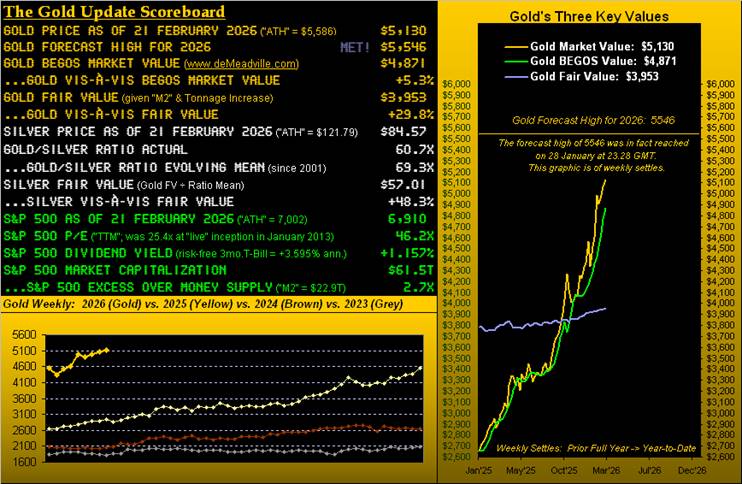

We begin with a tip of the cap to mighty JPMorgan Chase, which in recent weeks projected a Gold price (’tis said some several years out toward decade’s end), achieving the 8300 area, and even 6300 this year.

So we being we, we did the math in essentially measuring the regressed weekly change in the U.S. money supply (“M2” basis) across the past 45 years, duly thereto incorporating the increase in the supply of Gold tonnage itself.

And the answer is — by this proper world reserve currency calculation of Gold’s Fair Value — price would arrive at 8300 just in time for Christmas, indeed near decade’s end, in 2030, (just in case you’re scoring at home).

As to whether ’tis all that accurate, we were quite heartened — especially in this ongoing Investing Age of Stoopid — that iconic JPM demonstrated — at least by the appearance of its projection — the ability to perform math, a science rarely employed by the present day investment banking world. If only the honest price/earnings ratio calculation of the S&P 500 (today 46.2x) would as well be put forth by Wall Street (such as to get the S&P well-down to where it “ought be”, say 3500ish), we’d have the whole package.

“Well that’s the means reversion thing, right mmb?”

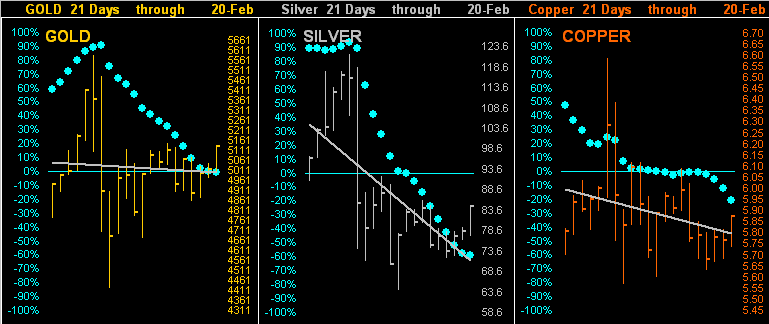

So ’tis, Squire. But we digress. Let’s instead turn to “The Now”. For per our title “Gold’s Key Near-Term Trend Rotates to Negative”, following a 61-day trading stint from last 18 November through 18 February wherein Gold maintained a positive slant to the key 21-day linear regression trend, it confirmed rotating to negative upon Thursday’s close (5016) and remains so despite yesterday (Friday) being up day to settle at 5130. True, that itself is an All-Time Weekly Closing High for the third consecutive week, albeit still shy of the 5586 intra-day record high from 29 January. And to be sure, such regression trend now is only barely negative; but “down” is “down”, as already has been the case for the other two elements of the Metals Triumvirate.

