The cloak makes the dagger so much more dangerous. For investors who don’t want to believe in a recession, the cloak causes them to stroll through markets with less wariness than they should have. They are glib while about to be gutted. For the Fed and feds, the cloak assures they are blind to the recession they are creating. They don’t see what’s coming.

“One cannot have a recession when the job market is so strong,” they say. “We are experiencing record low unemployment,” they say. And that is the cloak.

The seers can’t see … but you can

Economists don’t understand the cloak because they’ve never seen it before. It’s an invisibility cloak so they don’t even know the cloak is there, much less the dagger beneath it. Therefore, let me provide you with some special glasses that will enable you to see that which is lurking beneath the invisibility cloak. It’s simple really:

Imagine that no one in the United States wanted to work — that one morning we all got up and phoned work and said we quit and then went back to sleep. Would the unemployment rate go up?

[Pause for effect.]

No.

What if we remained with that choice for months? Would it go up then?

Not a bit.

Just the opposite, in fact, the unemployment rate would plunge to absolute zero!

Why?

Because the unemployment rate only counts the people who want a job and who cannot find one. In our scenario, I stipulated we imagine that no one wanted a job — no one wanted to work for whatever reason out of an abundance of reasons. In that case, no one is eligible for unemployment benefits because they are not applying for any of the jobs that are out there. They are, therefore, not on the unemployment roll that gets counted. There can be all kinds of jobs out there, but those jobs are finding no interested applicants.

Does zero unemployment mean the economy in this scenario is strong? No. It’s dead!

Imagine the same situation but scaled back, and you have the present situation. We acknowledge exists because we’ve named it: “The Great Resignation.” Yet, people are not thinking through how great the resignation really is and what it means — how it is an aberration that means their ability to see a recession by the normal markers, such as particularly unemployment, no longer works … at all!

It is really not hard to figure out that, with a significantly smaller labor force interested in any of the jobs that are out there, the number of people who will be counted as unemployed will be significantly smaller. They’re not working, but they are not “unemployed.” That is the cloak that makes this recession the most insidious decline the nation has ever experienced. Economists — even at the Fed — have a hard time thinking past the theories they were schooled in. They don’t think outside the box even in times that are so far outside the box we have given them a special name. They assume that everything else will keep functioning as normal in their formulae even though one factor is badly broken.

How the magic cloak of invisibility hides the dagger of recession

You see, real unemployment is not low. It has, in fact, rarely ever been this high. We have rarely (maybe never) had such a large percentage of the population that is not employed but also not interested in becoming employed. REAL unemployment, in the simple sense of people without a job, has never been so high; but statistical unemployment has never been so low because millions of people woke up one day and called in (so to speak) and told their employer they’re not coming to work anymore. Many of them never even entered the statistical count, or they fell off shortly after augmented unemployment benefits ended, but chose not to return to work.

What is important to realize here, which no one appears to be talking about is that people who don’t work, don’t produce, and “recession” designates a time when the production of an economy goes into a protracted slump. Thus, we’ve seen two full quarters of slumping production because so many people don’t want to work. It is, in fact, largely because “unemployment” is so miniscule that we are in a recession, and that is how the official statistics blind the seers from seeing it. It is hidden behind the very thing they think proves the lack of a recession.

That makes this a uniquely clandestine recession. Likely, no one has ever thought about unemployment this way because we’ve never had a situation like this before; but, if you do think about it, it makes perfect sense: Millions of vanished workers equal a huge recess in production (especially at a time when productivity of those who are employed is considered low as well), but that which vanishes off the face of the earth cannot be counted as “unemployed.” They have vanished in the sense that they are not workers any more, they are not in the labor pool.

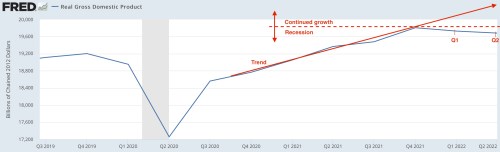

Thus, production, shows itself to be in a clearly protracted decline (blue line) from the trend (red):

Two quarters and still falling.

