Strengths

- The best performing precious metal for the week was platinum, up 4.16%, likely related to a pairs trade with palladium. However, lockdowns in China may be playing a role, too. Nomad Royalty Company announced this week a friendly acquisition by Sandstorm Gold, reports Bloomberg, creating the largest, pure-play and highest growth mid-tier royalty company. The all-share transaction is valued at approximately C$755 million. Under the terms of the transaction, shareholders of Nomad will receive 1.21 common shares of Sandstorm for each Nomad share held.

- Demand growth for gold will be driven by steady wedding and festival purchases given Indian consumers’ strong cultural affinity toward gold, ICRA Ltd., the local unit of Moody’s Investors Service, said in a report. Demand during the second-most auspicious gold buying day in the Hindu calendar of Akshaya Tritiya on Tuesday is expected to be strong, which should lead to a 45% jump in sales in the April-June period from a year earlier. Revenues of organized retailers are likely to rise about 14%, backed by their aggressive store expansion plans and a gradual shift from the unorganized segment to the organized one.

- U.S. Mint sales of American Eagle gold coins soared 129% in April to 88,000 ounces from a year earlier, according to figures on its website. The gold market is also holding at a critical support level, writes Kitco News, even as it sees continued selling pressure and no bullish interest from disappointing employment data.

Weaknesses

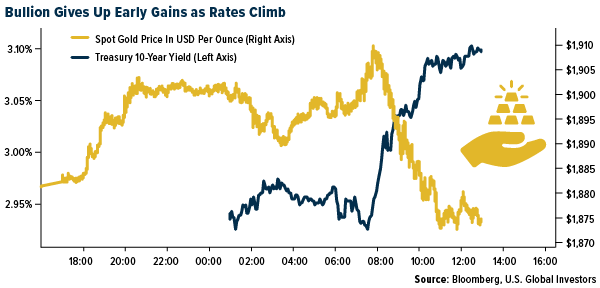

- The worst performing precious metal for the week was palladium, down 7.81%. Gold is on track for its third weekly loss with the Federal Reserve likely marking the bottom, short-term, for gold as future rate hikes are likely to remain at 50 basis points steps. Equity and commodity investments plunged the day after the rate hike, but gold found positive gains on Friday to close out the week.

- Exchange-traded funds (ETFs) cut 57,382 troy ounces of gold from their holdings in the last trading session, bringing this year's net purchases to 8.81 million ounces, according to Bloomberg. This was the fifth straight day of declines, the longest losing streak since January 12. The sales were equivalent to $108.8 million at the previous spot price. Total gold held by ETFs rose 9% this year to 106.7 million ounces.

- Elevation Gold announced fourth quarter production 25% lower than consensus on the back of lower tons stacked and lower grades. While the lower grade was attributable to a higher proportion of material being mined from the lower grade West pit, the lower stacked tons was caused by a three-week delay as operations transitioned from heap leach pad 2B to 3A.

Opportunities

- Sandstorm Gold has agreed to acquire nine royalties and one stream from BaseCore Metals LP for total consideration of $525 million, consisting of $425 million cash and $100 million Sandstorm shares. The cash consideration for the acquisition of the BaseCore portfolio will be funded from Sandstorm's newly upsized $500 million revolving credit facility to be implemented before closing.

- Concurrent with the BaseCore transaction mentioned above, Sandstorm has signed an amended and restated letter of intent with Royalty North Partners Ltd. to become "Horizon Copper", whereby Sandstorm will sell the acquired 1.66% Antamina NPI royalty to Horizon and Sandstorm will retain a long-life silver stream on the Antamina mine, along with a portion of the post-stream NPI royalty.

- Rod Antal, President and CEO of SSR Mining, commented on the company’s earnings this week, saying "The first quarter of 2022 continued SSR Mining's proud track record of operational outperformance, as we delivered gold equivalent production of 173,675 ounces at AISC of $1,093/ounce, positioning the Company well against full year guidance. In particular, we reported record quarterly production of 52,582 ounces at Seabee as we accessed a continuation of a high-grade zone outside of the Mineral Reserve that was first mined in the second quarter of 2021.”

Threats

- Western Australian gold miner Silver Lake Resources Ltd. withdrew its sales guidance for the year through June due to “severe” disruptions to its operations caused by virus-related labor shortages. The mineral-rich state’s resources industry -- which relies on flying workers in and out of remote sites -- has been hit by labor shortages during the pandemic after its pursuit of Zero-COVID meant implementing strict border measures, including enforced quarantines. After finally reopening its domestic and international borders in early March, Western Australian mining camps have become susceptible to coronavirus outbreaks, threatening some production.

- Global gold jewelry demand this year could be undermined by China’s stringent lockdowns to combat its COVID outbreaks, according to the World Gold Council. Bullion’s sharp rally earlier in the year hurt the country’s jewelry purchases, and demand all but halted as lockdowns were imposed in cities like Shanghai and Shenzhen, it said.

- As Chinese mining company MMG Ltd. turns its attention to expelling a second group of protesters occupying the giant Las Bambas copper operation in Peru, another group is trying to re-enter the site. Mine security personnel are collaborating with the police to oust members of the Huancuire community from areas near the open pit, said Alexander Anglas, a legal adviser to one of the demonstrating groups.