At a glance:

- Many people, businesses and governments are mired in a debt trap.

- Excessive fiat currency creation will destroy the dollar.

- Consumer price inflation and/or hyper-inflation are coming.

Breaking News:

- Gold fell $6 to $1,883 for the week ending December 25, 2020.

- Silver fell $0.13 to $25.82 for the week.

- The DOW closed at another all-time high on December 17, 2020.

- Federal Reserve “fake money,” created from nothing, boosted stocks to all-time highs in December. Their $7 trillion and counting will soon become $10 trillion, and then…

- Billionaires added more billions to their net worth in 2020, while many people lost jobs and wait in line at food banks.

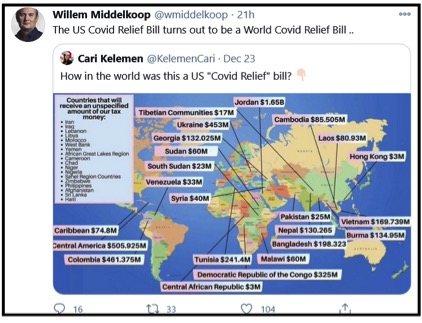

- Congress passed, without reading, a “Corona Virus Relief” bill that was 5,593 pages long. What did lobbyists include in the bill besides virus relief?

- $1,650 million for Jordan

- $453 million for Ukraine

- $169 million for Vietnam

- And so much more…

WHAT WILL HELP US LIVE LONG AND PROSPER?

- Minimize emotional and financial stress.

- Stay real – money, food, and thinking!

WE NEED DETAILS… What will create prosperity?

a) Be born into a wealthy family. This is beneficial but not retroactively available.

b) Chair an important committee in congress for several decades. The salary is good, and the “benefits” are great. Fantastic wealth is available to those who pay the price. The non-tangible cost can be high.

c) Invest in a big winner at the right time—like Apple stock, Microsoft stock, Tesla stock. Caveat: You must exit at the ideal time. This is possible, but few people are sufficiently skilled and lucky to take advantage of it.

d) Realize the “game” is fixed and “hard-wired” against almost everyone outside the elite. The rich get richer because they “write the rules” and work those rules in their favor.

e) Stick with real money—gold and silver—and be wary of wasting assets—like digital and paper dollars that are unbacked debts of the Federal Reserve.

f) Daily living in our present world demands we use those “fake money” dollars for transactions. But their purchasing power will decline every year until they fall into the dustbin of financial history—like hundreds of other failed currencies. Save with real money.

WHAT ELSE IS NECESSARY?

- Avoid debt traps and debt slavery, as discussed below.

- Avoid interest rate traps, as discussed below.

- Avoid counter-party risk. Trillions in loans and dollar denominated investments have counter-party risk. This is important.

- Protect your prosperity with real money – gold and silver.

- Minimize stresses from financial obligations, debt slavery, and the knowledge that your “fake money” is devaluing every year.

DEBT TRAPS—PRIVATE AND PUBLIC:

- TOO MUCH DEBT: Credit card debt. Student loan debt. Mortgage loan debt. Going into debt has been the American way since President Nixon closed the gold window and allowed the Fed to issue debt-based notes as currency.

- DEBT REQUIRES INTEREST: Those debts are someone’s assets. They expect to collect interest on their loans.

- DEBT PLUS INTEREST MUST BE REPAID: Current cash flow is needed to repay debt plus interest. What happens when the Powers-That-Be (PTB) lockdown the economy, kill millions of jobs, ruin small businesses, and destroy cash flow? Oops!

- THE DEBT TRAP: If you can’t pay the debt, interest and penalties are added, making the mountain of debt even worse. We can live our lives in debt slavery consumed by servicing debts.

EXAMPLES:

Official national debt exceeds $27 trillion. We pretend it will be repaid, but it grows every year. It can’t be paid with current dollars. Therefore, it will be defaulted, (Sorry, just kidding about paying it back…) or it will be hyper-inflated away. (Sir, your tall coffee is on special today for only $112. Filling your truck’s gas tank costs $2,000. A share of Apple stock sells for $1,500. Gold costs $18,000 per ounce.) Hyper-inflation is destructive, and it could happen again in the U.S.

Student loans are not discharged in bankruptcy.

Many public pension plans pay out enormous benefits, more than they can afford. Plans are under-funded, some must borrow to make payments, and thereby become more under-funded. Debt trap! Promised pension benefits could disappear like morning mist.

Student Loan Example: Borrowed $79,000. Paid $190,000. Now owe $236,000. Oops!

Mortgage Example: Borrow $300,000 to buy a house at 4% over 30 years. Total payments will be $515,000. It has been much more expensive.

Credit Card Example: Owe $10,000 and make minimum payments at 22.99% interest (Bank of America). Total payout is over $25,000 and it takes in excess of 20 years.

AVOID OR MINIMIZE CONSEQUENCES FROM THE DEBT TRAP!