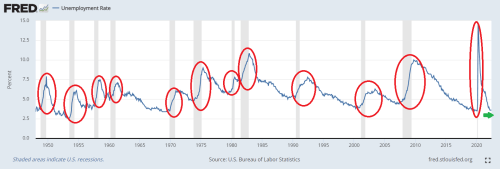

While official unemployment looks like it is barely putting in a bottom (green arrow):

Notice that unemployment NEVER gives advance warning of a recession. It is a lagging indicator. It only rises because we’re in a recession. It starts to rise as soon as production starts to fall (i.e., as soon as recession begins.) As you can see, it barely ticks up, if at all, before the start of the recession, then it soars throughout the recession, and doesn’t stop rising until slightly after the recession is officially over. So, it is a poor indicator for the Fed to be using in the best of times — like driving forward by looking at the rear view mirror to see if you’re still on the road.

Right now, the unemployment appears to have bottomed. Notice the little flat-line segment at the end of the long unemployment decline. The second that flat line takes a bump up from that level, which is so low the only time that compares is in 1954, the recession begins.

However, imagine (and you don’t have to really imagine it because it’s a fact) you took a massive bite out of the labor force that helped that unemployment level get down to these record lows. Wouldn’t that mean the REAL unemployment level (by which I mean the number of real people who had recently been productively employed but suddenly no longer are) is really even lower than shown anywhere on the graph because all of those millions are, for the first time during any such massive plunge, not being counted? Because they voluntarily quit.

Might that not seriously skew what happens down there in the reported netherlands? With so many fewer willing workers, it means anyone who is terminated who does want to work can rapidly find a job before they even go on unemployment. So, they never get counted either. Where I live, almost every business, as you walk down the street, says they are experiencing a labor shortage — that they cannot get all the help they need. Many have cut back on services or hours because of this. That means lower production — lower GDP for all the months of the Great Resignation. Lower production is recession by definition, but you won’t see it in the unemployment count.

Thus, today’s low unemployment number is the perfect cloak of invisibility for the current recession to stay out of sight of our officials — especially for those individuals who might like to make use of the cloak to hide a recession from others … like an upset electorate.

New jobs are a second cloak of invisibility

Now imagine people are continuing to resign (because they probably are). That means a lot of new job openings; so, newly listed jobs will look strong because the Great Resignation is continuing. In normal time, a flood of new jobs means the economy is strong; so, this number, too, is perfect for making a recession in plain sight.

The term “job openings,” however does not just refer to newly open jobs, but to all open jobs with a few specific exceptions given by the BLS (Bureau of Lying Statistics). It includes jobs that have been hanging out in the wind for months because people quit last year and the job has never been filled (resulting, of course, in lowered domestic production). When job openings are high because many news jobs are being posted because companies are expanding, it means the economy is hot. But if job openings are high because people keep quitting and exiting the labor force for good and no one takes the opened job because the available labor pool is so much smaller, then it means the economy is suffering. It’s in a state of paralysis where it cannot move to do the work that needs to be done because it cannot get worker ants to do the work! This is actually pretty simple to understand, and that is where we are.

Even if people are not continuing to resign and exit the labor force, the quits rate for those who do still want to work will be unusually high in a situation like the present because wages are rising to try to attract scarce workers into those jobs that are still hanging open, while options for those remaining workers are are plentiful, so they can find jobs they might enjoy better, giving many more people reason to quit one job and move to another. That means you’ll see an unusually high amount of churn in the job market, but it is for reasons that really mean the economy is broken … as in unable to perform … unable to produce like it needs to. In a word, “recession.”

That means even the payroll numbers and quits rate certainly won’t be functioning normally. High quits won’t be reflecting a strong economy, as they are usually interpreted to mean, because an economy where few people want to work is, in fact, a very sluggish economy. Open jobs are abundant, raising the quits rate as people start job hopping. It all creates an illusion of a strong economy, and the Fed and others are beguiled by their own illusion because they helped create this mess and now don’t understand the mess they have made.

To reiterate just because the experts seem unable to understand this, and one of them might accidentally read this article because they found it trampled on the street somewhere and were hard up for reading material: people have quit jobs in order to exit the labor force, ostensibly for good, causing a high quits rate. Then another whole slew of people quit the job they had in order to take one of those better jobs someone just exited, piling not to the “quits rate.” So, the rate goes up rapidly but not because a robust economy is causing such high demand for products that companies are being pressed to hire a lot of ADDITIONAL people, but only because of the churn.

