‘Ultimately, the power to create money is the power to destroy.’

“The bottom line is this inflation and all its consequences are probably unstoppable.”

Bill Blain, Morning Porridge

“They should have known inflation was broadening and becoming more entrenched,” LPL’s Quincy Krosby recently told CNBC. “Why haven’t you seen this coming? This shouldn’t have been a shock. That, I think, is a concern. I don’t know if it’s as stark a concern as ‘the emperor has no clothes.’ But it’s the man in the street vs. the PhDs.” What we find odd about all the complaints against the Fed and its tardiness in dealing with inflation (because an election happens to be around the corner) is that they ignore what might have happened had the Fed acted earlier. The same concerns about recession and unemployment would simply have surfaced then instead of now. If Washington is worried about inflation, wait for the public reaction when unemployment and bankruptcies begin to rise.

The Fed has a long history of papering over busts to create booms and stifling booms to create busts, never through it all managing the economy half as well as Adam Smith’s invisible hand. Right now, it’s in stifling mode, but that could change at the first signs of real economic distress. “The Fed,” says long-time gold market analyst John Hathaway in a Sprott Insights interview, ”doesn’t have a dial. It’s an either on or off switch. They’re either switching off the economy and crashing financial assets and the economy, or their crying uncle and caving in, which will likely open the door to more inflation. I think either outcome is positive for gold.”

Historically, the Fed has opted for monetary inflation as its baseline policy because the alternative – an economic depression – is something no central banker wants to add to their resume. That is why, despite seven recessions, the dollar has lost 86% of its purchasing power since the world went off the gold standard in 1971. We are reminded, in this context, of an observation from former Fed chair Paul Volcker, the central banker who broke the back of the last runaway inflation in the late 1970s-early 1980s:

“We sometimes forget that central banking, as we know it today, is, in fact, largely an invention of the past hundred years or so, even though a few central banks can trace their ancestry back to the early nineteenth century or before. It is a sobering fact that the prominence of central banks in this century has coincided with a general tendency towards more inflation, not less. By and large, if the overriding objective is price stability, we did better with the nineteenth-century gold standard and passive central banks, with currency boards, or even with ‘free banking.’ The truly unique power of a central bank, after all, is the power to create money, and ultimately the power to create is the power to destroy.” (From Deane and Pringle’s The Central Banks, 1995)

Bloomberg’s John Authers sees central banks’ recent inflation blunder as more than just a gaffe likely to be quickly forgotten. Beginning in the early 1970s, “in place of gold, currency’s anchor,” he writes in a recent editorial, “became trust in the central banks that issue them. Now credibility appears to be at an end. With central banks desperately ripping up their playbooks to try to rein in inflation that’s veered far beyond target, they’re admitting they’ve been wrong, and giving up on trying to steer the markets on their plans for the future. That’s alarming, because the precedent of the 1970s is not encouraging.” He concludes that “the word of Powell or Lagarde is no longer as good as Volcker’s, and it’s certainly not as good as gold.”

Similarly, Stanford historian Niall Ferguson believes the monetary policy mistakes of 2021 were even more extensive than those made in the late 1960s and early 1970s, resulting from “blinking under political pressure.” “I never met Arthur Burns — Volcker’s predecessor, but one, as Federal Reserve chairman — who preferred puffing on a pipe to cigars,” he says in an in-depth Bloomberg opinion piece. “But I think I’ve read enough about Burns to suggest plausibly that the current Fed chair, Jay Powell, has more in common with him than with Volcker. This is unfortunate and potentially disastrous for the US economy.”

Cartoon courtesy of MichaelPRamirez.com

Cartoon courtesy of MichaelPRamirez.com

Short & Sweet

IN AN ANALYSIS REVIEWED RECENTLY AT BLOOMBERG, Goldman Sachs updates its bullish gold forecast from earlier in the year. It says gold demand has been hurt by a “wealth shock” in emerging countries, most notably China, that now “appears to have peaked.” Fed hawkishness, it says, will “add to fears of recession risks and boost gold investment demand.” Most notably, it is sticking with its twelve-month forecast of $2500 per ounce while revising its three-month target to $2100 (from $2300) and its six-month target to $2300 (from $2500). “In the absence of a large liquidity shock,” it advises, “we view current gold price weakness as a good entry point.”