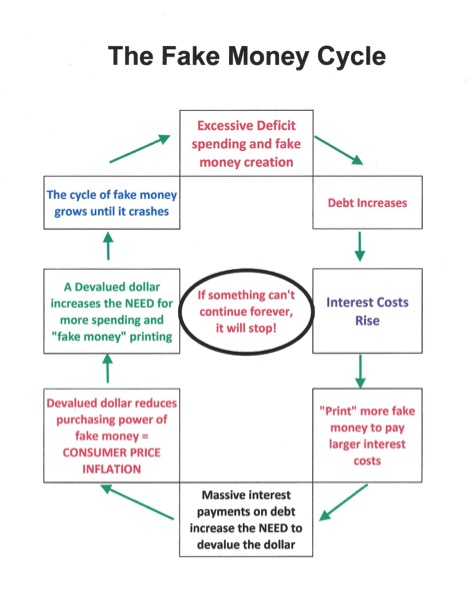

The Fake Money Cycle makes it difficult for everyone but the financial elite to live long and prosper. The cycle is a trap that leads to financial disaster. Expect inflation or hyper-inflation and a monetary reset.

The Fed might be forced to back “new-dollars” with gold—but only to convince Americans that “new-dollars” have value and are not worthless paper.

CONSIDER THE FOLLOWING:

- A dollar was worth 1/40th ounce of gold in 1971. Today it is worth 1/1,900th ounce of gold. By 2025 a dollar might be worth 1/10,000th ounce of gold, or less.

- An investment in Tesla stock would have been profitable, if you bought and sold at the best times. However, an investment in Enron stock turned into a disaster.

- Gold was valuable two thousand years before the PTB pumped Enron stock higher. Gold will be valuable thousands of years after Tesla stock has been removed from the S&P 500 Index.

- Silver sells for about half its all-time high price. Stocks are expensive. Expect higher silver prices and lower stock prices over the next several years. Expect higher gold prices as the debt trap and fiat money cycle weaken the U.S. economy and force more QE.

- Printing currency units, QE4ever, MMT, bond monetization, and stock speculations don’t create wealth or prosperity. They transfer wealth from the middle class to the upper 0.1%. Read “Our Phantom Middle Class.” Expect more created currency units, wealth transfers, and occasional “payoffs” to the rest of us. Think $600 for each adult while $billions are fed to military contractors and foreign countries.

Non-mainstream wisdom from Alasdair Macleod: “The Psychology of Money.”

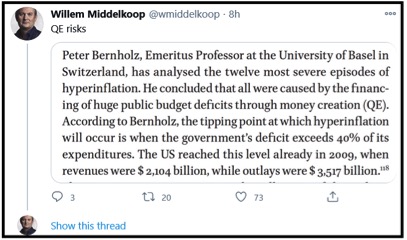

“The world stands on the threshold of monetary hyperinflation with the US dollar leading the way.”

“… hyperinflation of the quantity of money will destroy the mainstream’s dreams.”

“Now that fully two-thirds of US Government spending in the second half of fiscal 2020 was funded by monetary inflation (the other third being from revenues which fell sharply) we can say that without a miraculous change in circumstances and financing policies, the dollar is on a hyperinflationary course.”

“The government is ensnared in a debt trap…”

Gold and silver will rise as dollars are devalued. They will spike higher when people panic out of fiat currencies into something real. See below.

LIVE LONG AND PROSPER:

- Avoid debt, the debt trap, and debt slavery.

- Don’t get caught in the fake money cycle. Measure your savings in real money—ounces of gold and silver.

- Trust your public pension funds and the solvency of Social Security only as much as you trust your state and national politicians.

- We may receive most of the benefits that our politicians have promised, but how valuable will those benefits be if a monthly social security check buys two loaves of bread?

- Tesla stock may rise from its recent bubblicious high of $695 to $60,000, but what if $60,000 only buys rice and beans for half a year?

The official national debt has doubled every eight to nine years over a century. Given current circumstances (unemployment, recession/depression, “stimulus,” payoffs to everyone, 5,593-page relief bill, MMT, etc.) national debt could double more rapidly. Suppose:

1/1/2021 $27.5 trillion

1/1/2029 $55 trillion

1/1/2037 $100 trillion.

When will a reset occur? What will a cup of coffee cost when the reset occurs? Don’t know…

Reminder: Argentina lopped off 13 zeroes from their peso in 80 years—a devaluation of 10 trillion to one against the U.S. dollar.

CONCLUSIONS:

- The debt trap is in play and destructive for most Americans.

- The fiat currency trap will eventually destroy the U.S. dollar.

- Hyperinflation has occurred many times. It may be unavoidable in the western world.

- China and Russia could back their currencies with accumulated gold bullion. The US may have retained a few bars of gold in Fort Knox. Hmmmmm. Back with gold or debt? Hmmmm.

- Trust gold and silver more than promises from politicians or pension plans in our current fiscal and monetary environment. COVID-19, lockdowns, and political craziness make the environment unstable and dangerous.

- Gold and silver may not be the best investment possible, but they will preserve purchasing power and protect savings. THINK INSURANCE!

Call Miles Franklin at 1-800-822-8080 and recycle unbacked debt-based dollars from over-valued stocks into undervalued real money—gold and silver.

Gary Christenson