In fact, step back to our original scenario, and an economy where NO ONE wants to work, is a completely dead economy. It would have a GDP of zero. And an unemployment rate of zero. And an extremely high quits rate going into that crash to absolute zero as people quit for good. It’s just dead. It might be more helpful to think of us as somewhere just shy of that than to think of this as a strong economy. We are somewhere in between absolute zero and still living right now. Let’s call it the walking dead — a zombie economy; but you have to think your way through what the numbers really add up to during such extremely abnormal times.

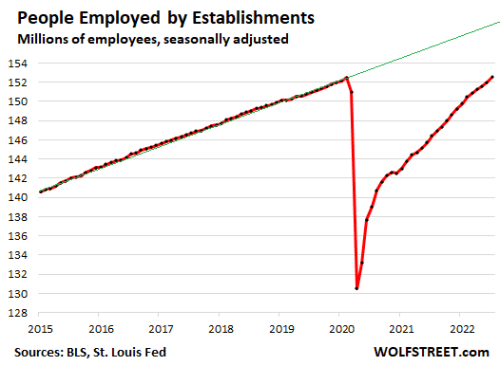

See the gap in the following graph between the green line and the red?

The green line was the trend for the number of people employed in the world force, rising consistently, mostly due to population growth as immigrants and maturing natural citizens enter the US labor force. The red line shows the total now employed. The gap between them is the shortfall in the labor force from what normal times would be, which more than explains why so many jobs are hanging open. The number of working-age people in the country has likely still risen along the green line, but the number employed is way down from that trend because people don’t want to be employed for various reasons, certainly not because they cannot find a job, given that jobs remaining open are abundant.

You can see the number of people employed has only caught up to its last high point two years ago, but population has grown since then. With more people, we barely employ as many as we did before the Coronacrisis with all of its lockdowns began. Moreover, each person is counted as an employed person for each part-time job he or she holds. A person holding two jobs counts as two employed people on payroll. Since we’ve read in the news lately that there are a lot more people holding 2-3 jobs, the shortfall is actually worse than it looks.

Economists will be the last to figure this out

The Fed’s economists will have good company in failing to see what is happening. The Biden administration and current Democratic congress also all have a vested interest in not figuring it out or, in the very least, in making sure you don’t! Frankly, I think they are as beguiled by this clever double cloaking as their economists are. Nothing is so well hidden as that which hides in plain site but veiled by an illusion that normally means the very opposite of the thing you are looking for … but especially if you’re not looking for it because you really don’t want to see it!

Economists — never good as a group at seeing recessions coming even when things are working as normal and never good at thinking outside the box — understand none of this. They have not yet recalibrated their normal measures. So, they look at the totally weird unemployment situation we are in and see numbers that look strong but are, in fact, badly broken and extremely unproductive (therefore recessionary).

Now, imagine how dangerous such an insidious recession is. Economists don’t believe it is happening. A stock market that has never been more deliriously exuberant, even before the Great Resignation, doesn’t want to believe it is happening and is told by economists it is not happening. So, investors hear what they want to hear — at least, enough do to bid the market up, making it appear all the more that fear of recession is the one thing that is receding.

Consumers FEEL recession is happening around them because they can see the shortages and know their economic situation is worse, but all the experts tell them it isn’t happening. As a result, nearly everyone is lost in a fog, partly because of what they don’t want to see, and largely because it looks the opposite of what they would normally expect. Not wanting to see it, they are also not likely to do the calculous to figure it out.

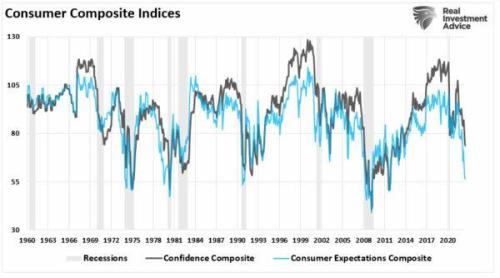

Yet, consumers have rarely been wrong in feeling a recession as soon as it begins, so they should trust their gut: (Keep in mind that all the gray recession areas below were figured out by the experts more than six months after the recession began, while consumer sentiment is reported as it happens. In other words, the consumers did not have the benefit of knowing they were in one of those recessionary gray areas until it was shaded in months after sentiment had already passed through those times.)

