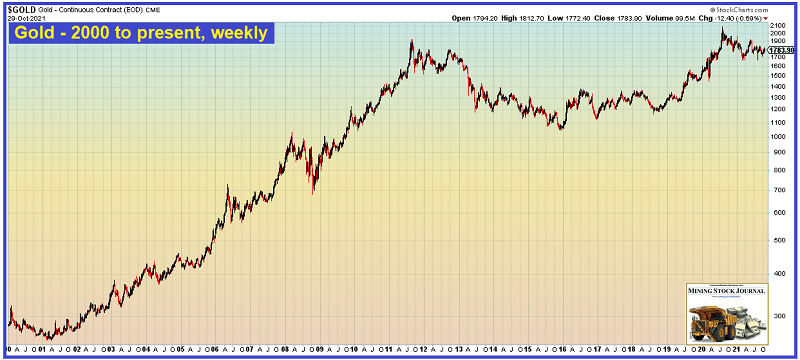

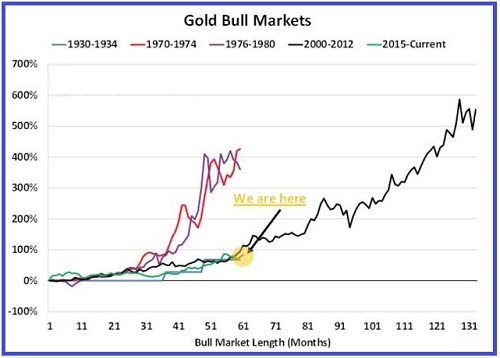

The fundamentals supporting a monster move in gold and silver have never been stronger. This includes extraordinarily negative real interest rates, Government debt outstanding that seems to be increasing at an increasing rate, the continued devaluation of fiat currencies from Central Bank money printing and escalating geopolitical risks. These are just the primary fundamental factors.

Gold and silver are at their cheapest levels relative to other commodities since 2009. Institutional investment allocation to the precious metals sector is at a historical low at well less than 1%. In 1979 institutions had 5% in the sector. Imagine the effect on prices if big funds were to allocate just 2% to the precious metals sector. (Note: the chart below was sent to me by a subscriber – I do not know the source but it’s an awesome chart – if anyone knows where it came from, please leave a comment so I can give proper attribution):

Away from the obvious macro economic fundamentals that should lead to a big move in the precious metals sector, India is in the midst of its peak buying season. Daily ex-duty import premium price data point to the heavy importation of gold right now. This is after import data for September show that India imported 71 tonnes directly from Swiss refiners. This was 60% of Swiss exports for the month. China was a distant 2nd on the list at 18.1 tonnes.

Speaking of China, Hong Kong reported that its exports to China jumped 61% in September from August to 34.7 tonnes. Keep in mind that the export data is reported by Hong Kong. China does not report any gold it imports through Beijing. This is intentional. Based on Shanghai Gold Exchange activity during September and October, China is importing considerably more gold than what is “visible” based on Swiss and Hong Kong export data.

A subscriber inquired about a recommended allocation to junior exploration stocks and the best way to build a position in illiquid stocks. Almost all of the companies I recommend and invest in are pretty liquid. I occasionally will use limit orders. But most of the “five letter” OTC stocks I cover also are listed on the TSX Venture or TSX, which makes them more liquid. I almost never have had problems getting “screwed” when I use market orders.

The other thing to keep in mind is that, with many of these plays, they are going to be 5-10 baggers – or more – or perhaps not work out at all. The point here is that we’re not going to be five cents “smart” on these stocks. Don’t worry about paying a few cents above the stated offer price. It won’t make a difference over the course of time.

Your percentage allocation is a function of the degree to which you are willing to take risks. By “risks” I mean risk losing 50-75% of your investment for the upside potential of 500-1000%. The best way to do it is pick out 5-10 of my ideas that you like and build positions in them that represent maybe 15-20% of your overall exposure to mining stocks. That would be what I consider to be a conservative allocation. An aggressive allocation would 50% of your mining stock exposure.

Finally, don’t put on full allocation positions in the stocks you choose all at once. I recommend always leaving cash on hand to take advantage of pullbacks/corrections in the sector. Even though the juniors I play tend to be relatively liquid, they will still move up and down in much larger percentages than the mid-cap/large-cap producers.

********************************************

The commentary above is from my latest issue of the Mining Stock Journal. Many of the junior exploration/development companies I cover, recommend and invest in have the potential to 5-10 baggers from their current down-trodden level. You can learn more about my newsletter here: Mining Stock Journal information. I do not take compensation of any type from mining companies and I have been doing my own research in the sector for over 20 years.