold and said gold-related assets account for the biggest weight in his portfolio.

- Many argue that gold prices are influenced by real rates, but CrossBorder Capital argues that gold is driven by liquidity. The advisory firm said in a note that “the relationship between liquidity and gold is statistically robust and simply states that a 10 percent rise in U.S. dollar liquidity leads to a 12 percent change in the level of gold prices, some three months later.” Central banks continue to print money, which is increasing liquidity at a rapid rate. Bloomberg notes that CrossBorder estimates gold could add a further 15 percent and test $3,000 an ounce by later 2021.

- Silver’s turbulent week drove the biggest discount since 2008 to the iShares Silver Trust ETF – the world’s biggest ETF tracking the metal. The fund fell 14 percent on Tuesday along with silver spot prices, but the ETF actually tracks the LBMA silver price, which is calculated once a day at an auction. Bloomberg notes that the result was an 11 percent discount between the fund and its underlying holdings, with the fund selling off more quickly. According to Mizuho International, this demonstrates that ETFs can provide a better sense of price than the less-liquid precious metals they track.

Threats

- Gold’s rapid drop this week could turn some investors off. Edward Meir, analyst at ED&F Man Capital Markets, told Bloomberg in an interview “the extent of this selloff was so severe that I think it’s caused jitteriness about longs getting back in so quickly.” This week’s price action is a reminder for investors about gold’s volatility.

- U.S. retail sales in July increased less than expected. Sales rose 1.2 percent, below forecasts of 1.9 percent, and far less than the 8.4 percent advance in June. Kitco News notes that coronavirus infections continue to spread across the country, forcing new lockdowns or pausing reopenings. Although new jobless claims hit the lowest since the pandemic began, there are still at least 31.1 million people on unemployment.

- The resilience of the consumer is to be tested with certain Covid-19 government relief programs not being renewed for the unemployed yet.