Real Investment Advice, Zero Hedge

Real Investment Advice, Zero Hedge

The government, which certainly doesn’t want to acknowledge a recession during an election year, leans on the numbers that are still working for it on the surface and tells everyone those numbers mean no recession is happening. The public becomes more confused because the experts are now arguing about what a recession even is when everyone once thought they knew. (Sort of like people once thought they knew what a woman is but now even those who are one say they have no idea because they are not biologists; and, if a woman who is eligible to be a Supreme Court justice cannot tell you what a woman is, who can?)

So, the zombies are all stumbling around blind, running into each other because no one understands what is happening to them.

But that is still not the really dangerous part.

When the instruments break, it’s time for dead reckoning

The really dangerous part is that, when no one sees a recession that has already formed and believes numeric indicators that are telling them the economy is strong, then no one is going to take the corrective action needed to end a recession. The recession will go deeper. It means Pilot Powell is trying to bring his jumbo jet to a soft landing, and his altimeter is telling him he still has a thousand feet to go to get down to ground level at the airport; but really, he has just three feet to go and hasn’t even put down the landing gear yet.

Now, it is very hard to convince people — especially professional economists — that the world they are seeing is not the world as it is or as they ever knew it to be. If you cannot trust the normal instrumentation on the panel because it has shorted, you have to rely on old-fashion dead reckoning to tell where you are and what is about to happen. So, look up from the panel of gauges you love to use — the Fed always likes to talk about its instrument panel — and see the world around you.

In the real world, we see something in the labor market that screams the economy is not strong at all. We see that companies that specialize in guiding other companies through layoffs are telling us business is booming like never before. That’s not a good sign. These are companies that thrive DURING recessions — during that period where the unemployment rate is skyrocketing, not just just putting in a bottom.

Here is what they say, particularly in the Tech. world (just like during the recession of the dot-com bust):

Business Is Booming for Layoff Specialists: ‘Never Seen Anything Like This’

Overwhelmed tech firms are flooding experts with requests for help. “HR departments are scrambling….”

Coming into the year, business was slow for the country’s layoff experts, as it had been for much of the past decade. Outside of a short period of tumult in 2020 at the beginning of the coronavirus pandemic, the U.S. economy had continued to roar along. Jobs were plentiful, layoffs were at a 52-year low, and the “Great Resignation” had led to worker shortages.

“Coming into the year,” of course, was right when this recession hit, that period at the start of recession where you see unemployment merely puts in a bottom. Such times as those, when we entered this year …

made life harder for companies like Davenport’s, which specialize in helping employers navigate the emotional and messy involuntary “exit” process…. Such services are in high demand during periods of tumult, but less relevant when businesses are humming along and hiring.

“Our worst times as an industry are when the economy is screaming ahead,” said Darren Kimball, the CEO of GetFive, another such service. The strong economy had proven “challenging” for Kimball’s company, he said, as a bevy of positive headlines gave companies fewer reasons to go through the messy and emotional process of layoffs.

And THEN …

Then, the tech industry started to collapse, and the companies came knocking. Rising interest rates had cut off the spigot of easy money that had long propped up the startup industry, and tech firms that had been focused on growth found themselves needing to stop burning cash and make sure they had enough runway to survive the downturn. For many, that meant layoffs, which led to a flood of inquiries to the layoff specialists.

Think dot-com bust for a comparable big stock crash event and corresponding recession:

“We’ve never seen anything like this,” said Kimball, referring specifically to the tech sector. “That part of our business has really taken off.”

Doesn’t show up on the instrument panel, though; but that situation built throughout the six months of this year that we KNOW have been in GDP decline:

GetFive received a record number of inquiries in July, according to Kimball, who added that early signs indicate “August will be better than July,” meaning worse for workers. Randstad RiseSmart has also seen a “dramatic” increase in requests for help from the tech sector, particularly from high-flying tech startups known as “unicorns,” Davenport said. So have others. “Everyone is preparing for the unknown,” said Sarah Rodehorst, the CEO of Onwards HR, an automated “separations platform” that helps companies avoid screwing up the layoff process.