“THUS THE SUPPLY AND DEMAND FUNDAMENTALS of the physical substance,” says Invezz’ Shivam Kausik, “do not determine the price of paper gold. The paper market follows its own heavily-financialized logic and is divorced from physical fundamentals. Instead, the paper price acts as a beacon, on which all physical prices are locally determined.” At any given point in time, physical investors must make a determination if the paper price is trading at a discount, premium, or at par with the current market reality. Several factors must be taken into account to do so, but there is one that takes precedence. Does the current paper price reflect the amount of danger lurking in financial markets and in the general economy? Of course, that call is subjective, but, as a prospective buyer, it helps enormously to view the price of gold within the context of the times. That is how we get to a place where the demand for gold can be off the charts even as the price languishes. This article offers solid insights into the nature of the gold investment, especially for first-timers.

MONEY WEEK’S JOHN STEPEK SEES US A NEW REALITY in which not losing money in real terms will be seen as a victory. Adjust your thinking, he advises, from the return on your capital to the return of your capital. He recommends gold along with a few other options. “What’s interesting is that investors still feel that it should be possible to make money,” he says in a recent column. “There’s some other asset out there which can protect and earn money during inflation, just as surely as an S&P tracker fund has made you money during the last decade. I don’t think this mindset is very helpful.”

“THE EVERYDAY PRICE INDEX surged 2.1 percent in May after a 0.5 percent increase in April, a 3.0 percent jump in March,” reports the American Institute of Economic Research, “and a 1.3 percent gain in February. Over the first five months of 2022, the EPI is up at an annualized rate of 20.6 percent. From a year ago, the Everyday Price Index is up 12.8 percent, the fastest on record dating back to 1987.” Inflation might not be as bad as you thought it was …… It’s even worse. $1000 is not what it used to be. In 1934 (the date on the Federal Reserve note shown), $1000 could buy you two brand new Ford Deluxe Roadsters with 3-speed transmissions. In 2022, two new brand new Ford Mustangs will run you about $54,000 – and some make the case that inflation is just getting started. $1000 might buy you a good set of snow tires.

THE STRONGER DOLLAR IS TRANSLATING to a buying opportunity for Americans on a whole host of consumer items – gold being just one of them. But, as has happened in the past (sometimes formally, sometimes informally), the dollar will need to go lower against its rivals at some point to balance the international monetary equation. Precisely for that reason, gold and silver’s price histories have been given to long periods of sideways action followed by sudden price spikes. When the wheel turned, it turned decisively. “When this panic hits,” writes James Rickards at the Daily Reckoning website, “and the dollar is deemed no longer reliable, the world will turn to gold. Frustration with the sideways movement of gold prices is understandable. But behind the curtain, a new liquidity crisis is brewing. Investors should consider today’s prices a gift and perhaps a last chance to acquire gold at these prices before the real safe haven race begins. Gold is so cheap right now, it’s practically a steal.”

–––––––––––––––––––

DAVID EINHORN, WHOSE GREENLIGHT CAPITAL HEDGE FUNDE is having a banner year, believes that the Fed is bluffing about its ability to contain inflation with quantitative tightening and that it will be forced to “capitulate” sometime next year. He likened the Fed’s current balance sheet reduction effort to “clearing off your snowed-in driveway with an ice cream scooper.” Einhorn’s grandfather taught him at an early age about the baseline value of gold ownership – lessons that have stuck with him throughout his Wall Street career. “The question,” he says in a US News report, “is whether there’s enough gold to back the currency reserves. The answer is for the price of gold to go higher, perhaps much higher.… Just wait until they’re forced to loosen into an inflationary spike to support the Treasury. At that point, it’s best to have some gold. That’s what grandpa Ben taught me.”

“IN THE VIEW OF JPMORGAN CHASE & CO. STRATEGISTS,” writes Bloomberg’s Denitsa Tsekova, “the reason why this may be the end of the bear market is that investors are holding way too much cash.” Nikolaos Panigirtzoglou estimates that cash levels are close to 40%, the highest level in a decade.” With all markets either in limbo or in significant decline, you might have been wondering where all the money garnered from the sale of various assets is ending up. Now you know. Panigirtzoglou thinks we may have reached the bottom for both equities and bonds. Given the magnitude of the bubble’s inflation and the correction thus far, he might be overly optimistic. As Ray Dalio tells us, cash is trash, but many investors see the sidelines as a viable option at this juncture.

