Gold and silver prices have risen sharply over the last month in response to the banking problems, a lower dollar and the expectation that central bank policy will ease in coming months. And the latest from the IMF suggests that there is more to come. If the IMF (International Monetary Fund) forecasts are right, gold and silver prices will soar higher in the next several quarters.

The IMF released two of their flagship reports on Tuesday April 11 – the Global Financial Stability Report and the World Economic Outlook update.

The opening chapters of the Global Financial Stability Report focus on the “fault lines” that have been exposed by the rapid monetary policy tightening by central banks. The bottom line of the report is that the rapid increase in rates has exposed the financial vulnerabilities significantly over the past several months.

Major Financial Stress Ahead

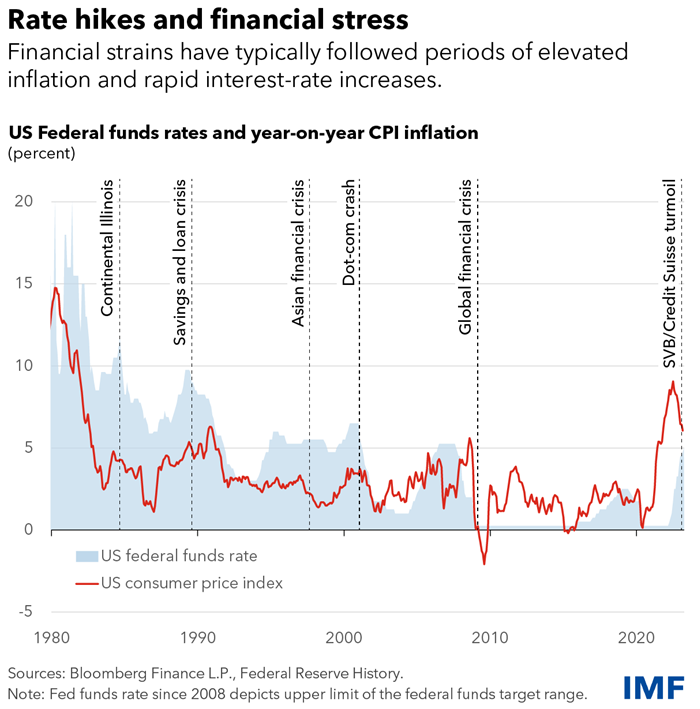

The report points out that financial crises often are preceded by monetary tightening. The chart below from the IMF website maps the US fed funds rate with major financial stress periods highlighted.

The report does try to say that the current financial problems are different than the previous periods of financial stress:

Financial crises have often been preceded by monetary tightening, but the latest stress episode differs in important respects from the 2008 global financial crisis, the 1997 Asian financial crisis, and the 1980s US savings and loan crisis. While the current stress is squarely in the banking system, the 2008 crisis quickly spread from banks to nonbanks and off-balance sheet entities of banks. Furthermore, the 2008 crisis was triggered by credit losses due to housing market declines, while the current turmoil in part stems from unrealized losses in portfolios of safe, but falling-in-value, securities. Finally, bank capital and liquidity rules and crisis management frameworks were strengthened significantly after the global financial crisis, helping stem a broader loss of confidence and underpinning a swifter and better coordinated policy response. The current turmoil also differs from the Asian financial crisis, when current account deficits and heavy external borrowing exposed corporates and banks to exchange rate and funding risks. And it differs from the 1980s savings and loans crisis, which occurred outside of larger banks, in entities with significantly less capital and liquidity.

DON’T MISS

This has been an exciting week for both gold and silver. We welcomed chart guru Patrick Karim back to the show, to take us through his expectations for the new quarter and he was even kind enough to give us some tops tips for any newbies to technical analysis.

However, the report goes on to ask questions about recent events in the banking sector as harbinger of more systemic stress that will test the resilience of the global financial system—a canary in the coal mine—or simply the isolated manifestation of challenges from tighter monetary and financial conditions after more than a decade of ample liquidity.

