- CPI Cheer

- Turning the Corner

- Recession Thoughts

- Curving Higher

- “Hardly a Boom”

- Core Problem

- Dallas, Denver, and Tulsa

Early this week, with the severe inverted yield curve and other signals flashing recession, I planned to use this letter to delve into the data. Then Thursday’s CPI data convinced markets to blow the all-clear whistle.

Lack of any “green shoots” would have been out of historical character and frankly quite alarming. We got at least some. This is how the transition back to a disinflationary trend starts. But we’re not there yet.

This CPI report was not an all-clear signal to the Fed. The headline rate year over year was still +7.7%. The core rate was still +6.3%. Those numbers are still way too high. Whatever the market thinks, the Fed is still on inflation watch.

There are indeed a lot of good things to like in that CPI data. Let’s review a good summary from my friend David Bahnsen:

“The CPI news on Thursday caused the largest single-day bond rally I have ever seen in my career, as the 10-year bond yield fell a stunning 33 basis points (down to 3.81%). What was that CPI news?

“The headline rate year over year was +7.7% whereas in September it was +8.2%.

“The core rate was +6.3%, down from 6.6% the month before. This, despite energy (+1.8%) and food (+0.6%) going higher. Paradoxically, food and energy going higher was deemed a positive because the overall rate came down despite them going higher, not because of them going lower. Also, that food increase on the month was the smallest increase of the year.

“The ‘owner's equivalent rent’ absurd contribution to inflation still caused it to move higher, not lower (by +0.6% on the month, though less than the +0.8% of last month). I say ‘absurd’ because rents are not going higher but this is taking into account leases signed a year ago (current lease levels), and is 30% of the CPI reading, so the lag effect as leases roll off month by month is severe.

“Health insurance prices were down on the month but still up 21% on the year.

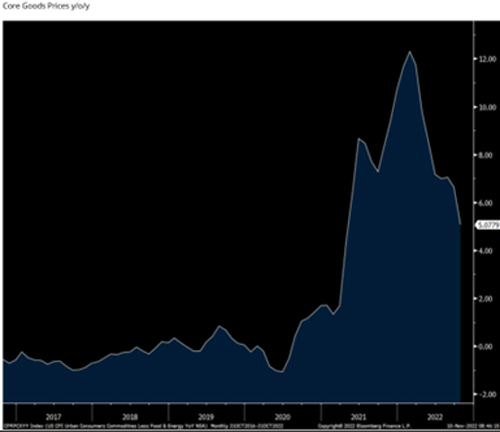

“But core prices on GOODS dropped 0.4% on the month and the yearly price dropped to 5.1% from 6% last month. Goods inflation has come down each month since I initially called a peak in goods inflation five months ago.”

Source: David Bahnsen

David Rosenberg had a different way to see inflation, one which struck a chord with me. Under the headline “Deflation Thumbprints All Over the CPI Data,” he wrote:

“If not for big increases in shelter (+0.8%), energy (+1.8%), and food (+0.6%), the CPI would have declined outright by 0.1%, the first dip back to deflation on this measure since May 2020.”

That’s monthly, not year over year, but certainly a good sign. We need many more such signs, though.

Monetary policy has a lag. Just because we get an inflation report that indicates we have turned the corner does not mean the journey is close to an end. I have said that I believe Powell has that “old-time inflation religion.” But there are several paths to his goal.

- One is the band aid approach of 75 basis points every meeting, which seems like what he is doing. But the market has lowered the terminal (where we end up) fed funds rate by 25 basis points. Then again, what do they know? They are guessing just like everyone else.

- They raise 50 basis points (bps) in December, the data continues to show moving in the right direction, and then they get to a series of 25 “bips” rate hikes until they get to where they think positive rates are at a minim in sight, if not already there.

- He can blink. Remember, Volcker backed off in 1980 (recession) and inflation came back hard. Volcker later said among other things you have to change expectations. He did that in 1982. Powell is aware of Volcker’s biography. I don’t think he will want to stop too early and he has said that would be dangerous but it is a possible path.

The end point is likely the same (give or take 25 bips).

But the market Thursday got positively giddy. The positive move in bonds was eye-opening. Not sure I have seen that size of move before. The 10-year fell 0.33% in one session! The Dow up over 1,000 points. No recession in our future! This is going to be better than a soft landing!

