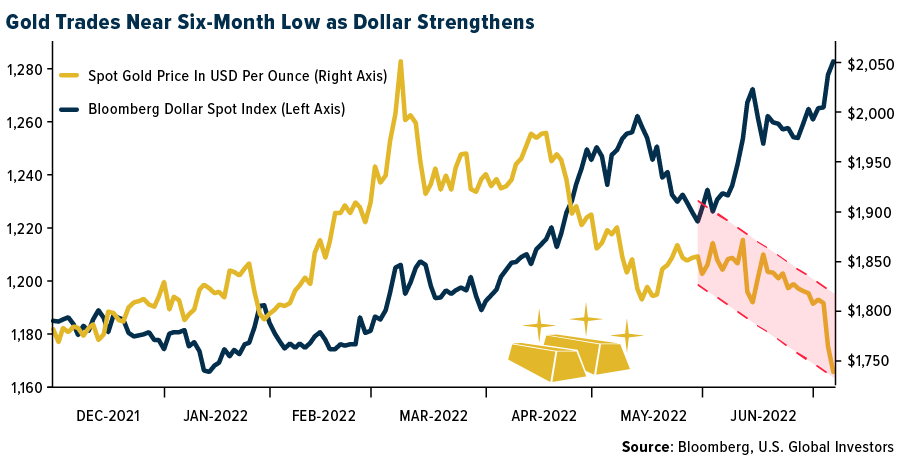

Last week gold futures closed at $1,740.40, down $61.10 per ounce, or 3.39%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 3.29%. The S&P/TSX Venture Index came in off just 0.30%. The U.S. Trade-Weighted Dollar rose 1.74%.

Strengths

- The best performing precious metal for the week was palladium, up 11.01%, perhaps on new tightness in the market with the Stillwater Mine remaining offline for at least several more weeks. In May, central banks reported adding a net 35 tons to global gold reserves. This is the second consecutive month of net buying, reports the World Gold Council, having recently oscillated between monthly net purchases and sales.

- Petra Diamonds announced its final tender for the 2022 fiscal year (June year-end). The tender was $93 million, bringing fiscal year sales to $585 million, a 44% increase year-over-year. The positive surprise is driven primarily by realizations, although volumes (carats) were a little higher as well.

- Sandstorm Gold reported preliminary results for the second-quarter sales this week. The company sold 19,200 gold equivalent ounces, compared to 18,004 in the prior year’s second quarter. In addition, total revenues came in at $36 million, a record for the company, and is comprised of sales, royalties, and other income.

- The worst performing precious metal for the week was gold, down 3.39%. Gold edged lower as the dollar strengthened, reports Bloomberg, on bets the deteriorating growth outlook for the euro area will lead to slower monetary tightening there than in the U.S. The greenback gained as much as 0.7% -- putting pressure on gold -- as the euro dropped amid weaker economic data in France. Concerns are growing about gas shortages because of cuts to supplies from Russia, with the fallout likely to restrain rate increases by the European Central Bank, the article continues.

- Exchange-traded funds (ETFs) cut 25,717 troy ounces of gold from their holdings in the last trading session, bringing this year's net purchases to 6.17 million ounces, according to data compiled by Bloomberg. This was the fourth straight day of declines. The sales were equivalent to $46.5 million at the previous spot price. Total gold held by ETFs rose 6.3% this year to 104 million ounces, the lowest level since March 17.

- Hecla Mining has entered into an agreement with Wheaton Precious Metals Corporation to terminate its existing silver stream on Alexco Resources’ Keno Hill Silver property for $135 million, reports Zacks. Wheaton will have a 5.6% shareholding interest in Hecla’s shares after the Keno Hill silver stream deal ends.

Opportunities

- Hecla Mining and Alexco Resource Corp. announces a definitive agreement for Hecla to acquire all the outstanding common shares of Alexco that Hecla does not already own. Each outstanding common share of Alexco will be exchanged for 0.116 of a share of Hecla common stock implying consideration of $0.47 per Alexco common share and a premium of 23% based on the companies’ five-day volume weighted average price on the NYSE and NYSE American on July 1, 2022.

- According to Stifel, gold and silver have historically outperformed through the summer months, beating the S&P 500 by 1.9% and 4%, respectively on average, over the last 25 years. Stifel believes this dynamic will hold through 2022 as investors look to preserve wealth after the recent dramatic contraction in the broader equity market. Lending further support for the case for gold, a recent Bloomberg study covering the last 50 years and seven recessions, showed bullion outperformed the S&P 500 by about 50% on average in a two-year period (that included 12 months before and after the start of U.S. recessions).

- Leaders of the Economic Community of West African States (ECOWAS) on Sunday lifted economic and financial sanctions imposed on Mail, reports Reuters, after its miliary rulers proposed a 24-month transition to democracy and published a new electoral law. While gold mining activities in the country were largely unaffected by the sanctions, we believe that the removal of sanctions and the agreed election timelines should improve investor sentiment toward Mali. Producing gold mining companies in Mali include B2Gold, Barrick, Resolute Mining, and Hummingbird Resources. ECOWAS is a regional political and economic union of 15 countries located in West Africa.

Threats

- According to RBC, Argonaut Gold announced a capex update at Magino and associated financing as a tough but necessary measure to recapitalize the company in getting construction to the finish line. The current share price and depressed valuation reflect the market’s low level of confidence given successive budget overruns, which may be sustained until the project has greater visibility to completion in early-2023.

- Newmont Corp. announced an incremental 10% profit-sharing payment to the workforce at its Penasquito mine in Mexico (17% of EBITDA, 14% of NAV) that amounts to a 1-2% negative impact to both NAV and market cap.

- Emerging market bonds face a $237 billion cascade of defaults, reports Bloomberg, with Sri Lanka already stopping its payment to bond holders this year. Russia stopped in June. Now, El Salvador, Ghana, Egypt, Tunisia, and Pakistan are cited as particularly vulnerable. As history shows, the collapse of one government can create a domino effect with their traders pulling money from shaky markets. Ghana is of particular interest as it is Africa’s second-biggest cocoa and gold producer. Currently, Ghana is seeking financial assistance from the IMF for access of up to $1.5 billion to shore up its finances and win back access to the global capital markets.