THE FINANCIAL PRESS WAS QUICK TO REPORT that the ban on Russian gold exports was largely symbolic, given flows had already been restricted. There may be more to the story, though, than meets the eye. At 300 metric tonnes per year, Russia is the third-largest gold producer in the world, behind China (370 tonnes) and Australia (330 tonnes). It exported roughly $19 billion in gold in 2020 (about 340 tonnes), its second-largest export after energy products and the fourth largest in the world, according to the OEC – so its market presence is not insignificant. Based on Trading Economics data, Russia increased its exports in 2021 to nearly $50 billion despite its policy to channel domestic production into central bank reserves, putting its supply contribution at just over 850 tonnes. An argument, in short, can be made that the stepped-up sales in 2021 contributed to gold’s rangebound price behavior.

“NEWMONT’S AFRICA UNIT SOLD 3,500 OUNCE OF GOLD to the Bank of Ghana under a central bank domestic gold purchasing programme launched in June 2021,” reports Reuters. Newmont’s sale to Ghana’s government will garner some attention among gold market analysts because it could signal the shape of things to come. Metal channeled into domestic reserves diminishes supply for the rest of the market. This is the first instance we know of in which an international Western mining company sold directly to a nation’s central bank. Typically, the metal is refined and sold in the open market. As such, Newmont’s sale, though minor in nation-state terms at 3,500 troy ounces, could be major in terms of what it represents. Ghana is the world’s sixth-largest gold producer.

SPECTRUM MARKETS, THE EUROPEAN DERIVATIVES TRADING PLATFORM, recently reported retail investors are more bullish on gold than ever. According to a Markets Insider article, the European Retail Investor Index (SERIX) posted its highest sentiment reading ever in May. “After a period of decline in May that saw the gold price drop below $1,800 on the 16th,” said Michael Hall, Spectrum’s head of distribution, “the gold price started what looked like a new rally in the last few days of the month, supported by both the dollar and euro undergoing a weak phase. Considering the macroeconomic backdrop, it’s no surprise to see investors looking to take advantage of a dip in the gold price to make safe haven allocations.” Wisdom Tree’s Nitesh Shah added that “with fears of a recession rising, investors are increasingly turning to gold as a hedge. (Also see: US Mint gold sales jump in May)

Notable Quotable

“I’m a fan of gold. I think gold’s valuable in a crisis. If the world turns to hell, the war expands and gets worse, God forbid a nuclear weapon is used, I think people are going to say: ‘How do I know what anything’s worth anymore? I’m going to make sure I have some gold because I don’t want to not have money at a time of desperation.’ It may never come to that, but I think it’s prudent to have a little bit of your portfolio in gold.” – Seth Klarman, Baupost Capital, Harvard University interview at Yahoo

“We ballooned the M2 money supply by 40 percent. We bought nearly two-thirds of the bonds sold by President Biden’s $2 trillion rescue package — and that was a huge mistake. That’s what has caused the inflation. I keep looking for that acknowledgment, but I don’t see it. So I’m going to assume that this was some kind of immaculate miracle. We’re going to call this ‘immaculate inflation.’ It apparently had no real cause. It was just a gift from heaven. But it’s not the Fed’s fault.” – Lawrence Kudlow, The New York Sun

“We believe that hedges in gold against the rising risk of stagflation, traders responding to the highest level of inflation in 40 years and turmoil in stocks and cryptos are some of the reasons why gold has not fallen at the pace dictated by rising real yields. With that in mind, we are watching what investors do (not what they are saying) through the ETF (Exchange Traded Fund) flows. During the past week, total holdings in bullion-backed ETFs have seen a small decline of less than 0.25% – again, a development highlighting investor maintaining exposure to offset the tumultuous conditions seen across other markets and sectors. Our long held bullish view on gold and silver has been strengthened by developments this past week. We still see the potential for gold hitting a fresh record high during the second half, as growth slows and inflation continues to remain elevated.” – Ole Hansen, Saxo Bank

