The Fed apologists like to cling to falling lumber prices as proof that the current spate of price inflation is, in fact, "transitory". OK, fine. Lumber prices are back down due to a rush of supply. But what about all the other industrial inputs? What's going on there?

Let's start with lumber. As you can see below, price spiked on a supply shortage and then, once supply re-emerged, price fell. If you use this item as your only indicator of inflation, then yes, the price increase was transitory.

But unfortunately for Chairman Powell and his sycophant media, we can't just look at lumber. After all, we're not living in the 16th century anymore.

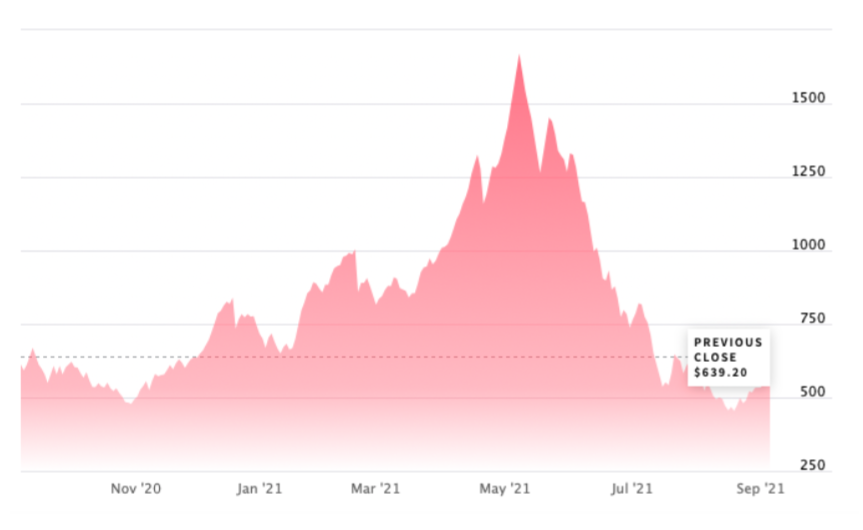

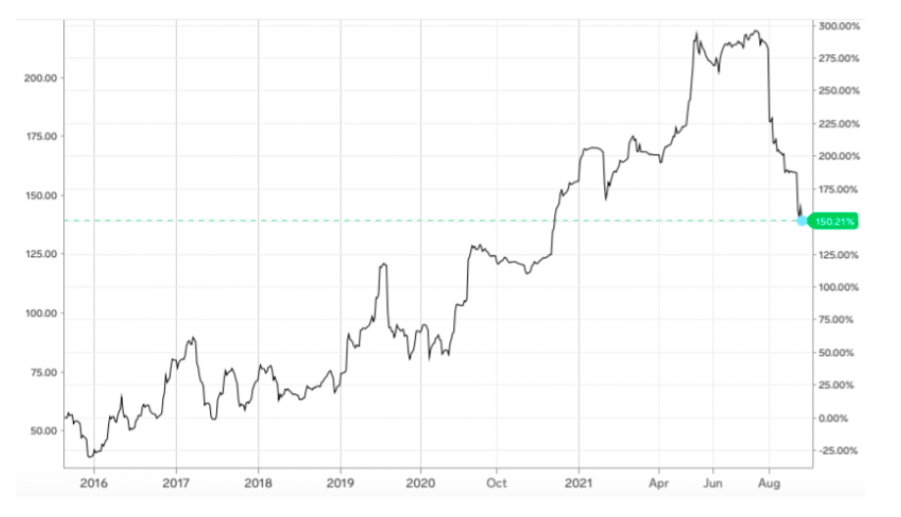

Let's start with hot-rolled steel...which is up about 3X over the past twelve months:

What about iron ore? Yes, price has fallen back recently, but it has still tripled over the past five years:

But iron and steel are heavy, and maybe you'd like to make something that's a little lighter in weight using aluminum instead. Oops. That price has nearly doubled over the past year:

If you're going to manufacture anything at all, you're going to need some energy to do it. So how's that price of crude oil these days? It's off its recent highs but still up about 80% versus last year at this time:

And don't even think about using natural gas to run your generator, create electricity, or heat your home this winter, as its price is up more than 300% versus last year:

I could go on, but I think you get the point. Based on input prices alone, inflation is NOT transitory, and you'll see this reflected again in this Friday's latest update of U.S. producer prices. Next week's CPI will show this too.

Also driving U.S. inflation higher is the jobs market. As potential employers are forced to raise wages to attract workers, these costs will be passed along to consumers AND the additional wages paid will lead to more dollars chasing fewer goods. So not only is the U.S. dealing with Cost-Push Inflation, we have a pending surge of Demand-Pull Inflation too.

