NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 49th year in the gold business

MARCH 2022

“[E]veryone knows they need a safe haven, but everyone also knows the traditional ones (government bonds) no longer offer that safe haven. That turns us to gold, the one asset that has a 3,000-year record of protecting purchasing power.” – Merryn Somerset Webb, Financial Times editorial

Waiting for the Fed

“The biggest buyers in bond markets are poised to become sellers,” writes Tommy Stubbington and Kate Duguid in a recent Financial Times article, “as central banks that have bought trillions of dollars of debt since the 2008 financial crisis start trimming their vast portfolios.” If the Fed follows through with its quantitative tightening program, it will overturn a monetary policy regime in place for thirteen years. One London trader quoted in that FT article says the bond market is now trading in “cloud cuckoo land” – that investors have not in any way priced the impact of quantitative tightening. So what will be the outcome when QT-Day actually arrives? When push comes to shove, will the Fed become truly hawkish (as roughly half the financial world now believes), or will it, in reality, remain dovish (as the other half of the financial now believes)?

Either way, Bleakley Advisory Group’s Peter Boockvar sees a bullish outcome for gold and silver. “Today’s CPI was hotter than expected and February’s print could be as well but again, it’s to what extent does it slow from here that should matter for markets,” he says in a Bloomberg update posted recently at YahooFinance. “I’ll use this as another opportunity to express my bullishness on gold and silver. From here, either the Fed will tighten too much and growth slows that results in the Fed backtracking, and that will be bullish for gold or the Fed will still be too slow in tightening, real rates will remain firmly negative and that will be positive for gold.”

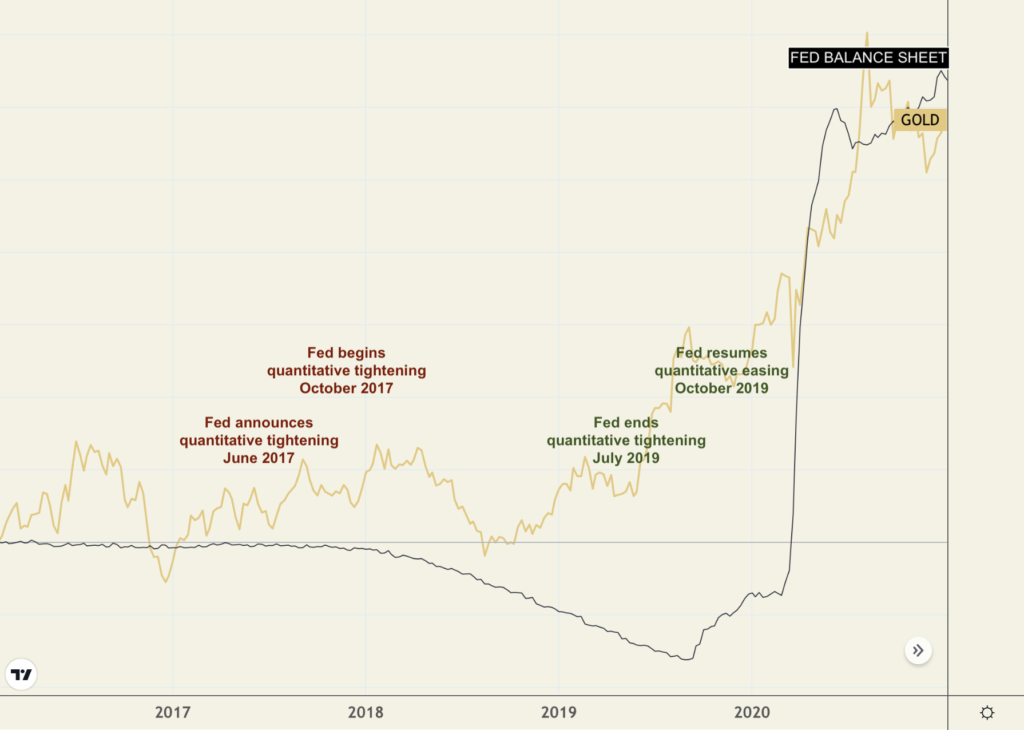

As shown in the chart below, there is some historical precedent for Boockvar’s bullish “backtracking” scenario. The Fed attempted to pare its bond holdings in late 2017. By 2019, though, it was forced to abandon the program when severe liquidity problems threatened a credit market meltdown – a situation not dissimilar to the challenges the Fed faces today. Gold held its own in the early stages of the program but sold off about 15% as it gained momentum. Then, after the Fed indicated it might change direction in on QT early 2019, it soared 25% and climbed to all-time highs ($2050 per ounce) after the Fed finally halted the liquidations altogether and resumed quantitative easing.

