Inflation is the rate at which prices within a basket of goods or services (called the consumer price index or CPI) rise or fall. When a currency falls, the ability of that unit of money to purchase goods and services weakens, ie., it takes more units of currency to buy the same basket of goods as before it weakened. The more a currency falls, the less you can buy with it because its purchasing power decreases. We call this devaluation/ loss of purchasing power.

Casey Research founder Doug Casey believes we often put the cart before the horse when thinking about inflation. The renowned investor, author, and speaker states,

“Inflation” occurs when the creation of currency outruns the creation of real wealth it can bid for… It isn’t caused by price increases; rather, it causes price increases.

Inflation is not caused by the butcher, the baker, or the auto maker, although they usually get blamed. Inflation is the work of government alone since government alone controls the creation of currency.

Indeed, governments in fiat economies can literally print paper money “out of thin air,” something impossible to do with a gold-backed currency. When the United States and most of the world was on the gold standard, dollars could be converted to gold at the US Treasury’s “gold window” @ 1 oz=US$35. However, the US government was only allowed to create as much money as could be backed by the gold in its faults. (it is often said, “the Fed can’t print gold” (or silver).

When gold goes up or down it is not inherently losing value; what has changed is the value of paper money, the fiat dollar. When you buy gold to resist inflation, ie., rising prices that eat away your savings by reducing your purchasing power, it is called a hedge against inflation.

Loss of purchasing power

Gold is also referred to as a store of value. This means that gold holds its value over time, as opposed to fiat currencies which lose value, their worth slowly eroded by inflation.

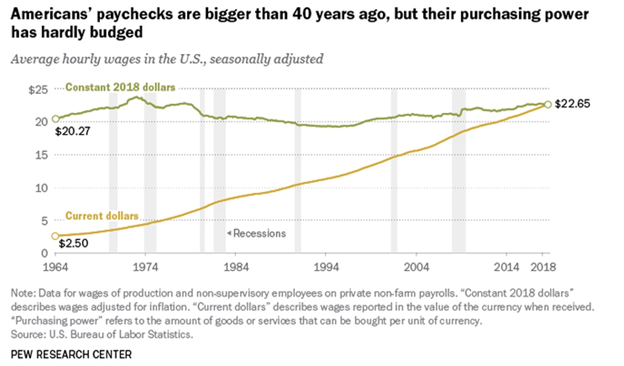

This dynamic can be seen most dramatically in wages. Wages have not kept up with inflation, meaning that, although average wages have certainly gone up over the past 50 years, the ability of the wage earner to pay for the same basket of goods as 50 years ago has decreased, dramatically.

This ability to pay is called purchasing power.

According to Pew Research, the purchasing power of most Americans – other than the rich who are not collecting wages or modest salaries, they are invested in the market, therefore do not have to worry much about wage inflation – has stagnated over the past four decades.

Since 1973 the compensation of the typical US worker has grown only about 12%. Since 1979, the hourly median wage has gone up less than 10% in real (ie. after inflation) dollars, or an average annual raise of barely 4 cents.

Real wages among the lowest-paid workers have fared even worse, increasing just 4.3% between 1979 and 2018.

Let us get granular with these figures. We are aiming to show how far a basket of breakfast groceries, and the cost of gas to go buy them, went in 1970 compared to February of this year. See table below:

1970

Milk: $1.32 per gallon

Eggs: 60¢ per dozen

Bread: 70¢

Bacon: 85¢ – 95¢ per pound

Gasoline: 36¢ a gallon

February 2021

Milk: $3.36 per gallon

Eggs: $1.59 per dozen

Bread: $1.32

Bacon: $5.77 per pound

Gasoline: $2.55 a gallon

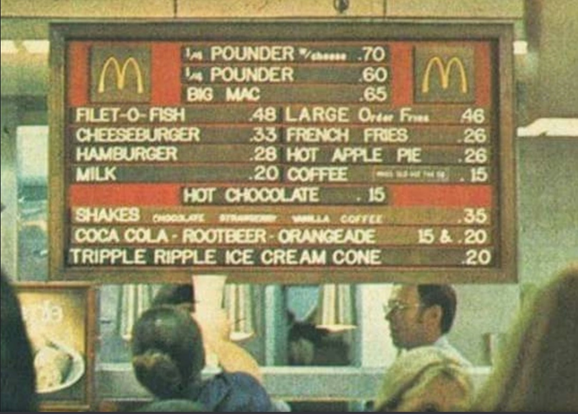

1973 McDonald’s menu

We can all agree there has been a large increase in the prices of our breakfast groceries, over the past 51 years. This is inflation.

