Over the past several months, we've written on multiple occasions about the issues and loopholes within the global unallocated gold market. This fractional reserve system risks collapse with every run on true physical metal, and recent events demand this update.

First of all, here are two links to previous posts on this topic. Before we begin, you might check them out:

Much of the focus lately has been upon the unallocated accounts at The Perth Mint. The Mint and its defenders have tried to shift the focus away from close inspection by casting aspersions upon those who dare question their business methods. Here's ETF kingpin and Perth Mint "advisor" Kevin Rich appearing on Kitco TV to disparage "bloggers" who dared to actually inspect The Perth Mint's publicly available documents and statements:

Watch this video on www.youtube.com

According to this Kevin Rich fellow, you'd be foolish to believe anything you see on the internet because "the Perth Mint website states there's actual bullion behind the depository programs" and that "unallocated programs are fully backed with physical product". Take his word for it, I guess. And what's funny is that the statement he cites is dated March 17, 2021. It's by no means current, and it does nothing to address the growing controversy.

And here's the thing: The "bloggers" in question are not bloggers at all. Instead, they are certified auditors with an extensive background in finance. Rob Kientz is a former auditor with experience at several "Big 4" accounting firms, and Dan Vigario is a London-based Chartered Accountant with full accreditation and experience in forensically deconstructing financial statements. These guys are legitimate experts, and their analysis cannot simply be waved off as "speculation by people on the internet".

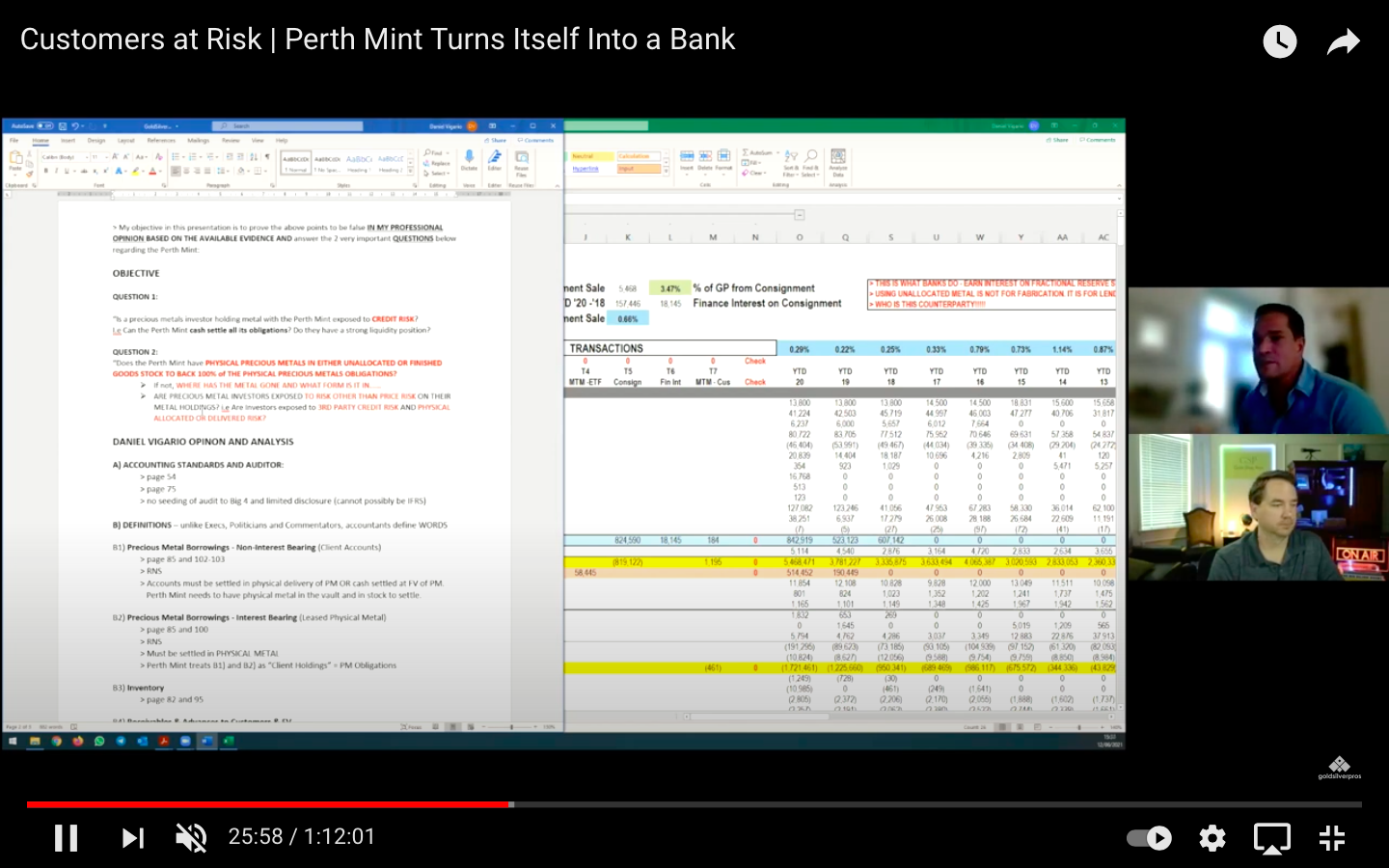

So with that in mind, I implore you to watch this latest video from Rob and Dan. It's lengthy, but it's worth your time. It's not simple, either, but the guys do a great job of explaining the complicated issues in an easy-to-understand manner.

Watch this video on www.youtube.com

It's quite obvious to me that Perth Mint is running a fractional reserve system in their unallocated accounts. Of course they are! How else can you explain the dramatically lower storage fees and insurance costs that come with an unallocated account in the first place? And that's fine. Many other companies run and manage similar unallocated schemes, and their customers appear to be just fine with it all...as long as they don't all show up one day and request immediate delivery of metal that the unallocated account provider does not currently have on hand.

The point of all this is threefold:

- Unallocated accounts are just another part of the alchemy the bullion banks and their friends in the precious metals industry have used to expand the availability of "precious metal equivalents". This system and the leverage inherent to it serves a role in creating the illusion that gold and silver are far more abundant than they actually are.

- If you are currently an investor in an unallocated account, understand that your reduced storage and insurance costs are due to the fractional reserve component of the unallocated account. As long as you hold unallocated metal, the only thing you truly own is exposure to price.

- Only true, physical allocated and segregated metal contains no counterparty risk. With everything else—from ETFs to metal certificates to these unallocated accounts—comes the counterparty risk of untimely liquidation and default.

Again, please take the time to watch the video posted above from Rob and Dan. Draw your own conclusions and then act accordingly.