And the answer to this question is that there are indeed other vulnerabilities lurking in the financial system:

Stresses triggered by the tighter stance of monetary policy may result in further bouts of financial instability. Activities in riskier segments of capital markets such as leveraged loans and private credit markets have slowed. Concerns have also been growing about conditions in commercial real estate markets, which are heavily dependent on smaller banks. While banking stocks in advanced economies have undergone significant repricing, broad equity indices remain very stretched in many countries, having appreciated markedly since the beginning of the year. A more extensive loss of investor confidence or a spreading of the banking sector strains into nonbanks could result in a broader sell-off in global equities. Some mutual funds have experienced outflows in recent weeks. Liquidity backstops and resolution mechanisms are less well developed for nonbanks …

… In addition to banking sector turmoil and fragile investor confidence, macro-financial volatility could also be exacerbated by geopolitical fragmentation …

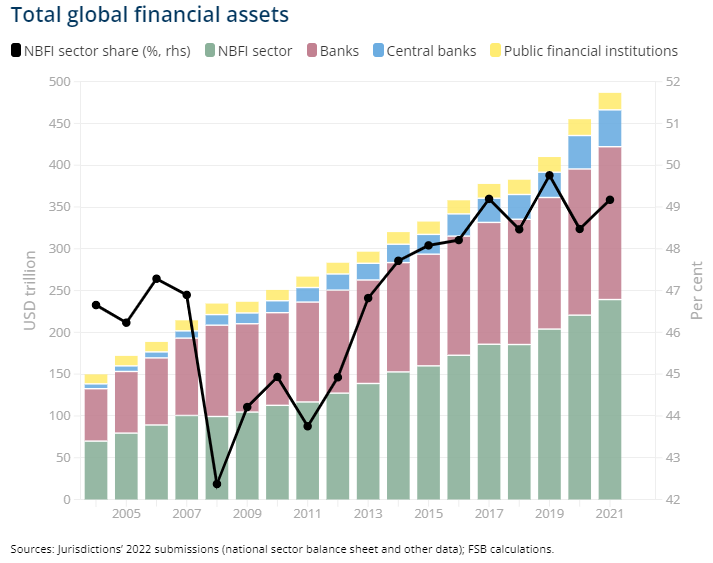

… The impact of tighter monetary and financial conditions could be amplified because of financial leverage, mismatches in asset and liability liquidity, and high levels of interconnectedness within the NBFI (non-bank financial institutions) sector and with traditional banking institutions. For example, in an effort to increase returns, life insurance companies have doubled their illiquid investments over the last decade and also make increasing use of leverage to fund illiquid assets.

Will Central Bank Support Ever Come to an End?

This ties into the question we asked in our March 30 post The Fed is now in a tug-of-war between fighting inflation and saving the banking system but where does the support from central banks end? Only with the banks? What about the pension funds and life insurance companies which are facing the same problems as the banks with declining values of longer-term government debt, which was deemed to be safe.

The NBFI sector is significant, in fact the Financial Stability Board estimates that the NBFI sector accounted for US$239.3 trillion (49.2%) of the $486.6 trillion in total global financial assets in 2021.

The Global Stability report also points out that this is all happening at lightning speed over social media:

The recent banking turmoil also demonstrated the growing influence of mobile apps and social media in spreading sudden financial asset allocations. Word of deposit withdrawals spread globally at lightning speed, potentially signaling that future banking stress may spread faster and be less predictable.

In addition, the report points out there are also vulnerabilities in the household sector:

Looking beyond financial institutions, households accumulated significant savings during the pandemic thanks in part to the fiscal support and monetary easing rolled out during the pandemic. However, they are facing heavier debt-servicing burdens, eroding their savings and leaving them more vulnerable to default. The steep increase of residential mortgage rates has cooled global housing demand. Average house prices fell in 60 percent of the emerging markets in the second half of 2022, while in advanced economies price increases have slowed.