A point I have made over the years. The market knows very little when it comes to predicting recessions. We get an inverted yield curve sufficient to signal a recession and the market shrugs it off and goes higher (2001 and 2007, etc.). Not unlike today. Let’s see what my good friend Sam Rines has to say:

“There are a couple takeaways from the rip in risk assets. First, a soft landing was not priced in. Second, the market is beginning to test the ‘higher for longer’ mantra the FOMC has been pounding at for months.”

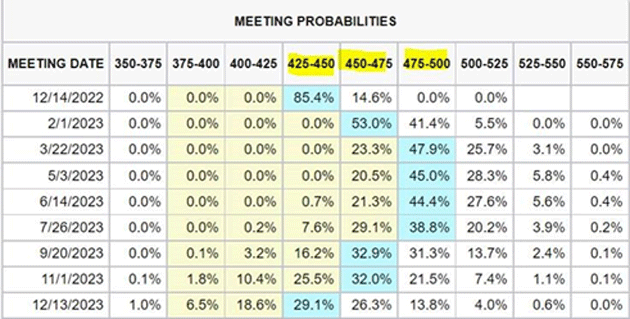

[Note from John on this chart: This is the statistical probability of rates reaching a specific point in a specific month. Go to the 3/22/2023 line. The market thinks there is a 23.3% chance for rates to be at 4.5‒4.75%. 0% chance it will be only 4.5%. An almost 50% (47.9) probability of rates being 4.75%‒5%. This also assume rate hikes of 50, 25 and 25 bips. The majority of the market is also seeing cuts in the third quarter of 2023, although a sizeable majority see more rate hikes in May/June.]

Source: Samuel Rines

More from Sam:

“Previous PolyMacro (Sam’s very private letter which he graciously lets me quote from time to time) notes have stated that the risk is not ‘75 or 50’at the next meeting. The risk is more 25s than priced, and the FOMC not being in a mood to cut late next year. The reaction to today’s print was ‘case in point’ with a 25 bps point hike taken out and cut(s) being priced in late 2023.

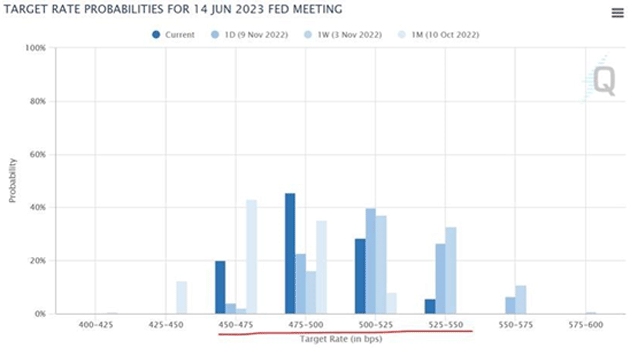

“For the moment, the June FOMC probabilities are the ones to monitor. Why? That is where the terminal / pause is being priced. If the next jobs report is a bust, does another 25 bps come out? If it is a blowout, does the market reprice the terminal?”

Thinking out loud with no real answer: First, recessions are by definition deflationary events. What if we get a real recession in early 2023? Will that reduce inflation faster? (Short answer: yes!) Does the Fed pause or even cut if inflation really falls? That seems not an unrealistic possibility. Something to watch.

As readers know, I expect a 5% fed funds rate and 5% unemployment, but perhaps not with a serious recession in the first quarter because inflation will take a tumble and the Fed has to start looking at future housing prices which will roll over in a recession but not show up for 6‒9 months at a minimum.

Confused? That’s understandable. I am happy to get the direction right when talking about the future, let alone the specifics. That being said, I still think we are headed for a recession. Let’s examine that thought.

|

How Are the Top Financial Minds Navigating Today’s Economic Crisis? Click here now to find out how 10,000+ readers are following their guidance. |

The word “recession” implies generalized economic pain. Business activity slows, people lose jobs and income, asset values fall—something for everyone. Not all feel the same degree of pain, but everybody feels something. Or at least sees it around them.

I’m not sure that’s the case anymore. Over the last 25‒30 years, technology has made life an increasingly individualized experience. We all live in slightly different worlds based not only on our physical locations, but also the ways we communicate and the information we choose to consider.

