Strengths

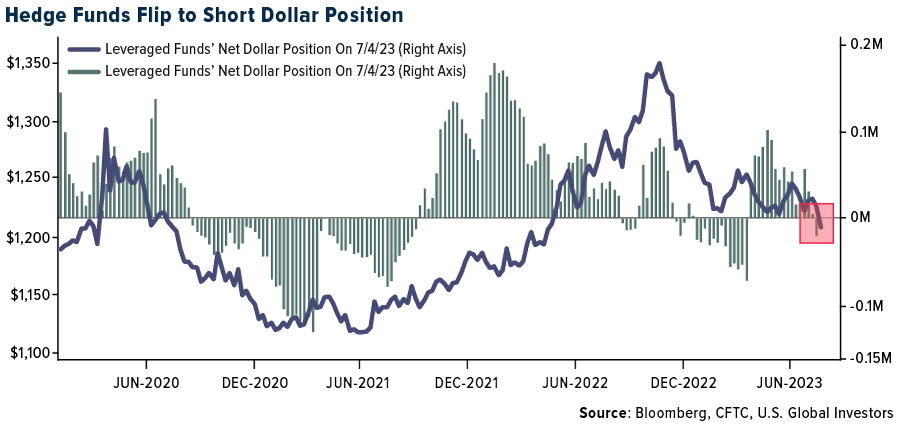

- The best performing precious metal last week was silver, up 7.91%. Softer economic data gave precious metals a boost with rate expectations waning and the dollar sinking. This has prompted hedge funds to flip to net short on the U.S. dollar futures. Every G10 currency has strengthened against the greenback over the past month, reports Bloomberg. Ecuador’s central bank recently reported to have added $36.1 million of domestically produced gold to its reserves.

- K92 Mining announced that underground mining operations have resumed at its Kainantu mine in Papua New Guinea. K92 says that since the mine closure on June 28, which resulted from two fatalities on the underground incline, there has been limited impact on surface activities with surface stockpiles being treated through the processing plant. The company reported second-quarter production results of 30.8K gold ounces, above consensus of 26.1K ounces.

- Calibre Mining Corp said that its gold production rose 15% year-over-year to a record 68,776 ounces in the second quarter, marking the miner's third consecutive record quarter. The company said that its year-to-date gold production rose 20% to a record 134,526 ounces.

Weaknesses

- The worst performing precious metal for the week was gold, but still up 1.39%. Data released by Rapaport shows that polished diamond prices further declined by 1-3% for 0.3ct to 3 carat stones in June. Polished inventory on RapNet remained high at 1.75 million carats on July 1, reflecting weak demand, as per Rapaport. Rough diamond producers including Petra Diamonds and Trans-Atlantic Gem Sales have already cancelled their June tenders while De Beers has its combining Cycle 5 and 6 auctions.

- Triple Flag Precious Metals reported second quarter GEO sales of 26.6K ounces and revenue of $52.6 million, versus consensus of 27.7K ounces and $55.1 million, respectively. The weaker performance versus consensus was on the silver side, where GEO sales were 8.2K ounces versus consensus of 11.4K ounces (28% weaker). This was offset mostly by stronger gold performance.

- Barrick Gold’s sales volumes were below consensus. Compared to Visible Alpha, second quarter gold sales volume of 1,001k ounces was 5% below the Street's 1,051k ounces on implied cash costs of $966 per ounce versus the Street's $921 per ounce. Barrick noted higher production at Carlin was offset by Cortez sequencing, Turquoise Ridge maintenance, and work related to Pueblo Viejo commissioning.

Opportunities

- A declining dollar is a positive trend for the gold outlook. The greenback is weakening as U.S. interest rates near a peak and the Federal Reserve’s aggressive tightening begins to take a toll on the world’s largest economy, investors say. That will set the stage for the likes of the yen, kiwi, and emerging-market currencies such as the Brazilian real and Colombian peso to strengthen, according to Alliance Bernstein and UBS Asset Management.

- Polyus PJSC plans to spend as much as 579 billion rubles ($6.32 billion) on buying back shares as Russia’s biggest gold miner prepares to delist from the London Stock Exchange. The board approved the repurchase starting Monday of as many as 40.8 million shares at 14,200 rubles a piece, the company said in a statement.

- According to CSFB, with headlines of Barrick’s interest in First Quantum and Endeavour Mining’s interest in Kinross’ Tasiast mine, along with Newmont’s definitive agreement to acquire Newcrest (deal closes in Q4-23), M&A remains in focus. The group continues to expect more M&A activity among the intermediate gold producers, to achieve scale, relevance, and stronger balance sheets to fund growth.

Threats

- The government of Mali is proposing to revamp its mining laws with a view to take an increased stake in the industry. Mining companies have always seeded a 10% stake to government, but now they would have the option to acquire another 20% versus the previous 10% cap. In addition, there is also a provision for another 5% for local investors. Mining licenses would be reduced to 10 years from 30 years. Mucahid Durmaz, West African analysts at Verisk Mapelcroft, noted such a change could normalize stricter state control and normalize interventionist polices, such as renegotiating mining contracts, impose export restrictions and introduce additional taxes.

- The Band of America commodities team now sees the silver price declining to a first quarter 2024 estimate average of $21.50 per ounce (versus spot at $23.09 per ounce), before rebounding. The prior forecast had silver rising to a peak price of $27.50 per ounce in the fourth quarter of 2023 before declining thereafter. Silver is forecast to remain well off the all-time closing high of $49.45 per ounce, set in January 1980. The dynamic for silver is seen differently than that for gold. The team expects silver will likely be supported by demand from solar panel and EV producers, but prices are unlikely to make meaningful headway until demand from traditional industrial sectors accelerates as the global economy bottoms out in 2024.