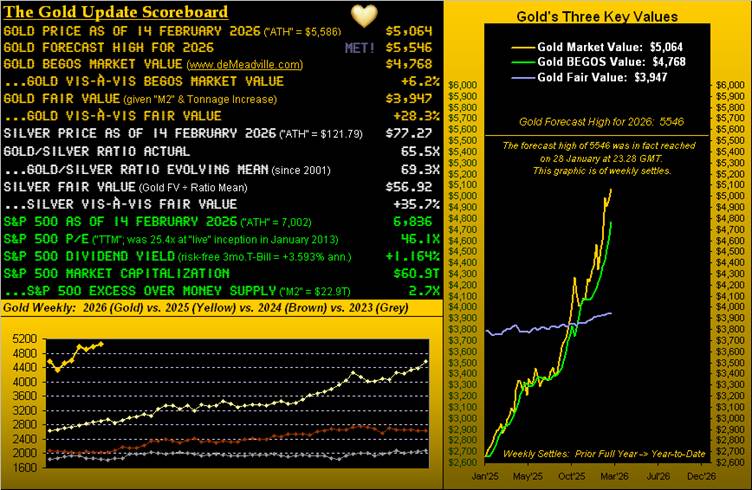

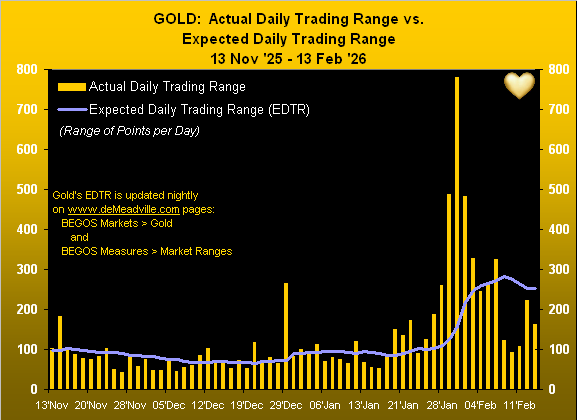

‘Tis a Valentine Day’s edition of The Gold Update, (the only other prior occurrence being back in 2015)! And on the heels of last week’s piece “Gold Reaching Peak Volatility”, our timing has been spot on as Gold’s daily trading range this past week clearly compressed compared to that of the prior fortnight. In settling yesterday (Friday) at 5064, Gold’s trading range for each of the past three weeks has declined from 886 points to 691 points to now “just” 245 points. Further, from intraweek high to intraweek low, this past week’s percentage range of 4.8% was the narrowest of the last four. Comparably compressed indeed!

To wit, the following graphic shows us Gold’s actual daily trading range by points (the columns) vis-à-vis each day’s “expected daily trading range” (the EDTR line) from three months ago-to-date. The five rightmost daily columns (which for you WestPalmBeachers down there is this past week) were well below the EDTR line’s expectations, as we’d sensed a week ago was due to become the case:

“Still mmb, gold just made its first weekly close ever above 5000!”

Squire, too, is spot on. Even as Gold reached its All-Time High of 5586 back on 29 January in marginally passing our forecast high for this year of 5546, never until yesterday had price actually settled a week above the 5000 milestone. Barring reading this piece, (to the extent anyone notices such settle), the relevancy of the week’s close seems rather insignificant given 13 of the past 15 trading days have already found Gold north of 5000. But then again, “The Herd” basically acts on emotion rather than on analysis. However, in just having web-searched the phrase “Gold headlines”, nary is there mention of this initial 5000+ weekly close; rather, the top links listed are specific to Olympic medals.

In fact, from the “How Soon We Forget Dept.”, coverage of the Olympics has somewhat dwarfed (albeit ongoing) geo-political issues such as Iran and Greenland. Moreover, you long-time readers of The Gold Update well know that geo-politically-driven surges in Gold’s price tend to be short-lived, even as we now read there’ll be no “Homeland Security” StateSide for at least a week; (nothing like a third “shutdown” within five months).