Gold and the Fed Balance Sheet

(2016-2021)

Chart courtesy of TradingView.com • • • Click to enlarge

Perhaps the more likely scenario, though, is Boockvar’s second alternative – a Fed that purposefully remains behind the inflation curve by raising rates and liquidating its bond holdings cautiously – very cautiously. In short, what if, in the end, the Fed talks like a hawk but walks like a dove by keeping real rates deeply in the negative? The point about Waiting for Godot, Samuel Beckett’s oft-referenced short story, is that Godot never shows up. What if the world is waiting for a Fed that never shows up? You do not need to be a Paul Volcker to appreciate the implications.

––––––––––––––––––––––––––––––––

“When the creation of money sufficiently hurts the actual and prospective returns of cash and debt assets, it drives flows out of those assets and into inflation-hedge assets like gold, commodities, inflation-indexed bonds, and other currencies (including digital). This leads to a self-reinforcing decline in the value of money. At times when the central bank faces the choice between allowing real interest rates (i.e., the rate of interest minus the rate of inflation) to rise to the detriment of the economy (and the anger of most of the public) or preventing real interest rates from rising by printing money and buying those cash and debt assets, they will choose the second path. This reinforces the bad returns of holding cash and those debt assets.” – Ray Dalio (Bridgewater Associates), Where We Are in the Big Cycle of Money, Credit, Debt, and Economic Activity and the Changing Value of Money

–––––––––––––––––––––––––––––––––

Short & Sweet

“IT’S NOT OFTEN THAT A DAY STARTS with quite such a jolt,” writes John Authers in his regular Bloomberg column. “I have many opinions about Russia’s invasion of Ukraine. The impact on markets is, personally, well down my list of concerns. But it’s my job to cover them, and this can be expected to have a big effect. Within Europe, this is the greatest negative shock to the international order since the end of the Second World War, and it will have profound consequences.” In this detailed assessment, we feel Authers hits closer to the mark than anything we’ve read so far as to how markets are reading the Ukraine invasion. He concludes by saying “it might be best to take Thursday’s extraordinary rally as an opportunity to take a few profits and allocate something to cash or gold. Some insurance during a situation that is very dangerous seems like a good idea.” In our many years reading Auther’s columns, we do not remember him ever making an outright recommendation to buy gold.

THE PUBLIC HAS A VERY HEALTHY APPETITE for silver bullion coins at current prices. “The United States Mint kicked off 2022 with American Eagle silver bullion coin sales in January that are 4.7% higher than sales for the same period in 2021,” reports Coin World’s Paul Gilkes. “Silver American Eagle sales in January to authorized purchasers worldwide reached 5,001,000 coins, compared with 4,775,000 coins in January 2021 and 3,846,000 coins in January 2020. Sales on Feb. 7, 2022, added another 480,500 American Eagle 1-ounce .999 fine silver dollars.”