Geopolitical Tensions Put Pressure on Financial Risks

The final point from the Global Stability report we want to highlight is that the geopolitical tensions are also adding to the financial risks:

Rising geopolitical tensions among major economies could raise financial stability risks by increasing global economic and financial fragmentation and adversely affect the cross-border allocation of capital. This could cause capital flows to suddenly reverse and could threaten macro-financial stability by increasing banks’ funding costs. These effects are likely to be more pronounced for emerging markets and for banks with lower capitalization ratios.

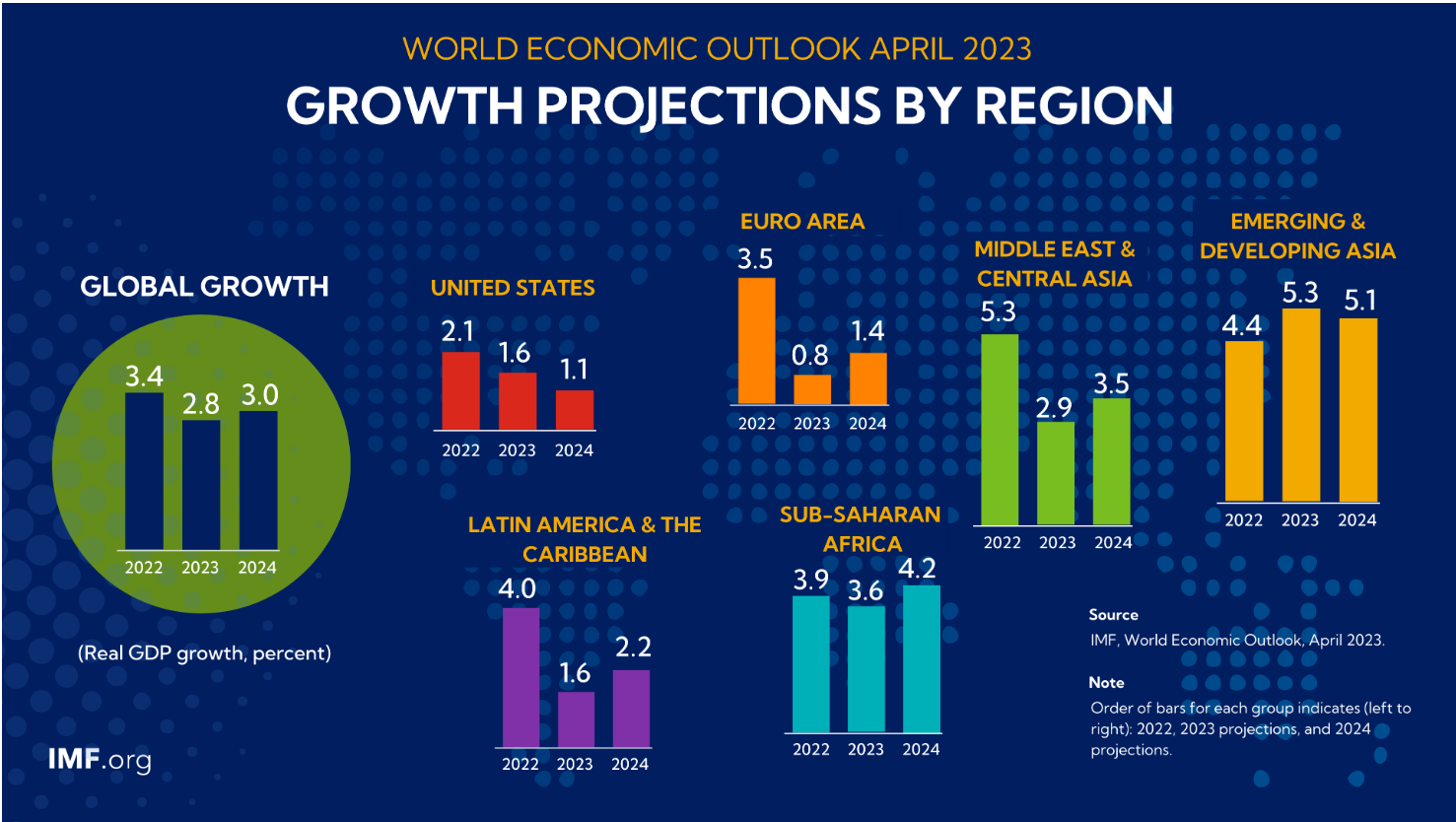

The result of higher interest rates, tightening credit from the banking sector problems, the war in Ukraine and geo-economic fragmentation is slower growth according to the World Economic Outlook report.