Still, regardless of Gold’s first ever 5000+ weekly close, relative to recent price volatility, last week was a sleeper. Here ’tis as rightmost depicted in the weekly bars from a year ago-to-date, even as the blue-dotted parabolic Long trend completes its tenth week. (And the aforementioned trading range this past week of 245 points was 79% of the expected 311 points … just in case on this Valentine’s Day you’re scoring at home):

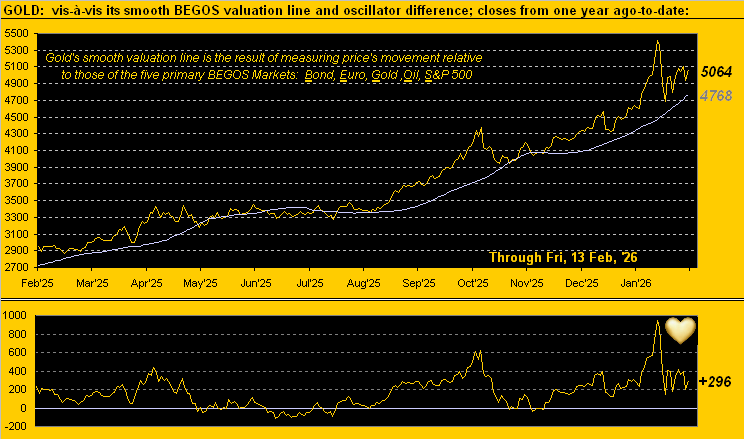

Note therein the reference to Gold being “still way overvalued”: per the opening Gold Scoreboard, the current price of 5064 is +28.3% above Fair Value (3947), although by our BEGOS Market Value (4768), such divergence is only +6.2%, i.e. +296 points as we next see:

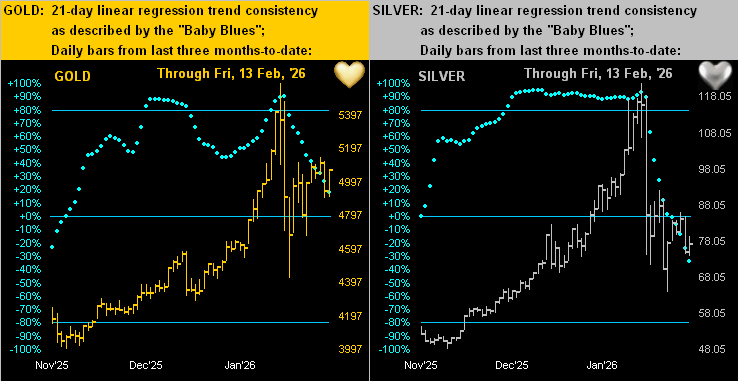

Now with furtherance to our title, Gold’s uptrend is regressing. One likely would be hard-pressed to read that in the FinMedia, but ’tis why you read us. Thus, we go below to the two-panel graphic of price from three months ago-to-date for Gold on the left and for Silver on the right. And quite starkly for both precious metals, their respective “Baby Blues” of day-to-day trend consistency continue to steadily fall. Specific to the yellow metal, the 21-day regression trend — although weakening — still is positive given the Blues are above the 0% axis; however, immediate buying basically need come to the fore, lest the Blues fall through that floor. ‘Course for the white metal, her Blues having already broken below same is mathematically indicative of her trend having rotated to negative. So even as ’tis Valentine’s Day, we again must say: Poor ol’ Sister Silver!

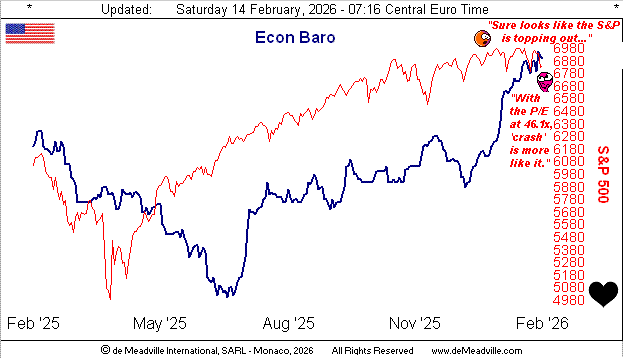

As for the Economic Barometer, despite last week’s ample stream of incoming metrics, the change for the Baro was minimal. To be sure, January’s Non-Farm Payrolls netting +130k was the highest reading since May a year ago (+144k). That is not positive for the Federal Reserve’s Open Market Committee to vote for a FedFunds rate cut, nor is the the month’s +0.4% pop in Hourly Earnings. ‘Course, the FinMedia continues to assume the Fed shall reduce rates this year, given their notably fawning over a benign Consumer Price Index dropping from the +0.3% pace in December to +0.2% for January; but the fawners seemed to ignore the Core CPI (the one which assumes you neither drive nor eat) rising from +0.2% to now +0.3%. Oh well. More importantly, a non-dovish Fed is not a Gold friend. Either way, the next FOMC Policy Statement is not due until 18 March, 22 trading days hence. Here — with black-hearted respect to the S&P 500 — is the Baro:

