Strengths

- The best performing precious metal for the week was palladium, up 2.90 percent. Impala Platinum Holdings reported earnings for the full year surged more than 10-fold as a weaker rand and higher metal prices offset mining disruptions from the virus. Basic earnings are estimated at 15.81 billion to 16.1 billion rand in the year ended June 30, versus just 1.47 billion rand a year earlier.

- Swiss gold exports to India hit an 8-month high in July after falling to record lows amid the pandemic. Chirag Sheth, a consultant at Metals Focus in Mumbai, said purchases are slowly returning to normal in the world’s second-largest gold consuming country.

- Ghana is moving ahead with its initial public offering of the gold royalty fund in September to be listed in London and on the local bourse. Africa’s biggest gold producer hopes to raise $500 million through the IPO, reports Bloomberg. The fund will pay dividends from the government’s income from gold operations.

Weaknesses

- The worst performing precious metal for the week was platinum, down 2.34 percent. Gold had a second weekly loss as the dollar rose against other currencies amid concern over mixed economic data.

- Colombia sold $475 million its gold in June, equivalent to 67 percent of its holdings, according to the central bank’s website. This means the nation missed out on gold’s record price surge just a few weeks later. Gold now accounts for about 0.4 percent of Colombia’s international reserves, compared to much higher percentages of other South American countries, reports Bloomberg.

- The Bank of Nova Scotia, also known as Scotiabank, agreed to pay $127.4 million to settle U.S. allegations that the company engaged in gold and silver futures contracts spoofing. The bank will also pay a $17 million fine on CFTC claims that it misrepresented the scope of the alleged wrongdoing. It was reported that three Scotiabank compliance officers knew of the unlawful trading by one of its traders but failed to prevent further unlawful conduct.

Opportunities

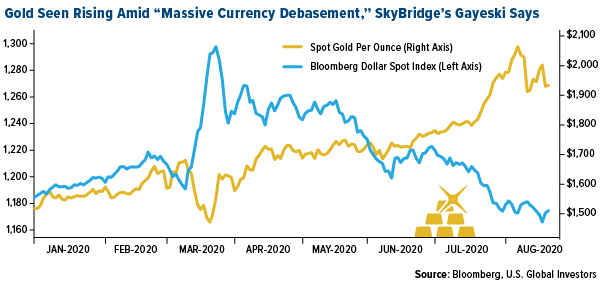

- SkyBridge Capital, which recently added exposure to gold after exiting in 2011, says that gold will continue its record-setting rally due to massive currency debasement as the world prints money like crazy. Chief investment officer Troy Gayseki said “gold is obviously a natural alternative currency” as the dollar weakens against other paper currencies. Bloomberg notes that Gayseki went on to say that it wouldn’t surprise him to see bullion around the $2,100 to $2,200 an ounce range by the end of 2021.

- News broke late last week that Warren Buffett’s Berkshire Hathaway bought $565 million worth of Barrick Gold in the second quarter. This reversal by Buffett, who has many times complained that gold does not pay a dividend or have any real use, could attract more generalist investors to the space. Buffett is one of the most respected and well-known investors, and hopefully other investors follow suit by adding to their gold exposure through miners, funds or the physical metal itself.

- Northern Star Resources boosted its fiscal year 2021 production estimate after reporting a 67 percent increase in resources to 31.8 million ounces and a reserve jump of 102 percent to 10.8 million ounces. Newmont and Kirkland Lake Gold signed a strategic alliance agreement to jointly assess regional exploration opportunities around both of their projects in Ontario. Evrim Resources and Renaissance Gold completed their merger-of-equals and changed its name to Orogen Royalties. According to a statement, Orogen’s mission is to create and acquire precious metal royalties.

Threats

- The Pebble Mine in Alaska, what would be the largest in North America, may have its federal approval put on hold after a small group of Republicans, including President Trump’s son, moved to block the project. The proposed mine was about to win a key permit despite concerns from environmentalists that it would damage Alaska’s salmon fishery. The Trump administration is now reportedly rethinking the permit, reports the Washington Post. This is a surprising turnaround since President Trump is largely anti-regulation. But not too surprising once you find out that Donald Trump Jr. often fishes in what could be a potentially impacted area from the mine’s operations.

- Initial jobless claims rose by 135,000 to more than 1.1 million in the week ended August 15, according to Labor Department data. This unexpected increase comes just one week after claims fell below 1 million for the first time since April and underscores hopes of a swift recovery.

- Corporate America is more indebted today than ever before. More than $1.6 trillion of “fresh cash” was injected to help scores of companies stay afloat during lockdown, but now many companies will have to divert even more cash to repay those obligations. Bloomberg Intelligence analysis found that the average junk-rated company had debt levels relative to earnings that were so high in the middle of this year that they almost would have tripped “do-not-touch” alerts from baking regulators a few years ago. This overburdened corporate sector could slow the whole economic recovery down.