Global economic activity is experiencing a broad-based and sharper-than-expected slowdown, with inflation higher than seen in several decades. The cost-of-living crisis, tightening financial conditions in most regions, Russia’s invasion of Ukraine, and the lingering COVID-19 pandemic all weigh heavily on the outlook. Global growth is forecast to slow from 6.0 percent in 2021 to 3.2 percent in 2022 and 2.7 percent in 2023. This is the weakest growth profile since 2001 except for the global financial crisis and the acute phase of the COVID-19 pandemic.

Being prepared for turbulent times ahead is key. With geopolitical and financial risks brewing, global growth slowing, US dollar weakening and real interest rates declining, it’s a good idea to build up some portfolio protection in the form of physical gold and silver bullion.

From The Trading Desk

Gold price has moved up again this morning to settle just below $2030. Lower inflation numbers out of the US yesterday and a weaker USD has supported the price move above the important and now near term support level at $2,000. Gold is within 3% of its all time highs. Silver too has joined in, comfortably over its near term new support level at $25.

Fed minutes released yesterday, show the fallout from the recent banking crisis in the US will likely tilt the economy into a recession later this year. However, Vice chair for Supervision Michael Barr went on today the banking sector ‘is sound and resilient’ ! We will more than likely get one final rate hike of 25bp in May but the market is pricing in lower rates for later in the year.

Strategist at Blackrock put a note out yesterday that they expect the Fed will stop its rate-hike cycle without getting inflation to its 2% target. They went on to say ‘We think the politics of inflation narrative is on the cusp of changing, that means Americans will have to live with high prices for years to come’. All bullish for Gold and Silver!

Stock Update

Silver Britannia’s

– We have a limited number of Silver Britannia’s from the from the Royal Mint, with the lowest premium in the market at Spot plus 40% for EU storage/delivery and for UK storage/delivery. Please call our trading desk. Stock is limited at this reduced premium.

Gold Kangaroo’s are available for EU clients, starting at 4.5% over Spot and Gold 1oz Bars start at 4.2% over Spot.

GoldCore have excellent stock and availability on all Gold Coins and bars. Please contact our trading desk with any questions you may have.

GOLD PRICES ( AM/ PM LBMA FIX– USD, GBP & EUR )

|

USD $ |

USD $ |

GBP £ |

GBP £ |

EUR € |

EUR € |

|

|

12-04-2023 |

2008.90 |

2008.20 |

1618.37 |

1610.17 |

1839.15 |

1827.86 |

|

11-04-2023 |

2001.50 |

2002.70 |

1608.41 |

1610.97 |

1833.17 |

1833.47 |

|

06-04-2023 |

2017.25 |

2001.90 |

1619.04 |

1611.73 |

1851.23 |

1837.54 |

|

05-04-2023 |

2022.30 |

2030.85 |

1622.29 |

1625.90 |

1847.78 |

1853.15 |

|

04-04-2023 |

1982.25 |

2009.60 |

1585.60 |

1607.28 |

1814.16 |

1837.18 |

|

03-04-2023 |

1963.10 |

1983.30 |

1591.09 |

1598.94 |

1810.17 |

1820.47 |

|

31-03-2023 |

1978.80 |

1979.70 |

1599.46 |

1598.21 |

1618.93 |

1818.16 |

|

30-03-2023 |

1968.10 |

1965.80 |

1593.96 |

1588.17 |

1811.64 |

1800.08 |

|

29-03-2023 |

1965.85 |

1965.00 |

1593.91 |

1593.22 |

1812.91 |

1811.34 |

|

28-03-2023 |

1949.85 |

1962.85 |

1587.37 |

1595.21 |

1803.03 |

1813.87 |

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here