The simple question, “Is the economy in recession?” doesn’t compute when there is no “the” economy. Your economy is yours, mine is mine, and we can have radically different impressions of its health.

Yet even as we perceive different realities, an actual reality still exists. Back in July I predicted A Weird Recession with falling GDP but perhaps not the usual mass unemployment. That’s still my expectation, though maybe we need a new word to describe it.

While this probably won’t be good no matter what you call it, letting inflation get further out of control would be even worse. Avoiding that fate will have a price.

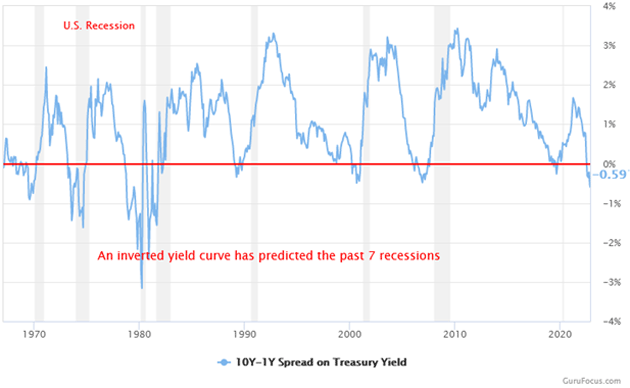

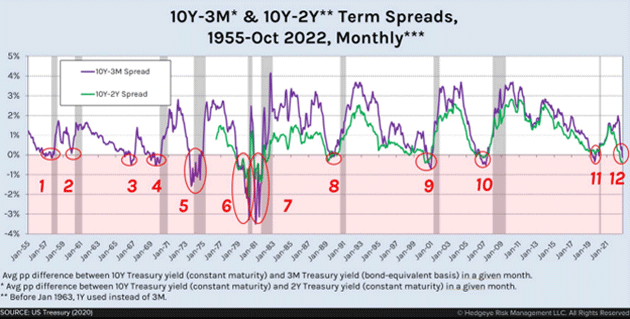

We have a pretty reliable recession indicator: the inverted yield curve. It’s often early but rarely misses. Right now, the yield curve says recession is coming and I see no reason to think it wrong.

[Quick review: The yield curve is simply a graph of interest rates by maturity. Normally, rates go higher as the borrowing period gets longer. A 5-year auto loan will have a higher rate than a 2-year loan because the longer term means more risk for the lender. Same with government bonds, though in that case you’re not worried about credit risk. Inflation is the bigger factor.

It is highly unusual for short-term rates to be higher than long-term rates. When it happens, we say the yield curve is inverted and it usually points to recession. I wrote a longer explanation earlier this year (see Curve Ball ) which you should read if this is unfamiliar to you.]

Now, there are different ways to define inversion. Most involve comparing a shorter-term Treasury yield with a longer one. Inversion occurs when the short-term rate goes higher. You can graph these comparisons as a “spread.” Here’s a chart of the 10-year yield minus the 1-year yield. When the spread goes below zero (the red line), it’s an inversion. You can see from the recession bars these occurred ahead of the last seven US recessions.

Source: GuruFocus

The pattern isn’t unique to this pair of rates. Here’s a chart (courtesy of Neil Howe) illustrating the 10-year/3-month and 10-year/2-year spreads. It goes back to 1955 and shows the same results. Inversions indicate recession is coming.

Source: Neil Howe

Curiously, the yield curve even predicted the 2020 recession long before any of us heard about COVID. How it did that, I don’t know. Maybe recession was coming anyway for other reasons the pandemic pushed aside. Obviously, it’s an indicator we shouldn’t lightly dismiss.

The current inversion was already forming when the Fed began raising rates last spring. It has only grown clearer since then. This long delay doesn’t mean it’s wrong. Look at those charts and you’ll see inversions can precede recession by months, sometimes over a year.

I know all the reasons to think the economy looks better. I don’t want recession. But I’m also not going to argue with the yield curve, and it is very confident recession is coming.