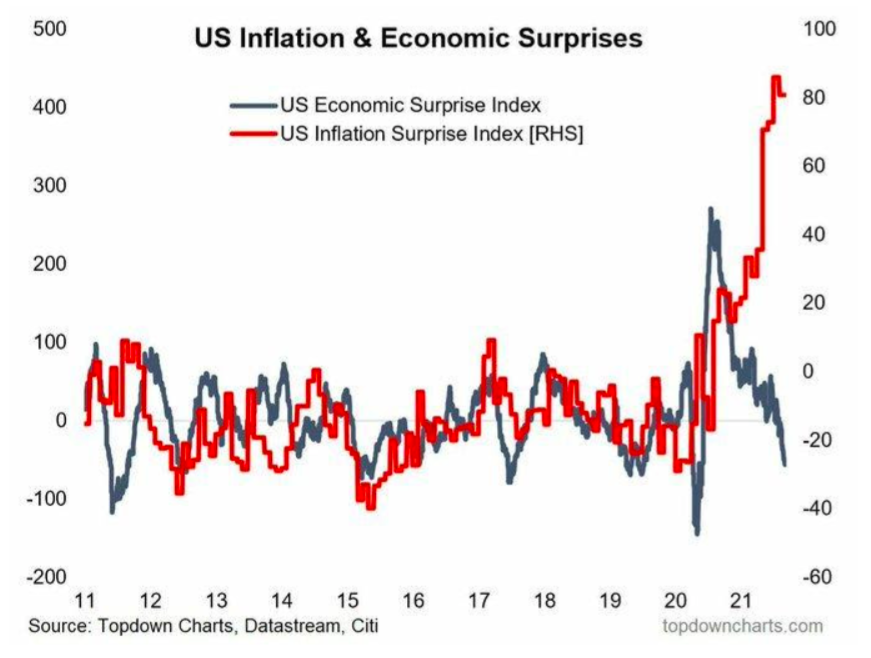

All of this is leading to something we've been forecasting since the summer of 2020—STAGFLATION. You can see this building in the chart below, where economic data is consistently "surprising" to the downside while inflation data surprises to the upside.

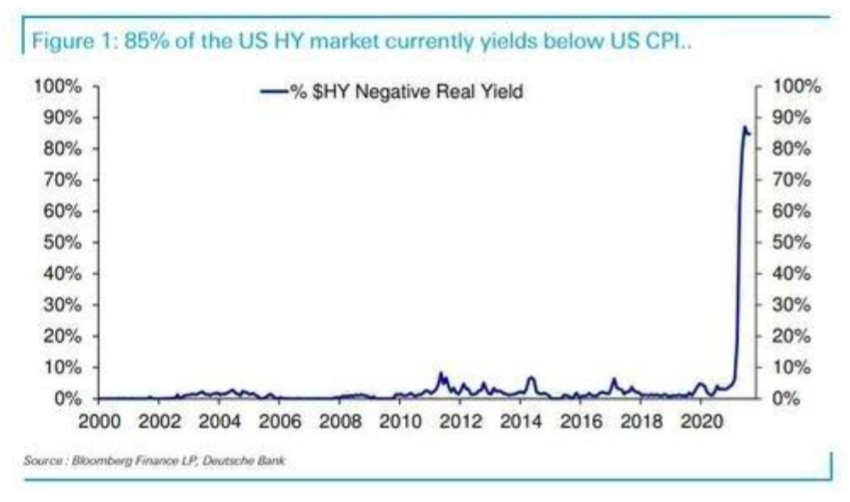

So what does all this mean for the precious metals? Quite obviously, NOTHING....at least not yet. The price of COMEX gold is currently down about $100 year-to-date. And why? Because The Fed and their apologists have successfully managed to convince "the market" that inflation is, in fact, transitory. No one—no institution, hedge fund, pension plan, insurance company or central bank—would purchase a 10-year U.S. treasury note with a yield of just 1.40% if they knew that inflation was going to remain above 5%. Locking in a negative 3.5% inflation-adjusted return for ten years would be a fireable offense for a money manager, but that's what these fools keep doing. All because the financial media keeps repeating The Fed's lies about "transitory inflation".

And it's not just U.S. treasuries. An incredible 85% of the high yield bond market now trades at a negative inflation-adjusted rate. By any historical measure, this is madness!

Again, though, COMEX gold and silver have not yet reacted to all of this, but it won't remain this way much longer. As inflation continues to grow, the denial of the obvious will falter. And just like during the summer of 2020, COMEX gold and silver will rush to "catch up" as the reality of persisting inflation and stagflation sets in.

I'll remind you again that COMEX gold was trading below $1680 on June 5, 2020. It then surged to $2080 in just eight weeks. COMEX silver traded in a $4 range for nearly six years and was still trading at $18 in mid-July of 2020. It then moved more than 50% and reached a high of just over $30 in just three weeks.

To paraphrase Hemingway: COMEX gold and silver have ignored the ongoing inflation, but their eventual upward reaction will be gradual and then all at once.

In summary, now is definitely NOT the time to give up and dump your physical precious metal and/or your mining shares. Instead, you must believe your own eyes and intellect. Inflation and stagflation are here to stay, and COMEX precious metal prices will soon reflect this reality.