January is not a "delivery month" for COMEX gold. However, open interest and "deliveries" have surged during the month, so this week let's take a minute to get on the same page as to what this all indicates.

Let's start with that front/delivery month calendar. These are the months where the trading volume can be found. When one month "expires", the speculative trading action moves forward to the next month. Below are the months considered "delivery months" for COMEX gold:

- February

- April

- June

- August

- October (sort of)

- December

Here in late January, the trading activity and volume is rolling out of the current front month of Feb23 and into the next front month of Apr23. The Feb23 contract goes "off the board" at the COMEX close on January 30 and then moves into its delivery phase. This means that, by the close on January 30, almost every Speculator will have closed his/her Feb23 position and likely reestablished a new position in the Apr23 or another contract down the board.

Any party still holding a Feb23 contract on January 31 is considered to be "standing for delivery" and must show, at a minimum, enough cash in their brokerage account to be considered 100% fully funded should a Feb23 contract be put to them or delivered. Any party without this 100% funding is liable to see their position forcibly closed by their margin clerk on January 31, otherwise known as First Notice Day.

In a nutshell, that's how it works. As such, trading at the end of a month preceding a delivery month will often bring price weakness as Speculators sell their long positions, sometimes without fully reestablishing their position farther down the calendar. This net selling of gold contracts is what can bring about that end-of-month price weakness.

OK, enough about that. This post is about what’s currently going on in the Jan23 gold, so let's focus our attention there.

Knowing what you now know about front months, you'll recognize that January is NOT a front/delivery month. Instead, it's the months of December and February. January just falls in between. As such, let's review what took place in December.

When the Dec22 contract went "off the board" on November 29, 2022, there were 18,667 Dec22 COMEX gold contracts still open and allegedly "standing for delivery". If you're keeping score at home, at 100 digital ounces per contract, that's a demand for as much as 1,866,700 ounces.

As the month of December progressed, "deliveries" were made while, at the same time, additional open interest appeared as parties either ponied up 100% margin for an immediate purchase and delivery OR placed a new sell order for the purpose of making an immediate delivery. By the time all deliveries were finished and the contract finally expired on December 28, a total of 20,750 deliveries were made for 2,075,000 ounces. This is not an atypical number for a COMEX delivery month and right about in line with recent averages.

So now it's January and, as you know, January is not a front/delivery month. As such, when the Jan23 contract went "off the board" on December 29, 2022, there were only 698 Jan23 contracts open and standing. You'll note that's a far cry from the 18,667 the month before.

And now, finally, to today's lesson...

Thus far in January there have been a total of 5,981 total "deliveries" made. Holy Toledo! What's going on here? Well, let's dig a little deeper. The CME updates delivery and open interest numbers every night, so when we take a closer look at which parties have been active this month, a bigger picture gets revealed.

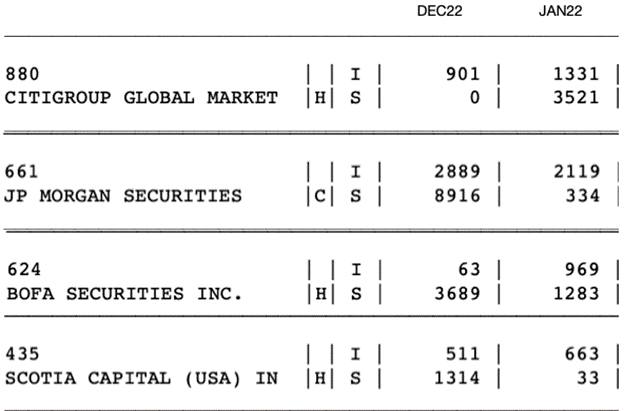

Below is the recent issue/stop activity of four of the biggest bullion banks in the world. Scotia is not the player they used to be, but the other three remain Godzillas in the global gold market.

If you're unfamiliar with how this data is reported, here's a key:

- H = House or proprietary account of the bank

- C = Customer accounts of the bank

- I = Issuing/Selling/Delivering gold

- S = Stopping/Buying/Taking delivery of gold

I left the Dec22 numbers on the chart above for scale. Focus instead upon the Jan23 numbers and let's add them up. For just these four banks alone, we have:

- 5,082 contracts being issued or "delivered"

- 5,171 contracts being stopped or "taken delivery”

Hmmm. Those numbers almost perfectly match, and they comprise all but about 800 of the surprisingly large number of total "deliveries" so far this month.

So what's going on here? Nothing of interest. There's no "delivery surge" or "sudden demand for physical" on COMEX. Instead, it's just the same old paper shuffle that we've been writing about for over a decade!

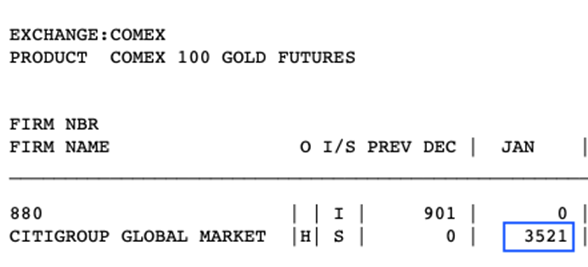

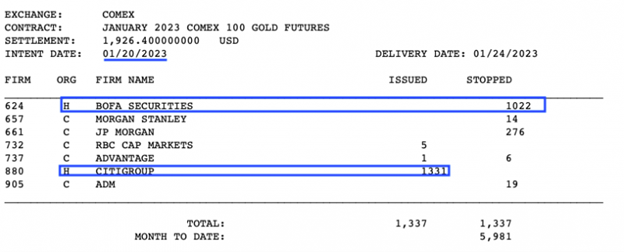

There's very likely little, IF ANY, actual gold that's being "delivered". Instead, it's just a simple exchange of warehouse receipts and warrants. Until late last week, it was Citi that was stopping and "taking delivery" of Jan23 COMEX gold. They had stopped 3,521 contracts.

But then here comes last Friday, and that same House Account at Citi suddenly issues and "makes delivery" of 1,331 contracts while House Account of BofA, which had previously issued/sold 969 contracts this month, suddenly became the buyer/stopper!

So, again, what the heck is going on here? I'll tell you what's going on—NOTHING! It's all just the same old scam and charade of "physical delivery" on COMEX. No actual metal is moving, neither is there any actual metal being delivered or taken off the exchange. Instead, it's simply The Banks shuffling receipts and warrants, just like they always have.

And one last thing... WHEN delivery defaults finally emerge and a global bank run on physical metal begins, it is NOT going to emanate from COMEX. I'm afraid that anyone who still clings to the "COMEX Default" idea is failing to understand how that exchange operates.

Instead, the chain of leverage and rehypothecation will break somewhere else. Maybe on a smaller market. Maybe in a Swiss bank. Maybe in the unallocated accounts that are offered by myriad bullion dealers. History will note where the scam finally ended.

Just don't expect it to happen on COMEX, where the games have been played since 1975 and, as recent "delivery" notices have shown, the games continue to this day.