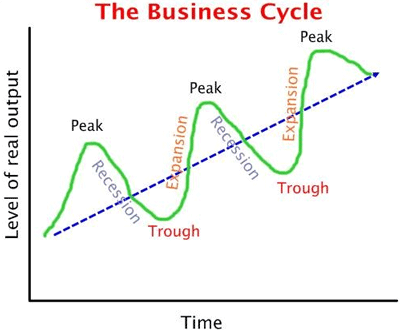

In business cycle theory, “recession” is the opposite of “expansion.” The economy alternates between expansion and contraction phases, netting out to gradual growth over time. The process looks something like this, though not quite so steady in real life.

Source: Economics in Plain English

This cycle isn’t a law of nature. Our collective economic choices affect it in ways we don’t always understand. My friend Peter Boockvar went further a few years ago, saying we no longer have business cycles but credit cycles instead. By that, he meant central bank policies have overwhelmed the other factors that once caused expansion or contraction.

But exactly what is expanding or contracting? That’s a whole different question. We use GDP, Gross Domestic Product, as a proxy for economic growth. It has many flaws but is the best single indicator we have.

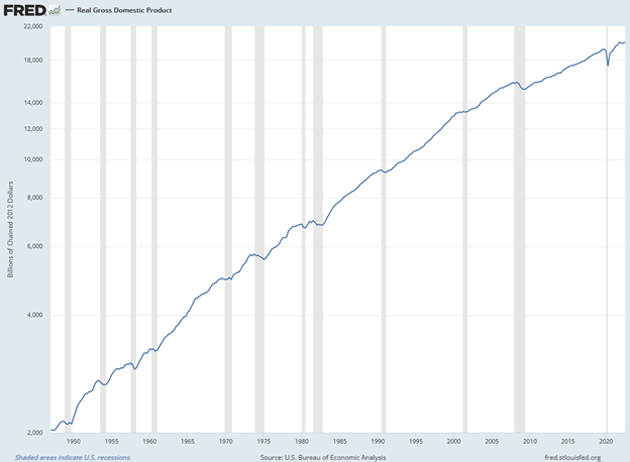

I’m going to review some GDP history in a way you may not have seen. Analysts usually talk about GDP as a percentage change. Raw GDP is actually expressed in dollars, though, and looking at it that way can be more enlightening.

Here’s a chart showing real GDP since 1947—not real GDP growth but the actual output, adjusted to 2012 dollars. This is a log scale to keep the percentage change constant.

Source: FRED

You can see from the generally constant angle how long-term growth has been quite steady, though the angle flattened noticeably after 2008.

You can also see how the recession bars correspond with periods when GDP declined. That’s not coincidence. Declining GDP is recession, or at least a necessary element of it. Recessions don’t occur when economic output is rising.

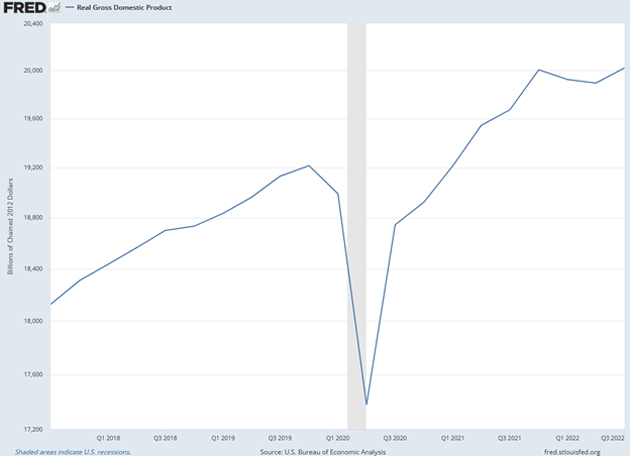

Now let’s zoom in on the last five years.

Source: FRED

This shows how COVID produced a sharp downturn in the first half of 2020, then a recovery by mid-2021, followed by a drop in this year’s first half and a third-quarter bounce. (Note the Q3 number is still an initial estimate at this point and could change.)

Here are the real GDP raw numbers for the last five quarters:

- Q3 2021: $19.673T

- Q4 2021: $20.006T

- Q1 2022: $19.924T

- Q2 2022: $19.895T

- Q3 2022: $20.022T (est.)

On October 27 when the Commerce Department released the Q3 advance estimate, the headlines said GDP was growing at a 2.6% annualized rate. But using the numbers above, growth in the last year was 1.8% (from $19.673T to $20.022T est.). What happened?