In 1970 the United States was still on the gold standard. An American with an ounce of gold, say an American Eagle coin, could redeem his gold for US$35. How much could he buy and how many people could he feed? At 1970 prices, that $35 could make a lot of pancakes and French toast, with plenty of bacon rashers for everyone and still a few eggs left to cook and milk for coffee and tea.

Now take that same $35 and try to make an identical breakfast feast today. The groceries do not stretch nearly as far, we estimate $35 worth of milk, eggs, bread, and bacon would feed about 40% less people than in 1970. Everything is just so much more expensive.

Of course, what has gone up even more, is gold. Selling an ounce of gold in 2021 would give you about $1,750 — a 50X increase over the $35/oz gold in 1970. Obviously $1,750 buys a hell of a lot more breakfast groceries than $35 — you could probably feed an entire football team, including coaches and trainers, with everybody coming up for seconds.

The point is a grocery shopper using gold as a currency rather than dollars in 2021 would see a 50-fold increase in their purchasing power.

The shopper using dollars by contrast loses about 40% of their purchasing power because the prices of their grocery items have at least doubled or in the case of bacon quintupled. The 35 dollars can feed 40% less people than in 1970. If they had kept that same ounce of gold and cashed it in 51 years later, they could feed 50 times as many people.

Which has been the better store of value, dollars, or gold? Obviously, it is gold – the only true safe haven that protects the holder against rampant inflation caused by money-printing.

More on that later.

For now, we want to get a bit more into wages and gold.

According to Pew Research, via Motley Fool, the real average wage, which Pew defines as “the wage after accounting for inflation” has roughly the same purchasing power as it did 43 years ago.

Source: Pew Research Center

This is incredible to think about. Many salary earners get an annual raise to compensate for inflation, usually 1-2%. So how can we say that wages have only gone up 12% since 1973? It is because your measly 1% or 2% raise to cover inflation is not really covering it. Core inflation these days strips out the cost of food and gasoline, giving an inaccurate picture of how much prices are rising. If these were factored in, your raise “to cover inflation” would be significantly higher.

“After adjusting for inflation, however, today’s average hourly wage has just about the same purchasing power it did in 1978, following a long slide in the 1980s and early 1990s and bumpy, inconsistent growth since then,” Pew report author Drew Desilver wrote. “In fact, in real terms average hourly earnings peaked more than 45 years ago: The $4.03-an-hour rate recorded in January 1973 had the same purchasing power that $23.68 would today.”

Wow. Think about what this is saying. Using our breakfast basket example, suppose your wage in 1973 was $4/hr. Forty-eight years later you are making 12% more, or $4.50, rounding up. You need to make $23 an hour to buy the same breakfast basket you could pick up in 1973 for 4 bucks. Your wage has gone up 12% but prices have increased up to 600%.

In the aggregate, wages have stagnated. They have failed to keep up with the price of goods, ie., the rate of inflation. The wage and salary earner is literally getting screwed every day because the value of the dollar is being devalued by a fractionally small amount. Over time, however, the diminished value is huge.

