The following is an excerpt from the latest issue of my Short Seller’s Journal:

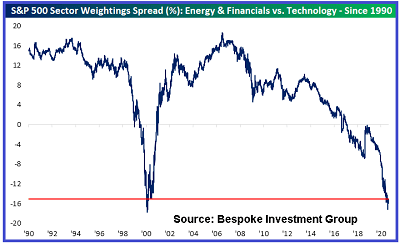

I thought this chart showed yet another interesting signal that the stock bubble could be ready to pop:

It shows the spread (the difference) in the percentage sector weightings in the SPX between Technology and Energy & Financials. Prior to 2000 and between 2002 and 2016, the Energy/ Financial sector had a higher percentage weighting in the SPX than Technology. Currently the differential in the percentage weightings between Tech and Energy/Financials is negative. The last time this differential was negative occurred at the peak of the dot.com/tech bubble.

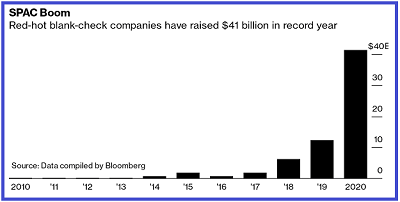

My interpretation is that the technology sector is a bellwether indicator of when market speculation becomes extreme and when retail piles into the action with blind ambition. Another indicator is the proliferation of SPACs (Special Purpose Acquisition Companies). Politely called “blank check companies,” these are blind pools of capital raised in the public market. SPACs do not have any existing businesses. Their purpose is to make some type of business acquisition within two years. This is what the top of a stock bubble looks like – just throw your money to a blind pool promoter and trust that they know how to invest it:

The SPAC sponsor may have an acquisition in mind at the time the money is raised, but the public stock investors have no idea what company or companies they are investing in at the time of the IPO. How’s that sound? Why not pay a nose-bleed valuation for a business at the top of a business cycle?

In truth, SPACs are fee-generating cash cows for the sponsors. In addition, sponsors often end up with 20% of the shares, gratis, after the SPAC has merged/acquired a business. Half of the IPOs YTD have been SPACs. Of the 18 that have gone public, 11 are trading below their IPO price. It’s one of the ultimate indicators of reckless speculative behavior, especially from retail investors, and the degree to which a stock bubble likely is reaching its limits.

A possible top indicator for the housing market? United Wholesale Mortgage (“UWM”) is going public via a merger with a SPAC. The deal values UWM at $16 billion and it will be the largest SPAC deal to date. UWM is the largest wholesale mortgage lender in the country. A wholesale mortgage lender funds mortgages offered through mortgage brokers, credit unions and banks.

The SPAC, Gores Holdings IV (GHIV), is paying UWM $925 million ($425 million in cash plus $500 million to raised via debt) for a 6% interest in UWM. UWM will own approximately 94% of the new United Wholesale Mortgage, which will trade under “UWMC.” Gore Holdings went public on August 10th, raising $525 million.

This type of deal is essentially a “reverse” IPO in which a private company goes public by merging with a public shell. The full terms of the deal are not available yet, but in all likelihood Alec Gores (the SPAC sponsor) and the senior executives of UWM will be awarded a large chunk of shares that will dilute the public shareholders. GHIV shares jumped to $12 on Wednesday after the deal was announced but closed Friday at $10.44.

Great time to invest in a mortgage finance company? The delinquency rate on FHA mortgages is now at a record 17.4%. FNM/FRE/VHA mortgages will soon follow. FHA started underwriting sub-prime-like mortgages in late 2008. FNM/FRE/VHA began doing the same about 5 years ago. In fact, the delinquency rate on VHA mortgages, which require zero down payment, is starting to accelerate.

This is a deal that I will be ready to pounce on with a short position after it goes public. I believe this is a bellwether indicator that the housing market is topping. Speaking of which, I’ll review the housing market data released this past week in the next issue. But, per usual, the headline reports for new and existing home sales sensationalized the actual home sale numbers.

As with general economic activity, there was a burst of activity in the housing market after the lock-down period. This was further fueled by the $1 trillion-plus in stimulus the Fed injected into the mortgage market. That, combined with the Fed’s zero-interest rate policy, pushed mortgage rates to the lowest in history. I expect the burst of housing market activity to taper off quickly, similar to what we’re seeing in the reports for general economic activity for August and early September.

Click on the graphic below for more information about this weekly newsletter: