- Gold is the ultimate currency. Does this mean gold mines are the ultimate businesses?

- I’ll leave that question with investors, but I will say that if bought and sold professionally, gold stocks can be incredibly rewarding.

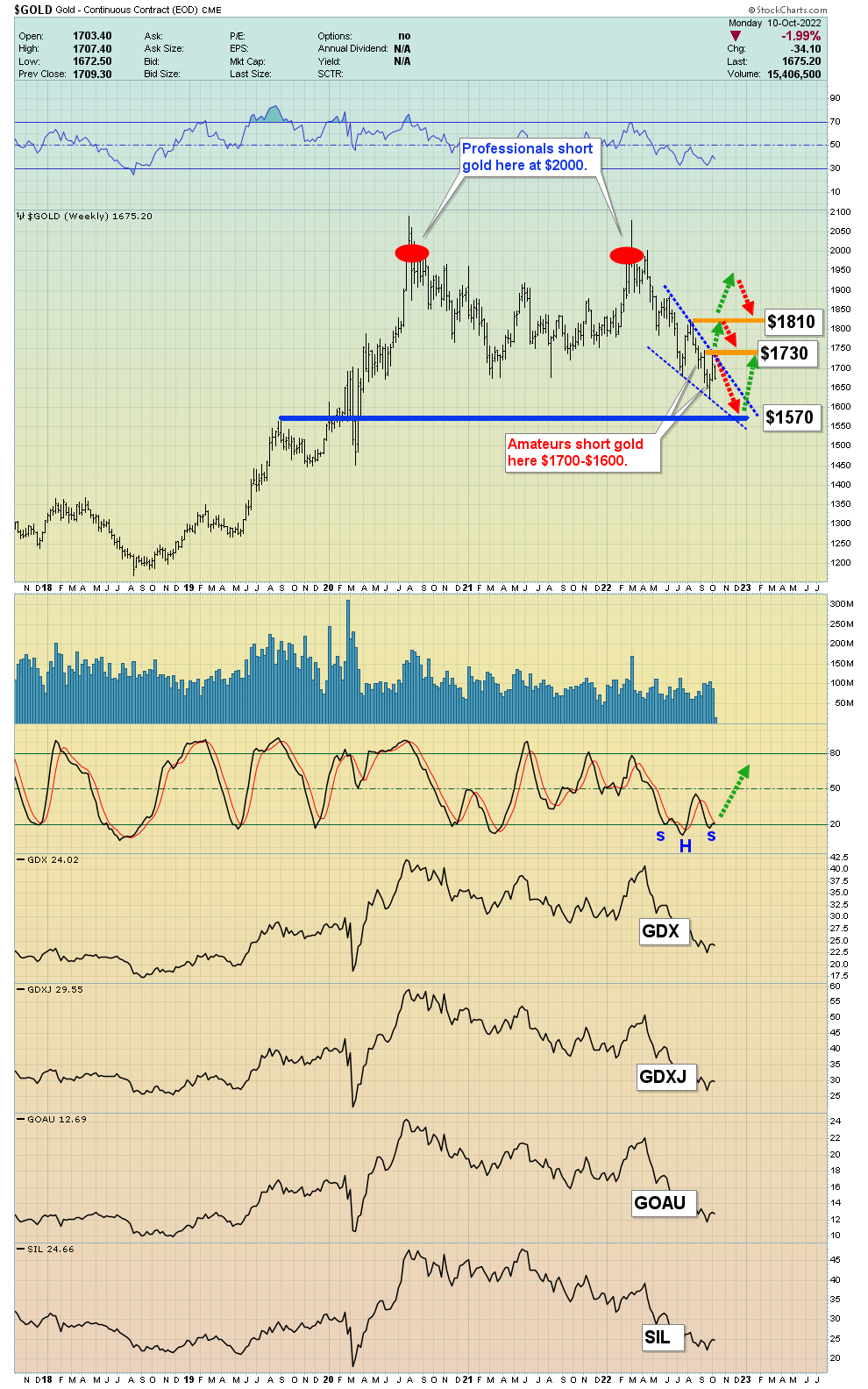

Click to enlarge this “Pros versus Joes” weekly gold chart. To make money with gold stocks, investors need to buy them on a price sale of $100/oz or more and sell them into rallies of similar magnitude.

Click to enlarge this “Pros versus Joes” weekly gold chart. To make money with gold stocks, investors need to buy them on a price sale of $100/oz or more and sell them into rallies of similar magnitude.- Please click here now. Double-click to enlarge this “gold stock tactics” daily chart. The big horizontal support and resistance (HSR) zones are where gold stock enthusiasts need to cast aside their fears and take bold action.

- The fruits of such labours are obvious, and on that note, please click here now. Double-click to enlarge this XME tactics chart. Taking bold buy and sell action with the mining stocks based on the key HSR zones for gold is crucial to a gold bug’s long-term success in the market…

- But core positions are important too, especially when it comes to bullion and fiat cash.

- Throughout modern history, many gold bugs have found themselves emotionally broken because they didn’t hold enough fiat cash to deal with the wild swings in the market.

- One of those “swings” was the 1930s gold confiscation. The bottom line: Gold bugs need to be prepared to manage every conceivable scenario, not just the ones that make the most common sense.

- The 2019-2021 virus cycle brought a lot of negative surprises for gold and stock market investors, and the 2021-2025 war cycle brings even more.

- It’s true that in the long term all fiat goes to zero against gold, but it’s also true that before that happens, investors can end up dead. It’s prudent to hold enough fiat cash to manage the risk that gold’s “big day in the sun” can take longer than expected to materialize.

- Please click here now. Double-click to enlarge this TBF bear bond ETF. Inflation cycles can create a “cat and mouse” game between the gold price and interest rates:

- Inflation first rises, and then gold rises. Next, central banks hike rates and gold fades. If it’s a major inflation cycle, inflation starts rising again and money managers begin to buy gold, silver, and the miners in a panic.

- A mix of gold/commodities/miners, bear bond plays, and fiat cash is the most prudent way to manage an inflation cycle. When there’s a war component to the cycle, as there is now, food, weapons, and medicine should also be part of a wise gold bug’s portfolio.

- A daily focus on the big picture is critical for investors as inflation, the 2021-2025 war cycle, a wildly overvalued stock market, and empire transition dominate the investing landscape. I cover this big picture 5-6 times a week in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “super special” this week that investors can use to get in on the action. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

- What about oil? Well, US president “Jackboot Joe” Biden is a former draft dodger who is now clearly obsessed with fueling the Ukraine war. He doesn’t care how many European “useless eater” citizens he freezes to death or financially ruins with his sanctions, but he does worry that high fuel and food prices in America would cause US citizens to demand he end his debt-funded war.

- Many Americans have a history of looting grocery stores over race and other issues that can be called minor compared to having no food to eat. If angry US citizens can’t afford to buy their food, it’s clear that grocery stores would be quickly cleaned out by looters… and this is why Biden is so obsessed with keeping the oil price low.

- Please click here now. Double-click to enlarge. Oil burst out of a bull wedge formation in anticipation of the OPEC supply cuts. Now there’s an expected lull.

- Is the US government draining additional oil out of the SPR (strategic petroleum reserve) as an attempt to counter the OPEC cuts? Perhaps Biden’s eagerness to do deals with Iranian and Venezuelan dictators while ensuring no fresh oil from the “evil empire” of Canada is piped to America… could this be a factor too?

- Biden’s actions are clearly deranged and there’s now a possible inverse H&S bottom pattern on the oil chart.

- A move above the psychologically important $100/BBL number ahead of the US mid-term elections would be more bad news for Biden… and good news for gold!

- Next, please click here now. Double-click to enlarge this DBA agricultural ETF. There’s an ascending triangle in play. Signs of a fresh uptick in inflation are beginning to appear in energy and agriculture while the stock markets swoon.

- Please click here now. Double-click to enlarge. During the last big move for gold (that ended in early March at about $2080), oil surged to $130/BBL and the dollar surged against the ruble. The dollar is showing new signs of a base pattern breakout… while oil does too.

- Please click here now. Double-click to enlarge yet another great chart with a base pattern, which of course is GDX! There is inverse H&S action all over this chart.

- That’s positive, and a two-day close over $28 seals the GDX base pattern breakout deal!

Thanks!

Cheers

St