Strengths

- The best performing precious metal for the week was gold, but still off 0.52%. Gold remained range bound as traders weighed concerns over the world’s economic recovery, which is supporting demand for haven assets, against prospects of tighter monetary policy. The collapse in the global sovereign-debt yield curve is accelerating, sending a foreboding signal to central banks that a withdrawal of stimulus risks triggering a slowdown in economic growth.

- Funds raised by junior and intermediate companies totaled $5.5 billion in 2020, the most since 2012 and a clear sign of heightened investor confidence in the yellow metal. This has allowed the junior sector, which had been on a general downtrend in terms of exploration since 2012, to fund its exploration plans. Additionally, the late field start for many companies in 2020 due to pandemic-related lockdowns caused some planned spending to run over into 2021. There are more than 200 additional companies exploring for gold in 2021 than in 2020. At 1,328 companies, that’s the most since 2012.

- Gold exploration budgets have increased 43% year-over-year to a total of $6.2 billion in 2021, outpacing the 35% increase in the global nonferrous exploration budget. Gold's surge has been driven by multiple factors, including a strong price performance, higher junior company financings and exploration plans carried over from 2020. Although the gold price has since retreated somewhat, it has averaged $1,800 an ounce in 2021, holding the interest of explorers and producers alike in exploration for the precious metal.

Weaknesses

- The worst performing precious metal for the week was platinum, down 2.09% despite bullish positioning in the futures market rising to a 19-week high. Newmont reported disappointing earnings. Revenues of $2.90 billion were 8% below consensus. Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) of $1.32 billion was 18% below consensus. Adjusted earnings per share (EPS) of $0.60 per share was also below consensus of $0.74. Attributable gold production was 1.45 million ounces, below consensus of 1.61 million ounces, mainly on lower throughput at Boddington, Nevada Gold Mines and Tanami.

- Reuters reported that a Iamgold convoy was attacked in Burkina Faso and that several people could be missing, pushing the share price off more than 5% for the day. The assailants lit the buses on fire before leaving.

- Mine safety, as measured by fatalities, has deteriorated in South Africa according to the Minerals Council lobbying group. Since the start of the year, the number of deaths has risen to 55 versus 43 in the same period last year. This means that safety trends are set to deteriorate for a second year after 60 workers died in accidents last year. The lowest year on record for fatalities was 2019, with just 51.

Opportunities

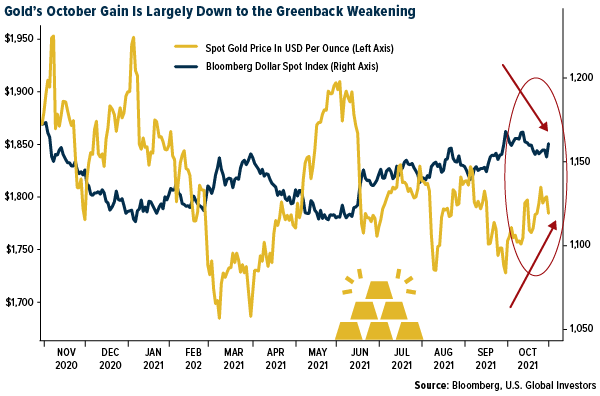

- Gold broke a two-month losing streak in October thanks in part to the dollar weakening, which largely offset monetary tightening sooner than thought theme. Gold may hit a fresh record high in the next 12 months as investors seek haven from a buildup of inflationary pressures. That’s the view of Agnico-Eagle Mines CEO Sean Boyd, who expects bullion to surpass the current record of $2,075.47 an ounce reached in August last year. “Inflation is not transitory,” Boyd said in a phone interview, noting that costs pressures are “more sticky” than three months ago. “We’ll see higher inflation as we move down the road, which is generally a very favorable environment for gold.”

- Transactions are picking up. Calibre Mining and Fiore Gold announced that they have entered into a definitive arrangement agreement whereby Calibre will acquire all the issued and outstanding common shares of Fiore. West African Resources has struck a deal to acquire the Volta asset from B2Gold in a stagged cash and stock transaction.

- K92 Mining announced that the strike extension for the J1 Vein at 3.9 meter thick was extended in total for another 211 meters in strike with an average grade of 21.69 grams per tonne. At the Northern extension over 97 meters were added and on the Southern extension over 114 meters extended in strike. The development drives continue to encounter solid geotechnical competency with the development work. Long hole drilling has commenced at the Judd Vein System with the first production stope targeted for production in the fourth quarter. The Judd Vein represent an entirely new ore source for the mill, increasing flexibility in the mine plan.

Threats

- At least one person was killed during protests against the evictions near Barrick Gold’s Kibali gold mine in northeast Democratic Republic of Congo last week, the local governor’s office said on Monday. Two villages near the mine, where residents had previously been resettled from, have been occupied by local people in recent months, “in violation of the rights of the company Kibali goldmines,” the Haut Uele governor’s office said in a statement. “Shots were fired and at least one death and several wounded have been confirmed,” the governor’s office said, referring to Friday’s confrontation between settlers and police.

- Silver’s on a slippery slope as the unwinding of pandemic-era stimulus and industrial disruptions from the global energy crisis threaten recent gains. The metal is poised for the first monthly advance since May, alongside gains in gold, on concerns that power shortages and supply-chain snarls will keep inflation persistently high. Whether or not China has a soft landing from its current energy crisis will also be crucial to silver’s price outlook as the metal is more leveraged to manufacturing activities there, according to Aakash Doshi, an analyst at Citigroup In.

- Next week’s Federal Open Markey Committee (FOMC) meeting will likely be a focus point for investors to draw lines in charts, as if were sand, to mark their trigger points. Unsurprisingly, trade directions get pushed on gold until the other side yields. Heightened gold volatility around timing of the Fed announcement consistently draws a statement as if to be settling an argument. Better to be patient and buy the dips, if they come, as the path of least resistance is likely higher given the current balance sheet of the government.