The answer is that headline GDP is reported as the current quarter’s growth, annualized (and seasonally adjusted, but we’ll ignore that for now). The change from the preceding quarter was 0.64%. Compound that to four quarters and you get 2.6%. But that is not what actually happened.

On the surface, you might look at the 2.6% and think 2022 could still be pretty good. It won’t be.

This year’s first three quarters saw real GDP grow from $20.006T to $20.022T, a difference of 0.08%. If the Q3 estimate holds up and Q4 is about the same, we are looking at something like a 0.7% year. Maybe 1% if we’re lucky. That’s not recession territory, but it’s hardly a boom.

Remember, though, we’re looking at real GDP here. The inflation adjustment matters; lower inflation means higher real GDP. Indeed, inflation had a lot to do with this year’s two quarterly declines. It seems to be moderating somewhat as the Fed tightens.

That might help real GDP growth. But the reason inflation is moderating could push it right back down.

In his news conference following the September FOMC meeting, Jerome Powell gave a surprisingly clear picture of where he thinks interest rates should go: “You want to be at a place where real rates are positive across the entire yield curve.”

“Positive real rates” means the interest rate for a given maturity is higher than the inflation rate. He wants to see this “across the entire yield curve” before the Fed stops tightening.

So, Powell wants to see every interest rate from overnight out to 30 years higher than the inflation rate. Which inflation? For Powell, that means the Core PCE index, which is part of the GDP dataset. The last report put year-over-year core PCE at 5.1%.

The “core” part means it excludes food and energy. Falling food and energy prices have no immediate effect on core PCE. Its main drivers are housing prices and rent, which are weakening in real time but not in the way it is calculated using the absurd Owner’s Equivalent Rent and lagged rent as input sources.

If we take Powell at his word (and I do), he’s told us quite plainly the federal funds rate is headed for 5%, unless inflation should mysteriously and unexpectedly go way down. It could need to go even higher if the rest of the yield curve doesn’t respond as desired.

If Powell stays the course, he will get us to the point where inflation is not the main driver and employment once again is. For the record, I think the employment mandate is misplaced. That should be a fiscal policy role, not monetary policy. But for now the Fed has to consider it.

All that points to recession in our future, at least to this humble analyst. Again, it could be a weird recession, milder than past ones because the labor market is so tight. I’m hopeful we won’t see the kind of mass layoffs that happened in 2008 and 2020. But we will see some and they’ll have an effect.

Meanwhile, those higher US rates will keep strengthening the dollar (despite the last few days) which is having a negative and sometimes dire effect overseas. This could change if other central banks start to raise rates to catch up. I don’t believe they actually think that way. That raises the odds we will see some kind of debt crisis or financial institution failure. The UK fiasco and this week’s bankruptcy of crypto exchange FTX could be just the beginning.

Adding all this up, I’m not optimistic 2023 will be a good year, at least the first half. I’d like to be wrong. I don’t think I am.

I leave for Dallas very early Wednesday (I do not like early flights) for a meeting with my new oil and gas partners (Jay Young and King Operating) and then a meeting later that evening at the Petroleum Club where I talk all things macro and energy and meet old and new friends. Then the next morning to Denver where I speak at the CFA dinner with Vitaliy Katsenelson on Thursday. Friday, I write the letter and if anyone cares to meet will be in the bar at 5:30 at the Hyatt Regency. If you can, drop a note to business@2000wave.com just to give me an idea of who’s coming. Then I fly back to Dallas the next day and meet Shane.

We will go to the Dallas Mavericks game on Sunday and will sit under the basket on the Mavs side of the court so drop by and say hi if you are there. (Thanks to Howard Getson of AI firm Capitalogix for the tickets.) Then meeting with friends, etc., plus my Mexican food fix at Gloria and Javier’s before flying to Tulsa for Thanksgiving with my kids.

Going to be a lot of fun. Have a great week and spend time with friends and family. And follow me on Twitter.

Your going to have fun in the energy patch this next year analyst,

|

|

John Mauldin |

P.S. Want even more great analysis from my worldwide network? With Over My Shoulder you'll see some of the exclusive economic research that goes into my letters. Click here to learn more.