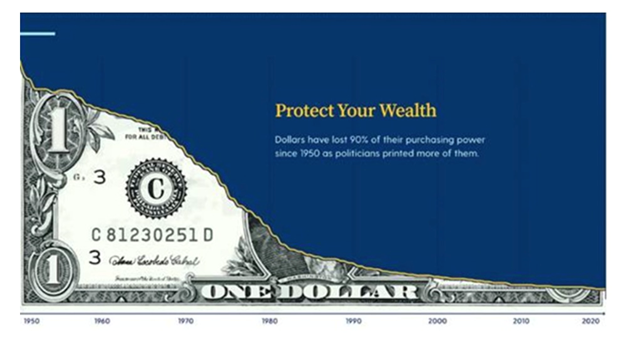

Consider: In the US there was an increase in inflation for every decade except the Depression when prices shrunk nearly 20%. The Bureau of Labor Statistics’ Consumer Price Index indicates that between 1860 and 2015, the dollar experienced 2.6% inflation every year, meaning that $1 in 1860 was equivalent to $27.80 in 2015. The dollar has lost 90% of its purchasing power since 1950.

To learn more about why the US under President Nixon went off the gold standard in 1971, and the negative aftermath, read The 50th anniversary of Nixon’s colossal error

It is never official until it’s officially denied

Last week the US Federal Reserve kept interest rates near zero, and most of Fed policymakers wants to keep them there until at least 2023, to keep the momentum in economic activity going as the country recovers from the pandemic.

According to Reuters, the Fed’s easy monetary policy of the past year or so includes a continuation of bond-buying at a pace of $120 billion a month, until the Fed sees “substantial further progress” toward its goals of full employment and inflation.

If the Fed keeps quantitative easing going for 33 months, the duration left in President Biden’s four-year term, we could be looking at adding $3.96 trillion to the Fed’s balance sheet, pushing it above $10 trillion. The balance sheet peaked at $4.5 trillion in 2015, after three rounds of QE to deal with the financial crisis, right now it is $7.69 trillion.

Federal Reserve assets. Source: Federal Reserve

There will be a lot more monetary policy being undertaken, besides bond-buying.

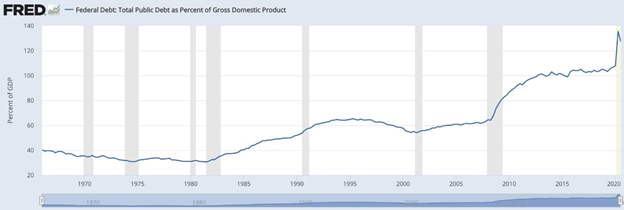

Meanwhile the US national debt currently sits around $28 trillion, after $4.5 trillion in pandemic-related spending. That does not count the $1.9 trillion covid relief package just passed by the Senate. Coming up shortly is an expected $4 trillion infrastructure bill, Biden’s Clean Energy Plan pegged at $2 trillion, and trillions more in social spending spearheaded by the Democratic Party’s progressive left wing.

Certainly, there will be a recovery in the US, but at what price? How much higher does the already unsustainable national debt have to go?

In October 2020, the debt zoomed past 100% of GDP, for the first time since the Second World War, but that was just the beginning. The debt is currently the same size as the economy or slightly bigger; very shortly the debt will be much larger than its economy!

We have monetary easing happening at the same time as fiscal spending “carte blanche” (remember Biden believes strongly in the power of the state to tax and spend. A long wish list waits to be filled, with little to no concern regarding the already out of control $28 trillion national debt, courtesy of Modern Monetary Theory, or MMT).

The result of these two forces acting together, is bound to create inflation. We did not get inflation during the financial crisis because we did not have the spending component. All the money stayed within the banks. This time is different.

Last month Lawrence Summers, the former treasury secretary for Bill Clinton and economic adviser to Barack Obama, wrote in an op-ed for The Washington Post that Biden’s stimulus might cause “inflationary pressures of a kind we have not seen in a generation, with consequences for the value of the dollar and financial stability.”

Already, we know that several commodities, from copper to crude oil, have been surging in price. Then there is the pent-up consumer demand.

According to estimates by Bloomberg Economics, consumers in the world’s largest economies amassed $2.9 trillion in extra savings during covid-related lockdowns — with half of that total, $1.5 trillion, in the US alone. Bloomberg notes the $2.9T is at least double the average annual growth of gross domestic product seen during the last expansion, and equivalent to the annual output of South Korea.

Should all the money saved over the past year in the US be spent, it would propel economic growth as high as 9%.