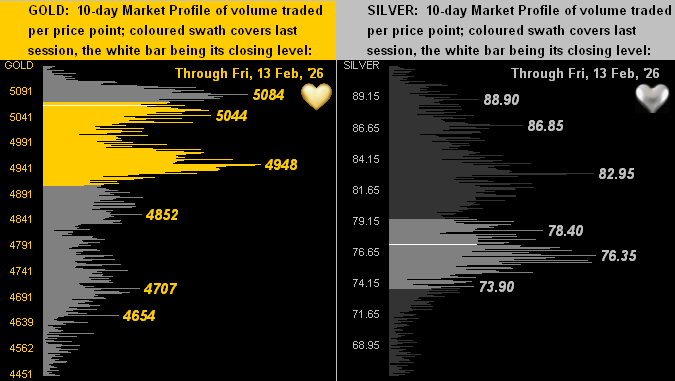

Now ahead of The Gold Stack and our wrap we’ve the 10-day Market Profiles for the precious metals, featuring that for Gold (below left) and for Silver (below right). Obviously by the respective white bars of current price, Gold (5064) is better positioned than Silver (77.27). For this past week alone, Gold’s net gain (notwithstanding the earlier-stated intraweek range of 4.8%) was +1.5%, whereas Silver recorded a net loss of -0.3%. Blame Silver’s dropper on mischievous Cousin Copper? The red metal as well recorded a weekly net loss of -1.7%, and his chart technicals are not looking very happy. Does this mean Silver is entering one her phases wherein she discards her precious metal pinstripes for her industrial metal jacket to go off cavorting with Copper? Oh, say it ain’t so, Sister Silver!

And so, to the stack:

The Gold Stack (continuous contract pricing):

Gold’s All-Time Intra-Day High: 5586 (29 January 2026)

2026’s High: 5586 (29 January)

Gold’s All-Time Closing High: 5411 (28 January 2026)

10-Session directional range: up to 5140 (from 4428) = +712 points or +16.1%

Trading Resistance: notable by the Market Profile, 5084

Gold Currently: 5064, (expected daily trading range [“EDTR”]: 248 points)

Trading Support: notable by the Market Profile, 5044 / 4948 / 4852 / 4707 / 4654

10-Session “volume-weighted” average price magnet: 4921

The Weekly Parabolic Price to flip Short: 4563

2026’s Low: 4319 (02 January)

Gold’s Fair Value per Dollar Debasement, (from our opening “Scoreboard”): 3947

The 300-Day Moving Average: 3549 and rising

The 2000’s Triple-Top: 2089 (07 Aug ’20); 2079 (08 Mar’22); 2085 (04 May ’23)

The Gateway to 2000: 1900+

The Final Frontier: 1800-1900

The Northern Front: 1800-1750

On Maneuvers: 1750-1579

The Floor: 1579-1466

Le Sous-sol: Sub-1466

The Support Shelf: 1454-1434

Base Camp: 1377

The 1360s Double-Top: 1369 in Apr ’18 preceded by 1362 in Sep ’17

Neverland: The Whiny 1290s

The Box: 1280-1240

To close, a most highly-valued reader of The Gold Update just enlightened us as to equity margins being on the up move. Without our doing the actual math, margin debt today purportedly exceeds the $1T level, last year alone having increased some 36%.

“Wow, mmb, that’s more than double what the S&P did last year…”

‘Tis so, Squire, the S&P 500’s net gain in 2025 being +16.4%. Is it any wonder that (again per the opening Scoreboard) today’s S&P market capitalization of $60.9T is 2.7x the liquid money supply? Sell your stock and get cash from your broker? Or just an I.O.U.?

But wait, there’s more: how are how those precious metals’ margin requirements working out for ya? Three years ago on Valentine’s Day in 2023, the price of Gold was 1864 and the COMEX margin required to trade one futures contract was $7,000. Today at 5064, Gold is +172% higher than ’twas then … but the margin today at $46,000 is an increase of +557%! And as for Silver (deep breath): she settled Valentine’s Day 2023 at 21.85 with required contract margin of $8,000. Now Silver at 77.27 is +254% higher … but her requisite margin per contract at $76,000 is a +850% increase! Nuthin’ like a li’l volatility to keep one on one’s liquidity toes, eh?

Still, we close with this happy news. For even as price compression may weigh, with trend regression in play, everyday with Gold is Valentine’s Day!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro

deMeadville. Copyright Ⓒ 2010 - 2026. All Rights Reserved.