To wit, we go to the following animated three-panel chart. Each of the three panels (Gold, Silver, Copper) contains the last 21 daily bars, in animation by the day from a week ago-to-date. As the “Baby Blues” of trend consistency have been declining by the day for each metal, you can watch the grey diagonal trendlines negatively rotate — and specific to Gold in the left panel — such rotation is from positive to now negative, even as Friday was a firm up day; (doubtless this shan’t be found on CNBS, Bloomy, FoxyB, et alia):

“But mmb, a couple of up days could turn the trend back to positive, right?”

Absolutely so, Squire, with the caveat that they be robust up days given how much higher Gold was a month ago, (peaking in the 5500s). That opined, the tracks of both Silver and Copper of late are weaker than that of the yellow metal, and both those white and red metals have a historical hankering to at times directionally lead Gold. And as we’ve oft quipped over the years: “Follow the Blues instead of the news, else lose your shoes.”

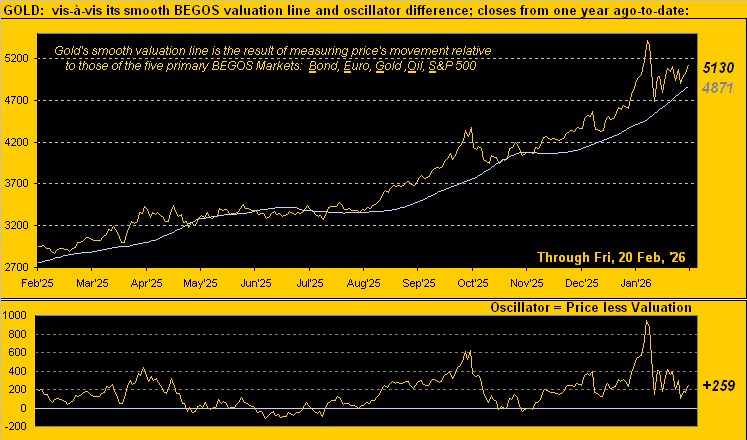

Too, per our Opening Scoreboard, Gold (5130) remains overvalued being +5.3% above its BEGOS Market valuation (4871) and +29.8% above Fair Value (3953). And whilst reversion to Fair Value (either down or up) can be a ponderous journey, that to BEGOS valuation generally occurs more swiftly, even as price has now been above such valuation for the last 60 trading days as we here see from a year ago-to-date:

“And a 60 days is a really long streak, eh mmb?”

Quite long, yes Squire, though not the longest: century-to-date, this 60-day stint (thus far) ties for ninth in duration, the most enduring streak being 88 days which culminated in mid-May just a year ago, after which Gold remained rather flat for a couple of months before resuming higher into August. Which is a nice segue for us to next bring up Gold’s weekly bars and parabolic trends, also from one year ago-to-date:

The above graphic’s rightmost parabolic blue dot represents the 11th week of the ongoing Long trend. The average Long-trend length of the 54 such stints so far this century is 13 weeks. ‘Tis not to say this Long trend is getting “long in the tooth”, but we do bear in mind that Gold has had an amazing run and, as earlier detailed, is overvalued.

Regardless, the trend is our friend “until it reaches the bend”, (thank you JP in SF). More bullishly — Gold’s overvaluation notwithstanding — our forecast high for this year of 5546 was already so quickly attained, we shan’t be surprised a wit if further highs unfold into 2026. But should Gold’s up track reverse course and our expected yearly trading range holds true, the potential low of 4136 comes into play (see our year’s opening missive). Indeed, the “Nothing Moves in a Straight Line Dept.” serves to keep our feet on the ground.