So, there you have it. BUSINESS IS BOOMING … if you’re a layoff specialist. That hardly speaks of the “strong job market” you keep hearing Powell talk about and Biden and all of his representatives … and just about every economist out there — all of whom are not thinking outside the box about just how abnormal the world is right now and how normal instrumentation might need major recalibrating during seriously abnormal times. And we all KNOW these times are more abnormal in a plethora of ways beyond which any us has ever experienced — abnormal in ways that mean an economy must surely be falling, no matter what the instruments we are used to relying on are telling us:

GDP falling. Shortages all over the world. War affecting nations at a level that many are calling a borderline “world war” because of the number of nations involved. Massive global economic and travel lockdowns over the past two years due to a scourge of disease upon the earth. Historic record unemployment only two years ago. The massive Chinese economy turning into rubble, due in good part to its centrally-planned lockdowns. (Central planners are notoriously bad for economies over the long haul.) Nations all over the world saying they are entering serious recession. Nations starting to default on their sovereign debts. A massive — albeit artificially created — energy crisis as big as the one we had in the seventies. Screaming inflation all over the earth. Droughts. Food shortages. Massive transportation logjams over a period of two years.

You don’t have to have great vision to do some dead reckoning in this kind of environment and say, “These instruments cannot POSSIBLY be right. We are in some serious trouble!” It’s a “use your head” scenario. Clearly the instruments are wrong, and it is so easy to explain why.

Yet … the economists keep relying on their instruments and telling everyone “all is well.”

So, take another look outside the cockpit:

Nationally, the unemployment rate remains low and jobs are plentiful. But after more than a decade of rising valuations and good times, the tech sector is suddenly grappling with a far harsher reality. “A lot of these founders are still in a moment of shock…. They didn’t expect it. They haven’t experienced it.”

Yes, “SHOCK.” That can’t be good. Executives in the Tech. sector are saying they were blindsided. This happened so quickly that they didn’t see it coming at all and are now looking for crisis-management assistance.

Who does see such things when the Fed and the talking heads on the telly and your government keep telling you, “Times are great! The economy is strong! We can’t be in a recession because the labor market is so strong.”

So strong that companies specializing in guiding layoffs are the only companies hiring like mad who suddenly cannot keep up with their workload. That’s how strong the jobs market is. Never been better for those guys!

“It’s almost like a complete reverse…”

It IS a complete reverse.

But it is a cloaked reverse.

Cloaked by old ways of thinking that blind us to understanding unique realities none of us have experienced before. Thus, these executives have no idea how to deal with what they are now experiencing:

“They’re finding—sometimes for the first time in their company’s lifetime—that they have to lay off employees, and they don’t have that expertise in-house…. “For years, things have been up and to the right. So the HR departments are really scrambling.”

Really scrambling to figure out how to do mass layoffs. That can’t be good. Especially when it is the sector that led the stock market upward all those years — the stock market that ridiculously believes it can defy reality and continue to head upward — that believes recession will cause the Fed to pivot and start to create new money again, even with inflation ripping Powell’s face off (and everyone else’s) with NO CONCEPT of how bad the recession, itself, will be. They will WISH they were in the days of good old-fashioned Fed tightening under normal recessionary times once the cloak is pulled off this recession and they see how truly sharp the poison dagger is because, by the time that big reveal happens, this recession will, indeed, be truly severe because almost no one is ready for it, and the Fed is going to keep tightening until the recession is too obvious to deny!

Why? BECAUSE NO ONE SEES IT COMING! No one believes in it. No one that can do anything about it anyway. It’s like all the doctors are smoking crack just before the surgery!

“Nobody wants to think about this, and even if they’re doing it, they just don’t even want to acknowledge they’re doing it.”

Even the companies doing the layoffs don’t want to think about it. Don’t even want to ACKNOWLEDGE IT IS HAPPENING!

The demand for help [with layoffs not with production!] has become so high in the tech sector that some startups are pivoting to offer additional layoff expertise.

That’s right. BUSINESS IS BOOMING for layoff companies — so much so that this is the one area where startups are actually starting up! That’s your pivot! The companies that specialize in laying people off during recessions cannot keep up with booming business of hiring in order to create new layoff-advisory divisions! They are diversifying into the new field of expertise in layoff orchestration.