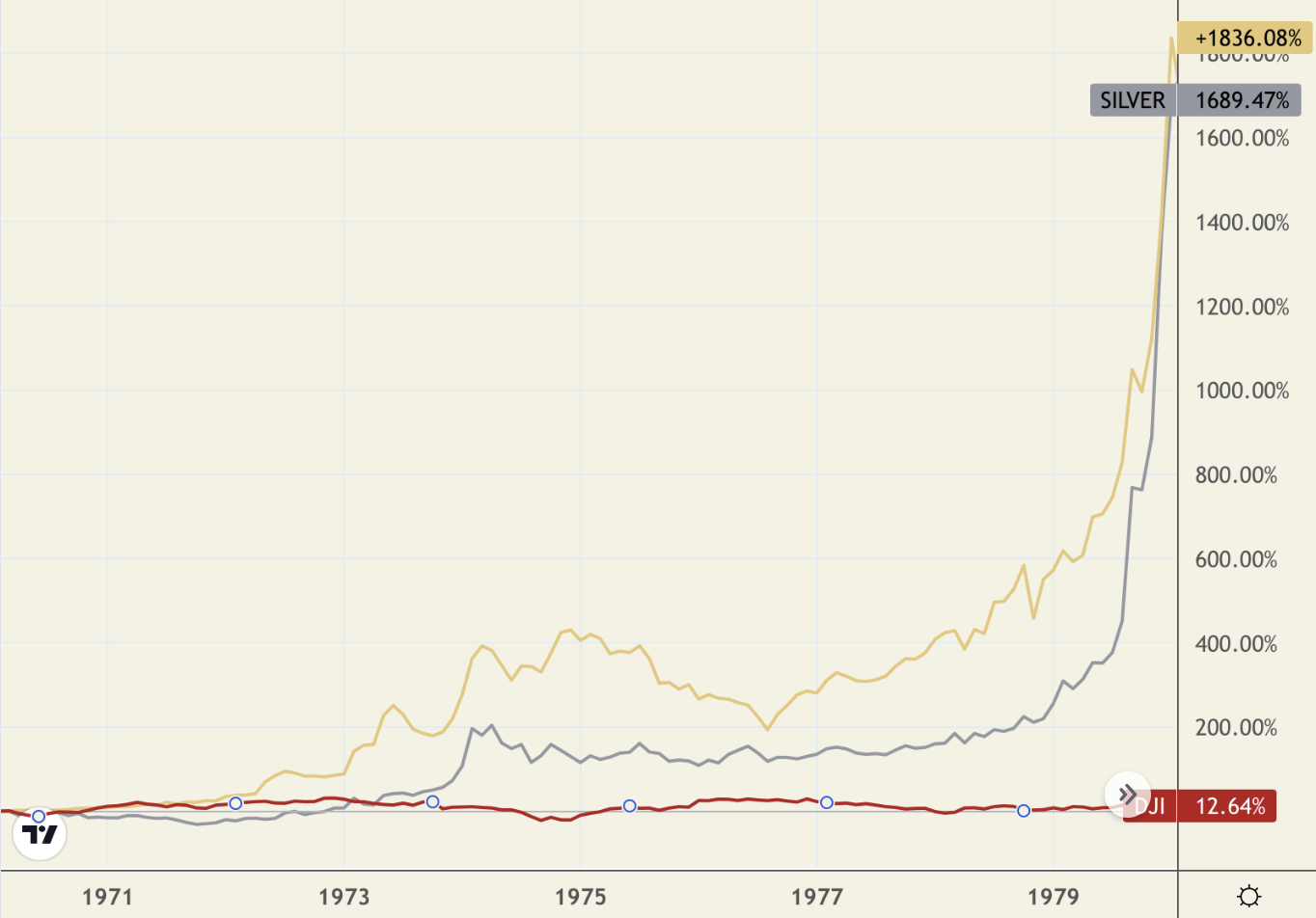

Gold, silver and stocks performances

(1970-1979)

Chart courtesy of TradingView.com • • • Click to enlarge

Chart note: During the stagflationary 1970s, gold rose 1836%, silver 1690%, and the Dow Jones Industrial Average 12.6%

“It’s an extraordinary moment; we have our first pandemic in 100 years. We have our first invasion in Europe in 75 years. And we have our first inflation around the world in 40 years. When you look at the combination, the intersection of the pandemic, of the war, of the inflation, it signals paradigm shift, the end of 15 years of financial repression and the next era to come.” – Ted Pick, Morgan Stanley, co-President at CNBC