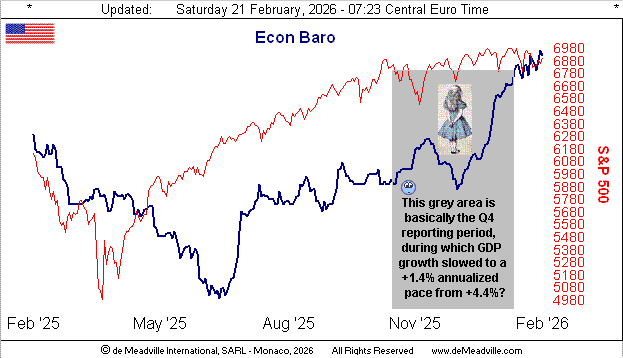

As for finding higher ground, we’ve the Economic Barometer. And the past week couldn’t be better put than as having been “Curiouser and curiouser!” –[Alice, Carroll, 1865]. Below in the Baro we’ve highlighted the reporting period for Q4 Gross Domestic Product (i.e. November through January), for which The Bureau of Economic Analysis yesterday pegged the annualized pace at a lowly +1.4%, even as the Baro recorded a fairly strong stint. Perhaps the 15 ever-missing government “shutdown” metrics are throwing the Bureau off track? Because quarterly GDP is refined two additional times (13 March and 09 April), we have to think such pace shall be upwardly revised given the Baro’s rise:

But wait there’s more: at long last that same Bureau’s “Fed-favoured” inflation gauge of Personal Consumption Expenditures was reported yesterday for December, even as The Bureau of Labor Statistics had already a week earlier reported its version of inflation for January. And the PCE paces (both headline and core) respectively doubled from +0.2% in November to +0.4% for December. “Rate cut?” Forget it. “Rate hike?” Unlikely, especially with Warsh waiting in the wings … for now anyway; (the new Federal Reserve Chairman — if Senatorially approved — technically begins his watch come 15 May). Either way, here’s our completed Inflation Summary for December with “Nuthin’ but red!” in exceeding the Fed’s 2% targeted pace. “Think ya may have to raise ’em, Kevin?”

Yet that stated, most curious of all was Friday’s reaction by the S&P 500: it went up! To borrow an age-old question: “What are they smoking out there?” We’re again reminded of a front-page piece in the Wall Street Journal from away back in 2000 about folks who actually believed the stock market never goes down, (after which commenced the DotComBomb). Fast-forward to today wherein, despite an above-average Earnings Season (that for Q4 concluding next week), the aforementioned S&P P/E is 46.2x, and the return a practically yield-less 1.157%. Have a nice day.

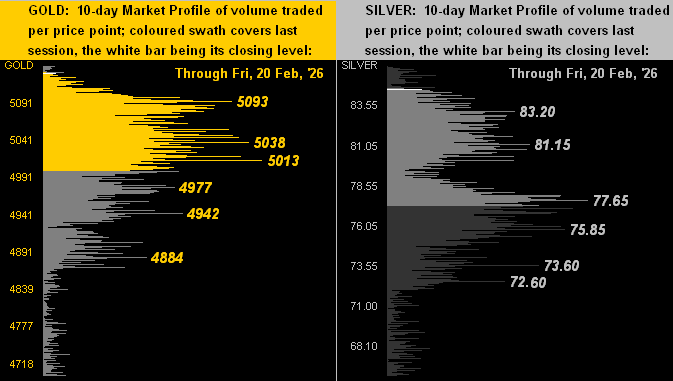

Having a nice positioning at present are the Precious Metals in their respective 10-day Market Profiles, Gold’s being below left and Silver’s below right. For the yellow metal (5130), there is notable volume-dominant support as labeled at 5093, 5038 and 5013. And for the white metal (84.57), her initial support is the 83.20-to-81.15 range, followed by 77.65:

“By the way mmb, I may get called away for avalanche duty next week above Chamonix…”

Well Squire, J. P. Morgan had to do without you for an entire career, as perhaps shall we for a week. Just mind your dynamite belt.

In fact, given we opened with the empire established by Morgan, let’s close with him by crediting ol’ Pierpont in reading the de facto source for leading market information:

He understood the value of Gold, as having read this, do you!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro

deMeadville. Copyright Ⓒ 2010 - 2026. All Rights Reserved.