Yeah! That sounds like a strong jobs market for the nation!

Says the founder of one of these new layoff companies,

Like a lot of founders of his generation, he had come of age in the post-financial crisis bull market of the 2010s. “I’ve had 11 years of just ‘Grow baby, grow,’” he said.

When his company, Continuum, figured out the universe had changed, he realized he needed to enter the layoff business and provide expertise to others like himself who had no experience with laying off workers.

“Because we’ve been in a bull market for 15 years, very few people have experience actually running layoffs,” he added.

In fact, they don’t even know what one looks like when it is staring them in the face.

The executives often had just left a board meeting where they had been instructed to cut costs enough to survive a downturn without much additional advice. The founders, he said, were left asking, “What the fuck do we do from here?”

Enter the nouveau experts of the layoff world, ready to assist in the downdraft of a recession that supposedly doesn’t exist because “JOBS ARE STRONG.”

“UNEMPLOYMENT IS LOW.”

Sure it is. Look outside the window. It is only low because all the former laborers are asleep on their lawn chairs.

Thus, Continuum, like many other companies, decided to make layoff expertise its new GROWTH industry. When the industry that is now growing the fastest and seeing the most startups in the Tech. world is the layoff industry, you know the normal employment meters are not telling you the truth. So, get behind the dashboard and figure out what is wrong.

Darren Kimball, the CEO of GetFive, offers an additional service: helping laid-off employees find their next job. He started GetFive after he left the hedge fund business in search of more meaningful work than pushing stocks “up and down,” as he put it. Today, GetFive helps people learn new skills and otherwise “present as modern.”

Oh, so a growth niche within the burgeoning layoff industry is helping people retrain so they can take the jobs that everyone else has exited because they no longer want to work! The jobs are there because people quit, but the remaining labor force is mismatched to what is available, which means lower production until the remainders who do still want to work can be retrained to the tasks.

Now, you may rightly say, “But this is all in the Tech. sector.”

True, but I’ll say back, “Just remember the Tech. sector was the THE sector leading all growth during the previous bull market, and…”

Davenport, the CEO of Randstad RiseSmart, said the tech downturn remains the main area where his company’s services have been in demand this year.

He doesn’t know where the economy is headed or if other sectors will come asking for help, he said. But, he added, there are “certainly a lot of signs pointing to trouble ahead.”

Layoffs are well underway in the leading sector, in spite of the fact that so many employees IN THE TECH SECTOR recently resigned (and apparently for good). Times must be seriously bad for Tech. if you have to orchestrate major layoffs AFTER a good number of your employees recently did not return for work, effectively already laying themselves off.

When the leading sector of the economy soared, it pulled many surrounding sectors up with it. What do you think it is doing to those other sectors now that it is falling even after hundreds of thousands, if not millions, of employees had already joined the Great Resignation?

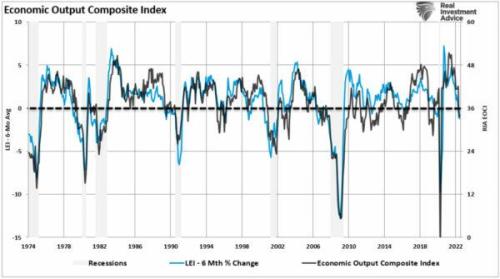

As you can tell in the following graph of one of the leading indicators or recessions, economic output is already below the level that normally assures a recession:

Real Investment Advice, Zero Hedge

Real Investment Advice, Zero Hedge

Conclusion

So, the pivot is in, but it is not a Powell pivot. It is the economy that has already turned half a year ago deep into a recession and is just getting started with its fall, given that other sectors are as certain to join the decline as they were to join the prior ten year’s rush upward in the slipstream of the Tech. industry. And none of the experts see it happening. So, with just three feet left to the runway and the landing gear still up and the pilot thinking he’s just maneuvering onto approach, this is not going to be a soft landing. All those people on the adjacent hillside whipping past your window at 300 miles per hour on their lounge chairs, should be a clue that this is going to be rough.

Buckle up.

Liked it? Take a second to support David Haggith on Patreon!