“I’ve been involved in markets since I got with E.F. Hutton in 1975. So, you know, a long time. I’ve never seen such a confluence of events of upside and downside potentials that are so strong that will impact each other like icebergs crashing into one another. Fiat currencies, we think, are at the doorstep of collapse. We will now see events unfold in a chaotic manner. It’s not going to take five years for this to happen. It’s going to happen in the next year or so. ……” – Michael Oliver, King World News

“Things weren’t supposed to unfold this way. The Fed was clearly going to be cautious, all moves made gingerly and well telegraphed to conspicuously vulnerable markets. Given time, inflation would surely subside. The worst-case scenario would be the Federal Reserve and global central banks raising rates until something began to ‘Break.’ There was time. Rates would remain extraordinarily low for months and even quarters. Nothing too pressing. Well, complacent markets – and central bankers – grossly misjudged two key aspects of underlying fundamentals. Inflation Dynamics were much more powerful and well-entrenched than appreciated. Similarly, Market Structure fragilities were greatly more acute than recognized. The upshot: things are ‘Breaking’ before central bank tightening cycles even get cracking.” – Doug Noland, Credit Bubble Bulletin

“Central banks did not spend the 1960s deliberately inflating asset prices, so while inflation punished markets in the 1970s, it did not force a central bank position unwind. This is why analogs to the 1970s are tenuous. The full extent of the QE trade will be impossible to quantify except in hindsight because it almost certainly spread in ways that aren’t entirely clear yet but are surely staggering. Sometimes in my role I’m asked to predict the future. But now, I think there’s more than enough value in being able to simply see the present clearly.” – Lindsay Politi, One River Asset Management at Zero Hedge

“In his remarks to reporters on Wednesday (6/14/2022), Powell appeared to acknowledge how powerless he felt. ‘We can’t really have much of an effect, but we have to be mindful of the potential effects on inflation expectations,’ Powell said. ‘So it’s a very difficult situation to be in.’ It’s tricky indeed, and Powell’s commitment to mindfulness won’t help one bit.” And it is not tricky just for the Fed. It is problematic for financial markets as well. – Jonathan Levin, Bloomberg

“When I read that, knowing Blinder’s politics, it reads to me like saying the Fed is not going to stomp out inflation. It will raise rates to try to deter and lower inflation (and cause the Fed to seem responsible in the process) but it will allow inflation to linger (that’s the ‘don’t expect miracles’ part) rather than to reduce inflation to target expeditiously.” – Robert Brusca, MarketWatch

Final Thought

‘Advice doesn’t have to be complicated to be good.’

“The world is complex,” writes analyst Safal Nivetchak. “Consider the various reasons floating around explaining the market’s fall in the last two months – war, inflation, interest rates, FII selling, China, supply chain disruptions, weak GDP, and over valuations. This is not a complete list, but enough to suggest that the world is complex. And so are financial markets. How do you deal with such complexity in your wealth creation journey without losing your sanity? Have an investment process that is elegant in its simplicity.” We found the down-to-earth practicality contained in Nivetchak’s advisory of enormous value, particularly for young investors searching for guidance on the road to building wealth – something appealingly analog in an increasingly complex digital age.

Though he never mentions gold, many successful investors see it as part and parcel of the keep it simple portfolio approach. He offers a memorable quote from Dutch computer science pioneer Edsger Dijkstra: “Simplicity requires hard work to achieve it and education to appreciate it.” Nivetchak ends by quoting Steve Jobs on keeping it simple: “… It’s worth it in the end because once you get there, you can move mountains.” Says Nivetchak, “That’s also true for investing for wealth creation. In practicing simplicity, and staying the course, over time you can also move mountains.”

Interested in practicing simplicity in your portfolio plan?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ORDER GOLD & SILVER ONLINE 24-7

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such, USAGOLD does not warrant or guarantee the accuracy, timeliness, or completeness of the information found here. The views and opinions expressed at USAGOLD are those of the authors and do not necessarily reflect the official policy or position of USAGOLD. Any content provided by our bloggers or authors is solely their opinion and is not intended to malign any religion, ethnic group, club, organization, company, individual, or anyone or anything.

–––––––––

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.