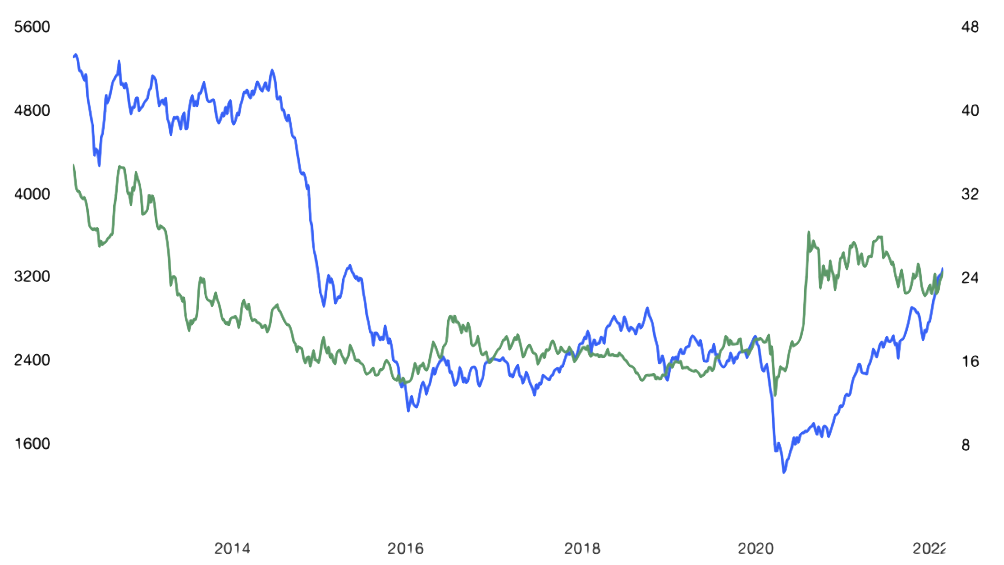

A NUMBER OF WALL STREET INVESTMENT FIRMS, including Goldman Sachs, are touting commodities as on the cusp of a secular bull market. Accordingly, Bloomberg reports that “investors are pumping more money into commodity funds than at any time in the last decade, enticed by red-hot inflation and a futures market offering big profits.” Silver can serve as a viable proxy for those who would like to participate in the potential commodities boom in a simplified way. The chart below shows a history of trading in concert with the commodities complex – though not with unerring exactness. In addition to the commodities market exposure, you get the added benefit of owning what many now view as a safe haven and store of value alternative to gold. Too, you can buy and take delivery of the metal itself – something you could not do with most commodities unless you happened to own a very large warehouse. We can help you set up an allocated safe storage account enabling you to buy and sell the metal with a phone call.

Silver and the S&P Goldman Sachs Commodity Index

(Ten-year)

Chart courtesy of TradingEconomics.com

BLOOMBERG RECENTLY REPORTED THAT ZIMBABWE, the country with the highest interest rates in the world, recently advised its citizenry that the cost of money could go up yet again. “If we see inflation going up in February and in March, brace up for very high interest rates,” Reserve Bank of Zimbabwe Governor John Mangudya recently told business leaders. Though some central bankers would like to present themselves as staunch inflation fighters, raising rates is only half the equation for fighting inflation. The other half is pushing the lending rate above the inflation rate, thus providing investors with a real rate of return on their money – something we should keep in mind in assessing the Federal Reserve’s presumed hawkishness. In Zimbabwe, inflation is still running at 60.7%, if current government data is to be believed, and it was as high as 322% just a year ago. Meanwhile, the overnight lending rate is 60%. It is reasonably evident that raising rates in Zimbabwe in and of itself has not kept a lid on the inflation rate.

YOU WILL RECALL THAT PURCHASING MANAGERS and manufacturers (producers) were the first to warn of the impending inflation at a time many economists had doubts. That makes a recent warning of runaway inflation from Heineken’s CEO Dolf] van den Brink worthy of special consideration. “In my 24 years in the business,” he recently told Financial Times, “I’ve never seen anything like it, not even close Across the board we are faced with crazy increases.” Van den Bink went on to say that his costs are running “off the charts” and that there was a risk of outright shortages.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––

INVESTORS OFTEN ASK ABOUT THE PERCENTAGE COMMITMENT one should make to precious metals in a well-balanced investment portfolio. Analyst Michael Fitzsimmons offered an interesting take on that subject in a Seeking Alpha editorial, headlined “Investors should worry about the value of their money as much as the value of their investments.” “Assuming a well-diversified portfolio (which does include cash for emergencies),” he says, “my belief is that middle-class investors (net worth under $1 million), should own at least 5-10% in gold. I also believe that as an American investor’s net worth climbs, the higher that percentage should be because, in my opinion, he or she simply has more to lose by a falling US$. For instance, an investor with a net worth of $2-5 million might have a 15-20% exposure to gold; $10 million, perhaps a 30-40% exposure.” USAGOLD recommends as it has for many years, a diversification of between 10% and 30% depending on your view of the risks at large in the economy and financial markets.

COLUMBIA UNIVERSITY ECONOMIST NOURIEL ROUBINI says that inflation will rewrite the rules of investment, particularly the 60/40 rule, i.e., the traditional portfolio consisting of 60% stocks 40% bonds. “The task for investors,” he says an analysis posted at the Project Syndicate website, “is to figure out another way to hedge the 40% of their portfolio that is in bonds.” He lists “three usable options for hedging the fixed-income component of a 60/40 portfolio” – inflation-indexed bonds, real assets like real estate and infrastructure, and gold. “Gold and other precious metals,” he says, “tend to rise when inflation is higher.” Gold, he adds, “is also a good hedge against the kinds of political and geopolitical risks that may hit the world in the next few years.”

“THE SENATE BANKING COMMITTEE, WRITES SETH LIPSKY in a recent New York Sun editorial, “is fixing to send to the full Senate tomorrow five nominees for governors of the Federal Reserve, including the chairman, Jerome Powell. The New York Sun opposes each of them. Yet our overriding concern is not the nominees themselves, but the failure of the senators to consider that the root of the problem in our economy lies with the system of fiat money itself.” Though we are sympathetic with Lipsky’s views, there is little hope that the monetary system will be anything other than fiat for the discernible future. Putting oneself on the gold standard remains the best option for dealing with the situation as it is.

CLAUDIO GRASS PULLS NO PUNCHES in a recent critique of the economics profession. He says that it has not lived up to its potential because since the days of ancient Rome, it “has been held hostage by the political establishment, it’s been corrupted and co-opted, and the scientific method that was supposed to be at the core of it has long been replaced with skewed assumptions, biased methodologies and pseudoscientific maneuvering.” He says that “the field of economics has long and often very embarrassing history of absurd theories, blatantly wrong assumptions and hypotheses, spectacularly wrong predictions and entirely avoidable policymaking blunders; a few of them hilarious, most of them catastrophic, some of them literally murderous.”

“AMERICANS ARE MISERABLE,” writes Hillary Hofflower at the Business Insider website. “They’re more miserable than they have been in half a century. New data from the General Social Survey — an ongoing study from NORC at the University of Chicago that’s one of the most influential social projects in the US — found that the percentage of Americans feeling ‘very happy’ plunged from 32% in 2018 to 19% in 2021, as Americans feeling ‘not too happy’ soared from 13 to 24% in the same time frame.” You won’t get much of an argument on that score here. The nation is in a lousy mood, frankly, and one wonders what it will take for national happiness to improve. Hoffower concludes by saying, “as long as we’re stuck in a version of ‘Groundhog Day,’ Americans are going to be feeling economic anxiety.” And that anxiety, sooner or later, one way or another, eventually will find its way to financial markets.

A word on the Ukraine crisis and gold

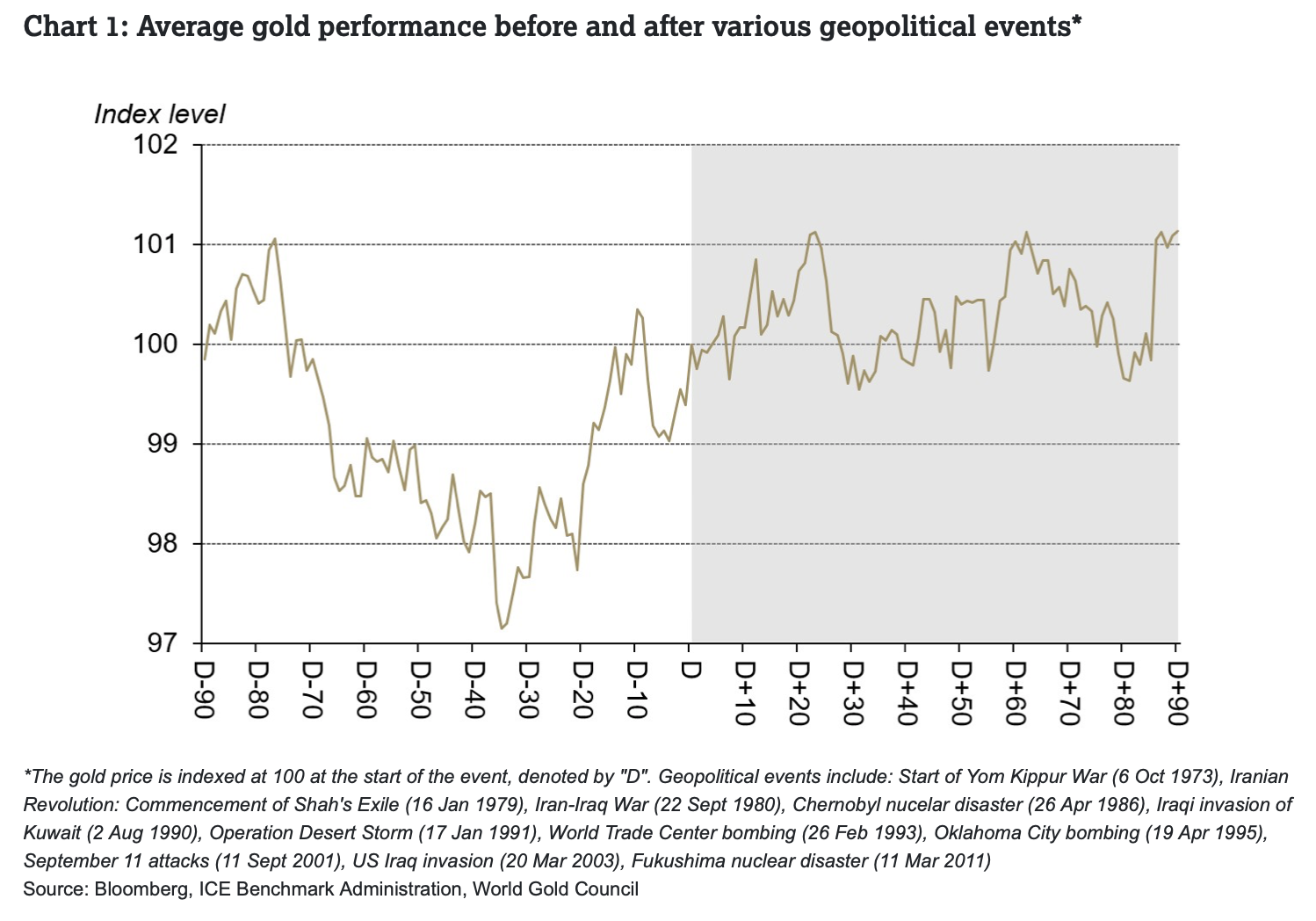

Gold’s strong, seesaw performance since Russia’s invasion of Ukraine began raises an interesting question as to how much of gold’s rally over the past month has to do with geopolitics and how much of it has to do with inflation and the impact of future Fed policy. Equally important, will the gains stick once the conflict ends? Some veteran gold market analysts warn that those gains can evaporate just as quickly as they appear, but in a study released over the weekend, the World Gold Council comes to a different conclusion based on data collected from a long history of geopolitical events (listed below the chart).

Chart courtesy of the World Gold Council • • • Click to enlarge

Chart courtesy of the World Gold Council • • • Click to enlarge

“[G]old has reacted positively to tail events linked to geopolitics,” writes Juan Artigas, WGC’s global head of research, “and, despite price volatility, tended to keep those gains in the months following the initial event. In addition, gold trades in a deep and highly liquid market, with collective volumes surpassing US$120bn a day on average and tight bid-ask spreads. All these, combined with the fact that bullion carries no credit risk, makes gold a sought-after safe haven asset.”

Final Thought

Beware the Black Swan. ‘There’s no clean way out.’

“The clan over the years’ matured and turned unruly,” writes Credit Bubble Bulletin’s Doug Noland. “Myriad severe development issues are increasingly on full display. The halcyon sandbox days are over for good, replaced by a confluence of insecurity, greed, and now constant infighting. To be sure, rich Uncle’s years of lavish generosity fostered a bunch of spoiled malcontents. The lax benefactor has come to realize he can no longer finance all the dysfunction and is desperate to craft a plan for exiting the relationship without unleashing mayhem. Some have structured their lives to stand on their own, while others’ very survival is at stake. All have developed bad habits, with some succumbing to deadly addictions. One camp says, ‘it’s time to get on with our lives without being further warped by all this charity money.’ Another is threatening to do harm to themselves. There’s no clean way out. Uncle fears calamity and harbors serious regret.”

Heightening the sense of impending danger, we would add our own observation that financial markets are full of eddies, crosscurrents, and strong undertows driven by excessive leverage and machine-based trading wherever the Fed might care to look. Today, the potential madness of machines is just as big a worry as the madness of crowds – their programming subject to the same frailties as their human creators. In fact, with algorithmic trading accounting for 60%-73% of U.S. equity trading, an argument could be made that machines now comprise the crowd.

“Since these automated strategies typically use artificial intelligence programs to analyze and react to market momentum, rather than economic fundamentals per se,” writes Gillian Tett points in a recent Financial Times editorial, “this tends to exacerbate a herding effect, not just in commodity markets but in any asset class. And since the institutions selling these derivatives bets need to hedge their own risks with other instruments, extreme robo-herding creates distortions across market niches that can suddenly unravel, causing wild volatility.” To make a very long story short, credit markets have a history of reacting unpredictably, and sometimes violently, to rising rates: Beware the Black Swan ……

–––––––––––––––––––––––––––––––

Looking to prepare your portfolio for whatever uncertainty lies ahead

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/orderdesk@usagold.com

ORDER GOLD & SILVER ONLINE 24-7

Up-to-the-minute gold market news, opinion, and analysis as it happens.

If you appreciate NEWS & VIEWS, you might also take

an interest in our Daily Top Gold News and Opinion page.

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such, USAGOLD does not warrant or guarantee the accuracy, timeliness, or completeness of the information found here. The views and opinions expressed at USAGOLD are those of the authors and do not necessarily reflect the official policy or position of USAGOLD. Any content provided by our bloggers or authors is solely their opinion and is not intended to malign any religion, ethnic group, club, organization, company, individual, or anyone or anything.

–––––––––––––––––––––––––––––––––––––––

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.