We don’t know how high US GDP growth will be this year (the latest estimate is 6.5%) but we expect that the addition to the national debt will be more than the increase in GDP. This would expand the debt to GDP ratio beyond the current (QE 2020) 127%.

There is a historically close correlation between gold prices and debt to GDP. The higher the ratio, the better it is for gold.

Debt to GDP ratio, 1970-2020. Sources: OMB, St. Louis Fed

Historical spot gold price. Source: Goldprice.org

However, all this expected growth, thanks to US stimulus, comes at a price. Reuters reports the downside is an increase to the inflation rate of 0.7% per year, on average, in the first two years, meaning by the end of 2022, we could see inflation close to 3%! (double the current 1.4%).

Note that this is well beyond the Federal Reserve’s 2% target and would likely call for some kind of policy response, to either reduce the money supply, increase interest rates, or both.

Or maybe not. Fed Chair Jerome Powell and Treasury Secretary Janet Yellen are currently in front of Congress to soothe fears about inflation and debt.

“The recovery is far from complete, so, at the Fed, we will continue to provide the economy the support that it needs for as long as it takes,” Powell told a congressional hearing, Tuesday.

Inflation? “Ain’t gonna happen,” Powell seems to be saying. More money-printing to buy more bonds? “Don’t worry be happy”.

It is never official till it is officially denied. The Fed Chair just denied that inflation and debt are a problem. Set the money presses free!

Conclusion

Something interesting to consider about personal debt and government debt. Many years ago, the banks thought you were a bad credit risk and would not lend you money if your debt was 40% of your income. 40% was your credit cut-off; the banks simply would not let you borrow over that limit.

Today US debt is +100% of GDP, which is scary enough. In 2020 the federal government is estimated to have collected revenues of $3.7 trillion, against the current national debt of $28 trillion. In other words, the percentage of debt to income is 750%!

Clearly the 40% credit cut-off for individuals has no bearing whatsoever on governments.

If you owned a million-dollar-a-year business but your bank debts totaled $1 million, there is no way your business is going to survive. The banks would stop lending you money long before your income to debt ratio reached 100%.

The US government only brings in $3.5 trillion a year yet it must pay interest on the $28 trillion debt and pay bondholders their interest when the bonds reach maturity. We know the debt is going to increase this year and likely for the next three. It is obvious to anyone looking at this that the government cannot afford this debt, nor does it have any intention of paying it back.

The only reason the government can get away with it, whereas a business or private citizen could not, is because it owns a money printing press and controls interest rates.

What happens when a national debt gets too high? Credit agencies start knocking down a country’s credit rating and it gets harder to borrow. To grant the country, now deemed a credit risk, a loan, the bank demands a higher interest rate. The higher a country’s debt, the higher the interest rates.

Who controls the printing presses? Fat-cat politicians, most of whom have no interest nor understanding of the plight of the working poor, who are basically wage slaves.

The more money they print, the less the average American (or Canadian, it is the same in Canada) can buy.

Wages cannot keep up with how fast the federal government has, through excessively adding to the money supply (with newly printed money) or borrowing it to pay for spending programs, been devaluing the dollar.

This is why February 2021 food and gas prices are so much higher than 1970 prices, and it’s why your dollar doesn’t go as far, because excessive money-printing has destroyed its value.

The truth is politicians are addicted to spending. They must spend, and print, to survive. Nixon figured this out when he took the US off the gold standard.

Nixon was persuaded, against his better judgment, to try beating inflation in 1971 by imposing wage and price controls. He did this essentially to get re-elected. But Nixon went further in committing what must be seen in retrospect as a colossal blunder in removing the fixed link between the dollar and gold.

The move killed the dollar, which has been losing value ever since. Why? Because successive governments and central banks have taken it upon themselves to create money (ie. the Fed) and spend money (the Treasury) with no consequences, something that could never happen if the dollar had a gold anchor.

Since 1970 the value of the USD has been more than cut in half.

How long can this go on for? We do not know but it is certainly going to keep happening under free-spending Biden, inflation is creeping up and will go higher, and the dollar will continue losing value. The only way to stop this madness, to protect yourself against dollar devaluation, in our opinion, is to own gold, the traditional and only true store of value.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.